Raytheon Co. and United Technologies Corp. have scheduled special shareholder meetings in mid-October to win approval of the companies’ proposed mega-merger. Raytheon’s shareholders meeting will be held on Friday, Oct. 11, at the New York offices of the law firm Shearman & Sterling LLP.

Based in Waltham, Massachusetts, Raytheon Co. is the parent of Tucson-based Raytheon Missile Systems, the Tucson region’s biggest private employer with more than 13,000 local workers.

UTC’s shareholders meeting will be held on the same day at UTC Center for Intelligent Buildings in Palm Beach Gardens, Florida, the companies said in a recent joint filing to the U.S. Securities & Exchange Commission. The merger of Raytheon and UTC, announced in early June, would be the defense sector’s biggest merger and create a company worth more than $120 billion with annual revenues of about $74 billion.

Though the companies have called the deal a “merger of equals,” UTC is acquiring Raytheon and Raytheon shareholders will get the equivalent of 2.33 UTC shares for each of their Raytheon shares in shares in the merged company, Raytheon Technologies Corp.

Mergers often result in layoffs as operations are consolidated, but the CEOs of both companies say there is little overlap in their product and service offerings, and note that both companies are adding thousands of jobs.

The deal still needs to win approval from federal anti-trust regulators, and the companies said in mid-August that the U.S. Department of Justice had requested more information on the deal.

When the deal was announced, President Trump questioned whether the deal would make the defense market less competitive, but there has been little pushback from Congress.

Raytheon and UTC executives have said they expect the deal to clear anti-trust reviews.

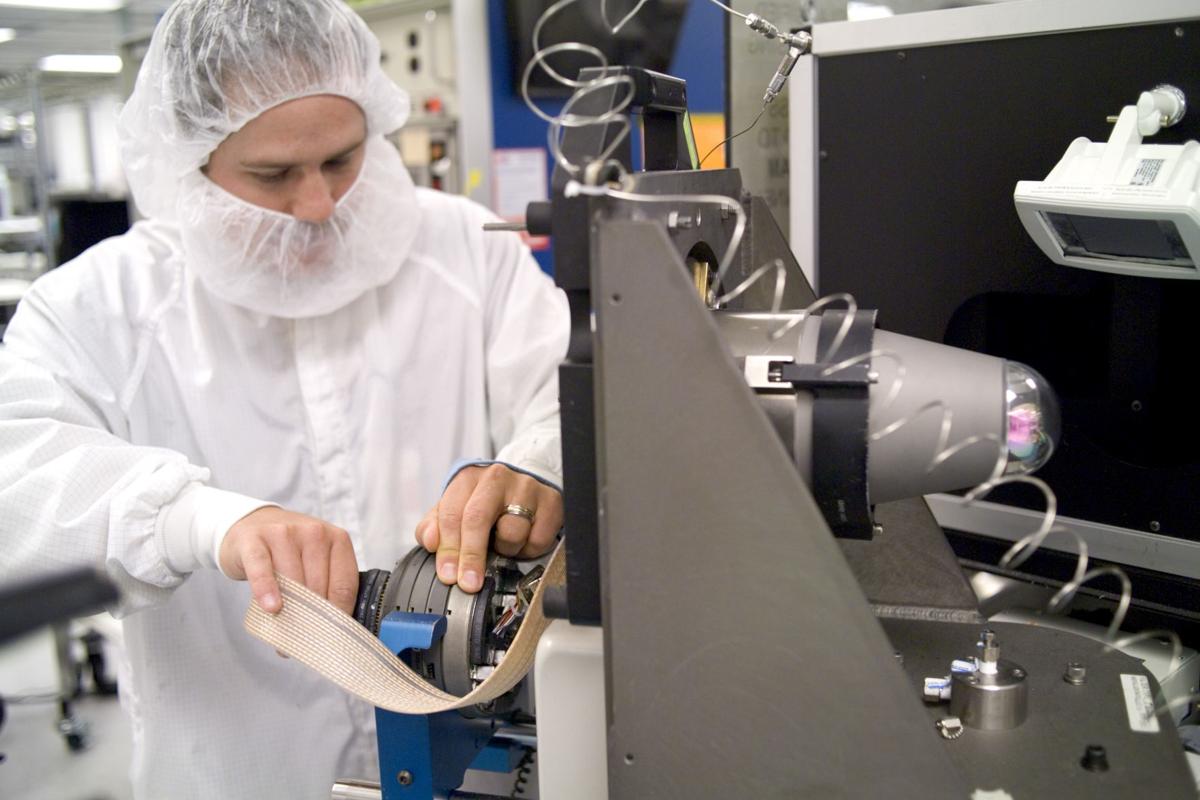

Raytheon is the world’s biggest missile maker and a leader in radars and other defense electronics.

UTC is the parent of Collins Aerospace, which makes aircraft avionics including navigation and communications equipment, and jet-engine maker Pratt & Whitney, while it is spinning off its Carrier Corp. and Otis Elevator Co. subsidiaries.

The deal got a little boost recently when Ellen Lord, undersecretary of defense for acquisition and sustainment, told reporters during an Aug. 26 briefing that the Pentagon had begun studying the competition issue and “There are no major concerns that I know of right now.”

Though some major shareholders have opposed the deal, some of the biggest investors in each company figure to be on board, analysts say. Three major investment firms — State Street Corp., Vanguard Group and hedge fund manager BlackRock — are the biggest institutional owners of stock in each company, together owning about 25% of UTC shares and about 20% of Raytheon stock.