When Tucson-based World View Enterprises began flying high-altitude balloons in 2013, much of the buzz was around the company’s plans to take tourists on breathtaking trips to the stratosphere.

But while the prospect of near-space tourism flights is tantalizing, World View is in no hurry to launch them — especially amid surprisingly strong demand for unmanned commercial flights.

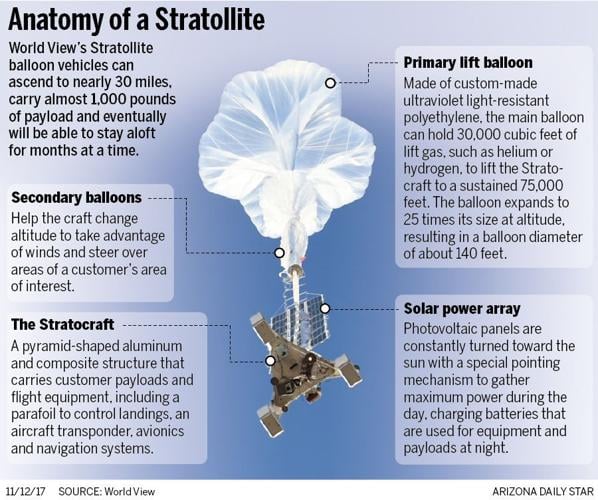

The company has flown about 50 test and commercial flights with its “Stratollite” vehicles, refining its proprietary flight systems in flights of increasing duration.

World View flew four Stratollites from late September through October, including its first launch from Spaceport Tucson — a launch pad adjacent to its headquarters south of Tucson International Airport — on Oct. 1 that landed five days later.

“We sort of surprisingly have this amazing business of unmanned (flight) work, so we’re letting that be the driver and have the manned flight fall in after that,” said Taber MacCallum, World View co-founder and chief technology officer.

World View co-founder and CEO Jane Poynter, MacCallum’s longtime business partner and wife, said the company is on track toward its initial goal of about 100 launches per year from Tucson.

“That’s the pace that we’re going to be at by the second half of next year,” said Poynter. “We’ve got customers that are banging down our doors, so we were really happy to have been able to really demonstrate for ourselves that launch capability.”

SETTLING IN

World View’s custom-built headquarters and manufacturing plant, financed by Pima County in a $20 million deal that is subject to an ongoing lawsuit, has worked out well since opening in late 2016, Poynter said.

The company has about 70 full-time employees at salaries averaging nearly $60,000 a year and plans to eventually hire more than 400 workers.

The facility features a wall of windows overlooking the Spaceport Tucson launch pad, an open office space with a lounge area overlooking the pad.

“It’s really set up for efficiency, for growth, and it works really well for our customers,” Poynter said, noting that customers can observe launches from a “bridge” area and view live flight video without interfering with mission control.

World View is marketing its Stratollites as a low-cost alternative to satellites for communications, imaging and remote sensing. Besides satellites, competing technologies include planes, drones and terrestrial infrastructure.

The company says its proprietary technology allows Stratollites to stay in an approximately stationary position over an area of interest, eventually for months at a time.

World View hasn’t finalized a standard price for commercial Stratollite flights, but the cost now ranges around a few hundred thousand dollars, compared with tens or even hundreds of millions for satellites and some high-altitude drones.

LEARNING FROM LAUNCHES

World View can’t talk about most of its clients under confidentiality agreements, Poynter said, noting that about half of its current business is defense-related.

Customers who have been made public include NASA, the National Oceanic and Atmospheric Administration, Ball Aerospace and the U.S. Southern Command.

In October, World View flew an hours-long research flight for Southwest Research Institute under a NASA program from a site in Idaho.

In February, the company flew a package of sensors for Colorado-based Ball Aerospace.

“We’re collaborating with World View to explore the feasibility of persistent imaging using their platform and Ball’s sensors and data analytics to open up new markets and opportunities for both companies,” said Debra Facktor, Ball vice president and general manager of strategic operations and commercial aerospace.

The company’s first launch from Spaceport Tucson last month included a payload for the U.S. Southern Command, a multi-branch military agency exploring the use of the balloon vehicle to help combat human and drug trafficking and maritime piracy. The company followed up a few weeks later with a second launch from Tucson for a confidential government customer.

And then there was the chicken sandwich.

In June, World View flew a spicy chicken sandwich as part of a promotion by fast-food giant KFC.

The 17-hour sandwich mission yielded more than publicity for KFC. The company used the mission to test a new mechanism to keep the Stratollite’s solar-panel array pointed toward the sun, and it pointed up the gentle nature of balloon flight, Poynter said.

“Everyone understood why we did it, KFC was thrilled and we got huge exposure for the company,” she said. “Yes it was a chicken sandwich, but you can’t fly a chicken sandwich on a rocket so it does speak to aspects of the differentiation of this – it’s very gentle and we can carry anything to the edge of space and keep it there.”

GEOENGINEERING EXPERIMENT

Though World View generally can’t discuss its future flights, it did confirm one planned flight for next year that will carry an experiment in climate change by Harvard scientists.

Harvard professors David Keith and Frank Keutsch hope to use a Stratollite to spray a fine mist of materials such as sulfur dioxide, alumina, or calcium carbonate into the stratosphere in a test of whether reflective particles could lower surface temperatures to combat global warming.

Poynter and Keith said the mission — which has already attracted some criticism from opponents of “geoengineering” — is still in the works but declined to elaborate.

“We are working away developing the experiment. We hope to fly next year,” Keith said in an email.

Meanwhile, World View will continue to push the envelope on longer-duration flights, with an initial goal of keeping Stratollites aloft for months at a time.

“Our stretch goal is a year —that’s our North Star, that’s what we’re aiming for, but that does require some materials work,” Poynter said.

World View is working with its plastics supplier, Dow Chemical, to develop polyethylene film with additives to prevent damage from ultraviolet light in the bright stratosphere, MacCallum said, adding that results so far are promising.

“It’s a complicated machine that also has to operate in this crazy-cold and crazy hot environment,” he said, adding that more testing on the Stratollite’s computers, electromechanical systems, battieries and other hardware is needed to make sure components can survive long-duration flights.

MacCallum said the company’s in no hurry to push manned flights, which it initially estimated would cost $75,000 per passenger, though it has begun the licensing process with the Federal Aviation Administration.

In 2014, Poynter and MacCallum worked with Tucson-based Paragon Space Development Corp., a company the couple co-founded, to fly Google executive Alan Eustace to 135,908 feet in a special suit beneath a balloon, breaking several skydiving world records. World View later acquired the technology used in the project from Paragon, which specializes in environmental and life-support systems.

“We can use the experience of unmanned flight at high altitude to inform how we would would do the manned flight, making the cost of doing the manned side much, much less,” MacCallum said.

LEAGUE OF THEIR OWN

For now, at least, World View has few direct competitors, but others are plying the stratosphere with balloons.

Google has been experimenting with high-altitude balloons to provide internet service and recently set one up to restore connectivity to hurricane-ravaged Puerto Rico.

A Spanish company is working on a launch vehicle that uses the combination of a balloon and a rocket to deliver small satellites to low-Earth orbit.

“It’s really, really different from what anyone else is doing,” Poynter said of World View’s balloon systems.

Investors have been impressed enough with the company’s prospects. Last year, the company raised $15 million in venture-capital funding in an investment round led by California-based Canaan Partners, after raising $7 million in 2014.

In a report issued last year, Accenture Consulting said the “Earth observation” industry — including planes, drones, balloons and satellites — is currently valued at $2 billion and revenues are projected to surpass $5 billion by 2026 at a compound growth rate of 9.5 percent.

Accenture’s report, which profiled World View’s business model, said high-altitude balloons “will certainly find a comfortable niche in the market in the coming years” as the commercial industry realizes their value.