The commercials are right — many consumers can save money by shopping around for auto insurance — but it’s hard to know where to start.

A new report from the Arizona Department of Insurance can help you narrow down your options before calling and clicking around to find the best rate.

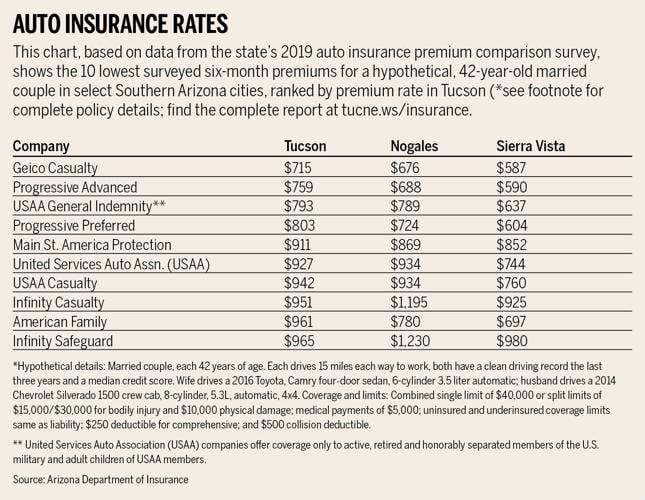

The department’s 2019 Automobile Insurance Premium Comparison and Complaint Ratio survey compares six-month premium rates for nearly 100 companies offering private-passenger auto insurance in Arizona, using 14 hypothetical policyholders and coverages for 10 cities including Tucson.

The annual report, available at tucne.ws/insurance, also lists each insurer’s complaint ratio, representing the number of written complaints received by the Insurance Department during 2018 for each 1,000 vehicles they covered.

While individual rates will vary based on things like age and driving record, the survey can help point consumers to the best rates, Insurance Department spokesman Stephen Briggs said.

“One of the best ways to save money on your auto insurance is to shop around and take advantage of the competition between the 190-plus auto insurance companies doing business in Arizona,” Briggs said. “The Automobile Insurance Premium Comparison provides information that can help you do that comparison.”

Briggs said consumers should also consider each company’s complaint ratio as an indicator of customer satisfaction, and they shouldn’t hesitate to ask questions of their agent or insurer’s customer-service department.

Indeed, the survey shows six-month rates for a 42-year-old married couple with clean driving records in Tucson ranging from $715 from Geico Casualty Co. to a whopping $2,434 from Allstate Fire and Casualty Co.

Among major insurers, six-month premiums for the same policyholder can vary by a few hundred dollars.

The state does not regulate auto insurance rates, instead allowing insurers to change rates and notify the state under a so-called “use and file” system.

But Arizona is a highly competitive market for auto insurance, with only two companies holding double-digit market shares.

According to the Insurance Department, in 2017 Arizona’s biggest private auto insurer by premium market share was State Farm Mutual Automobile Insurance, with a 14.8% share, followed in order of share by Geico Casualty (11.2%), Farmers of Arizona, Progressive Advanced, Allstate Fire and Casualty, Progressive Preferred, American Family Mutual, LM General, USAA Casualty and Safeco.

The state survey includes two scenarios for each of seven hypothetical policyholders: an 18-year-old unmarried male; an 18-year-old unmarried female; a married couple both age 42; the same married couple with at-fault accidents; a single, 81-year-old female; an unmarried 41-year-old female; and a family with a 17-year-old son.

Some caveats on using the premium comparisons:

- The surveyed rate most likely won’t exactly match what you are offered, since each hypothetical is based on specific policyholder characteristics including gender, marital status, age, driving habits, driving record, specific vehicle and coverage levels.

- The state lists premiums for hypothetical policyholders in central ZIP code areas for Tucson (85719), Phoenix, Mesa, Glendale, Scottsdale, Casa Grande, Flagstaff, Nogales, Sierra Vista and Yuma, but rates may differ in other ZIP codes in the same city.

- Some major insurers have several subsidiaries serving policyholders with different risk profiles — often referred to as preferred (lowest risk and rates), standard or substandard (high-risk) carriers — and consumers are generally placed with the subsidiary that matches their risk.

- Among other factors, Arizona allows insurers to consider a customer’s credit rating in setting premiums; those with worse credit generally are considered higher risk and pay more (the survey includes hypotheticals with no credit history and average credit).

- Many smaller insurers included in the survey, including some with the highest listed premiums, don’t have many active policies in Arizona or specialize in certain business, like high-risk policies.

- Some insurers offer significant discounts for things like keeping a good driving record over time, or for owning multiple policies with the same company.

- The 2019 survey lists premiums for Arizona’s current state minimum liability coverage limits, as well as a higher-limit policy for most hypotheticals. The state’s current minimum coverage is $15,000 per injured person, $30,000 per incident and $10,000 for property damage but next July, those limits will rise to $25,000, $50,000 and $15,000, respectively, under a law passed this year.