Shares in Tucson-based Accelerate Diagnostics fell Tuesday after the company posted fourth-quarter revenue below analysts’ expectations.

The company reported net sales of $1.8 million, compared with $2.1 million in the fourth quarter of 2017 and analysts’ average forecast of $2.6 million.

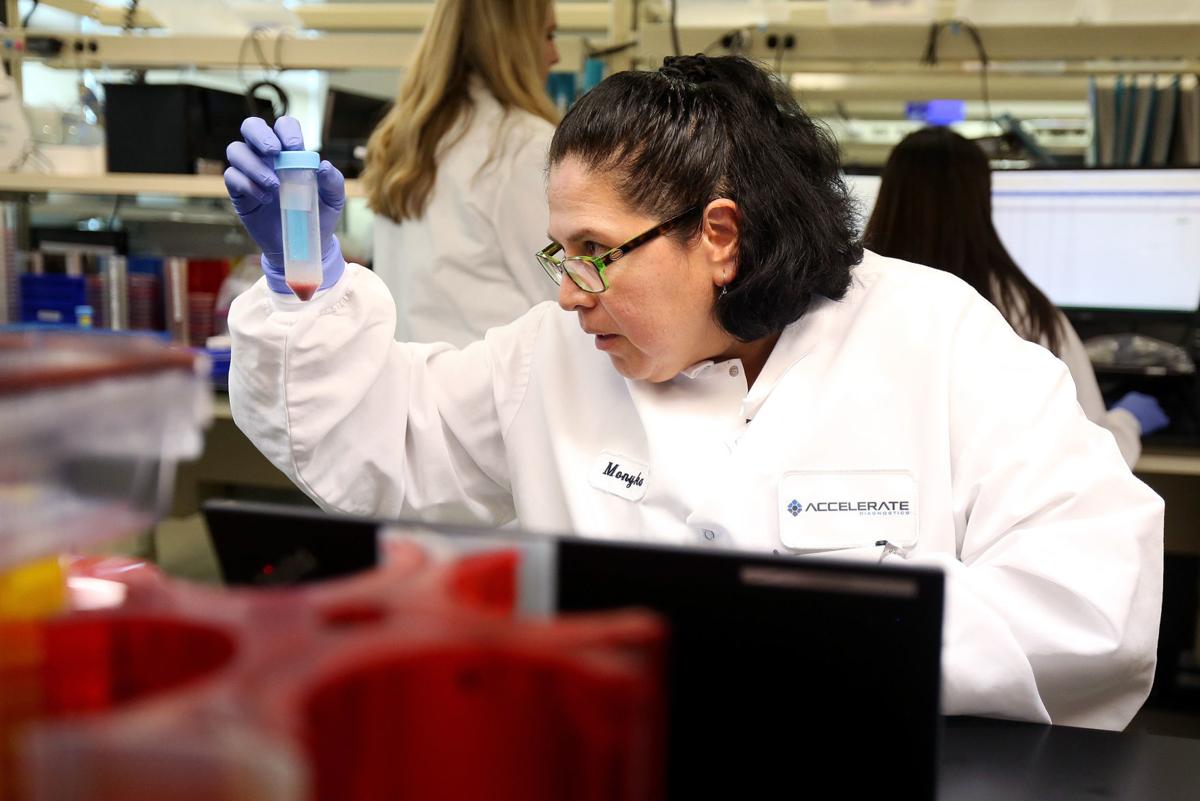

Accelerate, which is commercializing an automated lab system to rapidly identify blood pathogens, posted a fourth-quarter net loss of $22 million, or 41 cents per share, up from a loss of 27 cents per share in fourth-quarter 2017 but in line with analyst expectations.

The company’s shares closed Tuesday at $19.47, down 32 cents or about 1.6 percent, in trading on the Nasdaq Stock Market. Its shares have traded between a high of $27.65 and a low of $10.23 in the past year.

Accelerate attributed the sales decline to a lower capital sales mix as customers began adopting instrument reagent rental agreements, an option not available in 2017.

For all of 2018, Accelerate posted a net loss of $88.3 million on net sales of $5.7 million, up from $4.2 million in 2017.

The company spent $55 million on sales expenses and $27.6 million on research and development in 2018 as it ramped up its sales force and funded further clinical studies.