Defense contractor Raytheon Co. posted higher first-quarter revenue and earnings, partly due to lower costs because of the cut in the federal corporate income tax rate.

Though the results beat Wall Street expectations and Raytheon raised its outlook for the year, the company’s shares fell about 1 percent in trading Thursday on the New York Stock Exchange.

Raytheon reported $6.3 billion in first-quarter revenue, up 4.5 percent, and first-quarter net income of $633 million.

Earnings, adjusted to account for discontinued operations, came to $2.20 per share, compared with earnings of $1.73 per share on a comparable basis a year ago.

The average estimate of analysts surveyed by Zacks Investment Research was for earnings of $2.10 per share and revenue of $6.17 billion.

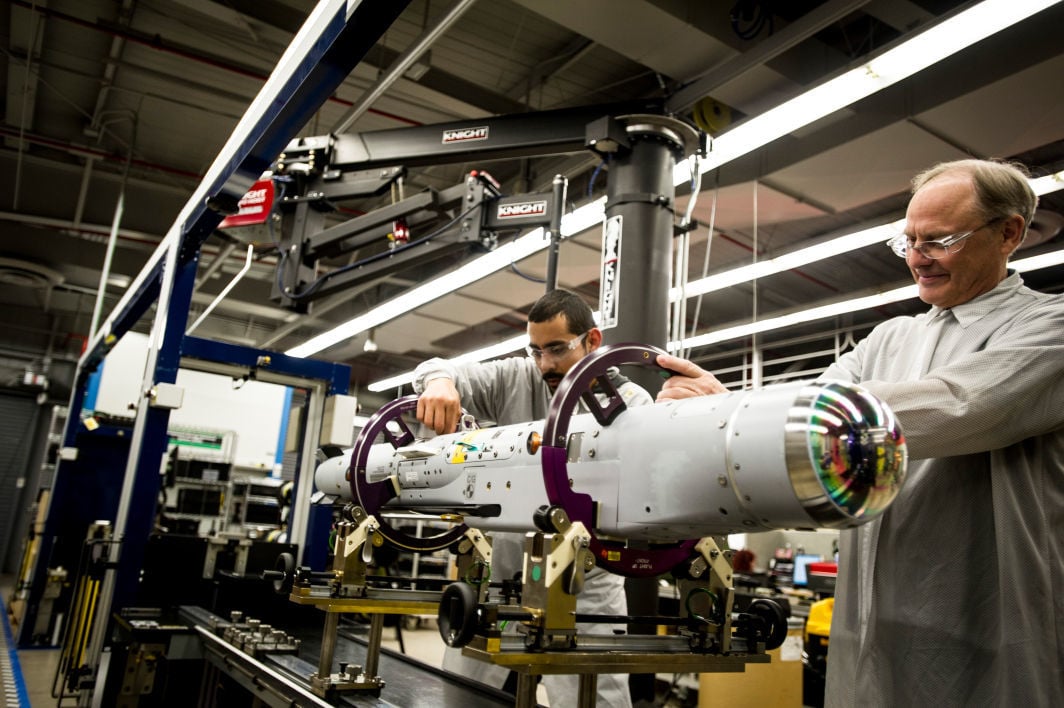

Sales at Tucson-based Raytheon Missile Systems — Raytheon’s biggest unit by revenue and Southern Arizona’s largest private employer — rose 5.2 percent to about $1.85 billion in the quarter that ended April 1, driven by higher sales from classified programs.

Operating income at the missile unit fell 2 percent to $212 million due to a “change in program mix,” Raytheon said.

In the first quarter, Missile Systems booked $552 million for Advanced Medium-Range Air-to-Air Missiles for the Air Force, Navy, and international customers; $186 million for Small Diameter Bomb II for the Air Force; $114 million for a thermal viewing system for Army tank commanders and $130 million on a number of classified contracts.

Raytheon’s Integrated Defense Systems unit saw its quarterly sales rise 7 percent as it booked $2 billion in international orders for the Patriot missile-defense system.

The Waltham, Massachusetts, parent company slightly increased its revenue outlook this year to a range of $26.5 billion to $27 billion and said it expects full-year earnings to be slightly higher at $9.70 to $9.90 per share.

Raytheon shares closed Thursday at $211.07 per share, down $2.62 or about 1.2 percent.

Raytheon shares have risen 14 percent since the beginning of the year, while the Standard & Poor’s 500 index has decreased slightly more than 1 percent. The stock has increased 37 percent in the last 12 months.