PHOENIX — Top Republican legislative leaders filed suit Monday to block implementation of the voter-approved tax on income of the wealthiest Arizonans.

The lawsuit filed in Maricopa County Superior Court contends the Arizona Constitution allows only the Legislature to impose a new tax, and then only with a two-thirds vote.

“Because Proposition 208 did not meet either requirement, its new tax was not constitutionally enacted,” the lawsuit says.

Arizona officials have certified Joe Biden’s narrow victory over President Donald Trump in the state. Democratic Secretary of State Katie Hobbs and Republican Gov. Doug Ducey stood up for the integrity of the election even as lawyers for Trump were across town Monday arguing without evidence to nine Republican lawmakers that the election was marred by fraud.

The Invest in Ed measure, approved by voters Nov. 3 by a margin of 51.7% to 48.3%, earmarks the proceeds for education funding.

The lawsuit says the measure seeks to exempt the money raised from a constitutional cap on how much schools can spend. It says a statute — even one approved by voters — cannot override what is in the Arizona Constitution.

Attorneys for the challengers also say that the amount of spending the Invest in Ed initiative would require exceeds the amount of revenues that would be raised by the new 3.5% surcharge on incomes above $250,000 for individuals and $500,000 for married couples filing jointly.

Finally, the lawsuit says it illegally ties the hands of state lawmakers by telling them they cannot use the new revenues that would be raised — about $940 million a year — to reduce education spending elsewhere.

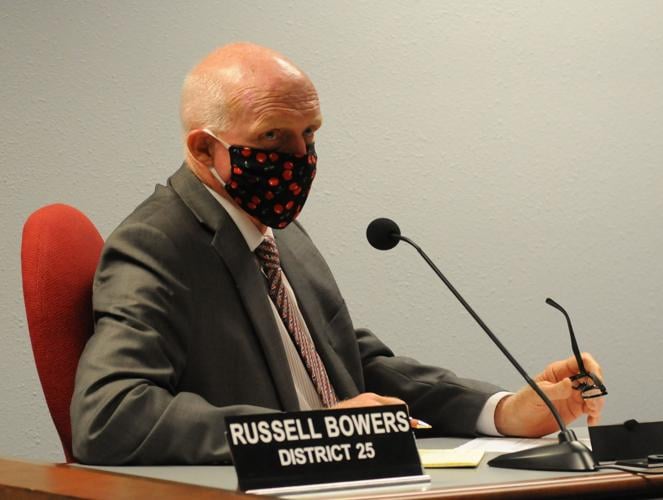

That provision in particular gets the attention of lawmakers who agreed to sign on to the lawsuit filed by the Goldwater Institute, including House Speaker Rusty Bowers and Senate President Karen Fann.

“Proposition 208 restricts their ability to appropriate funds for other legislative priorities,” wrote attorneys in the case.

“These legislative leaders further understand that despite the authorities vested in their offices and position, they are powerless under Proposition 208 to divert funds from the general fund, each with a supermajority,” he said. And that, the lawyers said, limits their ability not just to reduce state taxes but also to respond to emergencies and “eliminate educational programs that are no longer necessary or are deemed ineffective.”

The litigation seeks an injunction order barring any implementation or enforcement of the ballot measure until there can be a full-blown hearing.

A separate lawsuit against the measure also was filed Monday, by Ann Siner, founder of My Sister’s Closet, and retired Maricopa County Superior Court Judge John Buttrick.

Invest in Ed backers are expected to fight both lawsuits.

The Arizona Constitution makes the people co-equal with the Legislature when creating law, said attorney Roopali Desai, who represents the Invest in Ed initiative. And that means they have the same powers as lawmakers, even if the elected legislators disagree, she said.

In fact, in some ways the powers of the people are superior, because a constitutional provision bars lawmakers from repealing what voters have enacted. Lawmakers can make only changes that “further the purpose” of a voter-approved measure, and only with a three-fourths vote of both the House and Senate.

Invest in Ed, put on the ballot with a petition gathering process, was pushed by the Arizona Education Association and allied groups seeking to restore cuts that have been made to K-12 funding in the past decade. They say that per-student aid has not kept pace with inflation and student growth.

Half of the funds are earmarked for schools to hire teachers and classroom support personnel, such as librarians, nurses, counselors and coaches. The dollars also could be used for raises.

Another quarter is for support services personnel, including classroom aides, security personnel, food service and transportation.

There’s also 12% for grants for career and technical education programs, 10% for mentoring and retaining new teachers in the classroom, and 3% for the Arizona Teachers Academy to provide tuition grants for students who go into education careers.

Foes, led by the Arizona Chamber of Commerce and Industry, argued there was no guarantee that the cash would go to teachers and salaries.

They also pointed out that it would raise the state’s top income tax rate, now 4.5%, to 8%, which they said would be one of the highest in the nation. They argued that would be a damper on economic development.

But David Lujan, director of the Arizona Center for Economic Progress, pointed out that the only people affected would be those whose taxable income — after all deductions and credits — would be above $250,000 for individuals and $500,000 for couples.

Foes also questioned how much of the cash would wind up in the classroom.

They pointed out that the most recent report by Auditor General Lindsey Perry said just 54.7 cents of every dollar go into direct classroom expenses.

But as Perry’s report pointed out, there is more to that story.

One is that figure does not include other necessary instructional support like librarians and teacher training, nor guidance counselors, nurses, speech pathologists and social workers. And Perry said that, on average, Arizona schools spend less on administrative expenses than the rest of the country.

Other challengers in the suit brought on behalf of Fann and Bowers include other Republican lawmakers and the owners of three businesses who say their income exceeds the $500,000 threshold and would be affected by the new law.

No date has been set for a hearing.

Photos: 2020 General Election in Pima County and Arizona

Ballot processing in Pima County

Updated

An election worker stacks ballots to be processed at the Pima County Elections Center, Tucson, Ariz., November 5, 2020.

Ballot processing in Pima County

Updated

An election worker prepares ballots to be fed into her machine as ballot processing continues at the Pima County Elections Center, Tucson, Ariz., November 5, 2020.

Ballot processing in Pima County

Updated

Workers process ballots as the count goes on at the Pima County Elections Center, Tucson, Ariz., November 5, 2020.

Ballot processing in Pima County

Updated

An election worker looks over some ballots being processed at the Pima County Elections Center, Tucson, Ariz., November 5, 2020.

Ballot processing in PIma County

Updated

Election workers continue their work in preparing ballots in order for them to be counted later in the day the Pima County Elections Center on November 5, 2020. Photo by Mamta Popat / Arizona Daily Star

Ballot processing in PIma County

Updated

Deputy Scott Woodworth, left, and Deputy Andrew Conrad of the Pima County Sheriff's Department stand outside of the Pima County Elections Center on November 5, 2020. Due to some gatherings around the country at election offices, deputies are on site to help keep the peace. Photo by Mamta Popat / Arizona Daily Star

Ballot processing in PIma County

Updated

Election workers continue their work in preparing ballots in order for them to be counted later in the day the Pima County Elections Center on November 5, 2020.

Ballot processing in PIma County

Updated

Adrian Gomez, an election worker, feeds ballots into a machine which opens the envelopes automatically in preparation for them to be counted later in the day at the Pima County Elections Center on November 5, 2020. Photo by Mamta Popat / Arizona Daily Star

Ballot processing, Pima County

Updated

An election worker calls a voter to confirm a signature on a ballot at the Pima County Elections Office located at 6550 S Country Club Rd, on Nov. 4, 2020.

Ballot processing, Pima County

Updated

An election worker scans a ballot while doing the first check of the signature while processing ballots at the Pima County Elections Office located at 6550 S Country Club Rd, on Nov. 4, 2020. If the signature matches what the office has on file the ballot will move on to be counted. If the signature does not match it will be moved to a special desk where workers investigate the signature by following up with the voter.

Ballot processing, Pima County

Updated

An election worker scans a ballot while doing the first check of the signature while processing ballots at the Pima County Elections Office located at 6550 S Country Club Rd, on Nov. 4, 2020. If the signature matches what the office has on file the ballot will move on to be counted. If the signature does not match it will be moved to a special desk where workers investigate the signature by following up with the voter.

Election Day, Pima County and Arizona, 2020

Updated

Mark Kelly, right, Democratic candidate for U.S. Senate, waves to supporters along with his wife Gabrielle Giffords, second from right, and daughters, Claire Kelly, far left, and Claudia Kelly, second from left, during an Election Night watch party on November. 3, 2020 at Hotel Congress in downtown Tucson, Ariz.

Election Day, Pima County and Arizona, 2020

Updated

The crowd gathers in St. Philip's Plaza for a Republican supporters party on election night, Tucson, Ariz., November 3, 2020.

Election Day, Pima County and Arizona, 2020

Updated

Election night wears on as Republican supporters stay up late waiting for numbers at a party held at St. Philip's Plaza, Tucson, Ariz., November 3, 2020.

Election Day, Pima County and Arizona, 2020

Updated

Fox News declares Joe Biden the winner over Donald Trump in the state of Arizona behind the night's entertainment, singer Buck Helton, at a Republican supporters' party at St. Philip's Plaza, Tucson, Ariz., November 3, 2020.

Election 2020 Senate Kelly

Updated

Mark Kelly, Democratic candidate for U.S. Senate, speaks during an Election Night gathering at Hotel Congress in downtown Tucson, Ariz. on November 3, 2020.

Election 2020 Senate Kelly

Updated

Mark Kelly, right, Arizona Democratic candidate for U.S. Senate, waves to supporters along with his wife Gabrielle Giffords, second from right, and daughters, Claire Kelly, left, and Claudia Kelly, second from left, during an election night event Tuesday, Nov. 3, 2020 in Tucson, Ariz. (AP Photo/Ross D. Franklin)

Election Day, Pima County and Arizona, 2020

Updated

District 10 senate candidate Justine Wadsack moves through the crowd at a Republican supporters party at St. Philip's Plaza, Tucson, Ariz., November 3, 2020.

Election Day, Pima County and Arizona, 2020

Updated

Arizona house candidate Brendan Lyons speaks to the Republican party supporters gathered at St. Philip's Plaza, Tucson, Ariz., November 3, 2020.

Election Day, Pima County and Arizona, 2020

Updated

Gabby Saucedo Mercer, candidate for Pima County Board of Supervisors, watches polling numbers roll in at a Republican supporters party at St. Philip's Plaza, Tucson, Ariz., November 3, 2020.

Election Day, Pima County and Arizona, 2020

Updated

A woman in the crowd reacts as the first numbers of the night come up on network news showing Joe Biden well ahead of Donald Trump in Arizona during a party for Republican supporters at St. Philip's Plaza, Tucson, Ariz., November 3, 2020.

Election Day, Pima County and Arizona, 2020

Updated

The crowd of Republican supporters celebrate as news organizations declare Texas for Donald Trump during an election party at St. Philip's Plaza, Tucson, Ariz., November 3, 2020.

Election Day, Pima County and Arizona, 2020

Updated

Mark Kelly, Democratic candidate for U.S. Senate, speaks during an Election Night gathering at Hotel Congress in downtown Tucson, Ariz. on November 3, 2020.

Election Day, Pima County and Arizona, 2020

Updated

President Trump supporters wave a flag during an election watch party, Tuesday, Nov. 3, 2020, in Chandler, Ariz. (AP Photo/Matt York)

Election Day, Pima County and Arizona, 2020

Updated

Maria Miranda waves to drivers as she waves her sign while stumping for 2nd Congressional candidate Brandon Martin outside the polling site at Desert Gardens Presbyterian Church, 10851 E Old Spanish Trail, Tucson, Ariz., November 3, 2020.

Election Day, Pima County and Arizona, 2020

Updated

Voters wait in line to cast their ballots at Gideon Missionary Baptist Church, 3085 S. Campbell Ave., in Tucson, Ariz. on Nov. 3, 2020.

Election 2020 Arizona Voting

Updated

A poll worker wearing a face shield and mask checks outside for voters in need of assistance at the polling station at Tucson Arizona Boys Chorus, 5770 E. Pima St., in Tucson, Ariz. on Nov. 3, 2020.

Election 2020 Arizona Voting

Updated

A short line forms outside of the Drexel Heights Community Center, 5220 S San Joaquin Ave., polling place on November 3, 2020.

Election 2020 Arizona Voting

Updated

A voter glances at voting signs while approaching the Donna R. Liggins Neighborhood Center polling place located at 2160 N 6th Avenue, on Nov. 3, 2020.

Election Day, Pima County and Arizona, 2020

Updated

Poll volunteers work the final half hour of the night at the Dusenberry-River Branch Library, one of the voting sites in Tucson, Ariz., November 3, 2020.

Election Day, Pima County and Arizona, 2020

Updated

Election Protection Arizona's Chris Griffin sits just outside the exclusion area at the Christ Lutheran Vail Church polling site, Vail, Ariz., November 3, 2020.

Election Day, Pima County and Arizona, 2020

Updated

Voters file into the polling site at Christ Lutheran Vail Church, 14600 E. Colossal Cave Rd., as voting takes place across the nation, Vail, Ariz., November 3, 2020.

Election Day, Pima County and Arizona, 2020

Updated

A poll worker gestures a couple of voters inside the Desert Gardens Presbyterian Church, 10851 E Old Spanish Trail, one of polling sites across the area, Tucson, Ariz., November 3, 2020.

Election 2020 Arizona Voting

Updated

Trump supporters greet another arriving Trump supporter arriving outside of the Living Word Bible Church voting station in Phoenix, Ariz., on Election Day, Tuesday, Nov. 3, 2020. (AP Photo/Dario Lopez-MIlls)

Election 2020 Arizona Voting

Updated

Trump supporters greet voters arriving in their cars at the Living Word Bible Church voting station in Phoenix, Ariz., on Election Day, Tuesday, Nov. 3, 2020. (AP Photo/Dario Lopez-MIlls)

Election Day, Pima County and Arizona, 2020

Updated

A line forms outside the polls at Continental Ranch Community Center located at 8881 N Coachline Blvd., on Nov. 3, 2020. According to Poll Marshal Judy Burns, the place had a line zigzagging through the parking lot when doors opened and a steady number of voters throughout the day.

Election Day, Pima County and Arizona, 2020

Updated

A line forms outside the polls at Continental Ranch Community Center located at 8881 N Coachline Blvd., on Nov. 3, 2020. According to Poll Marshal Judy Burns, the place had a line zigzagging through the parking lot when doors opened and a steady number of voters throughout the day.

Election Day, Pima County and Arizona, 2020

Updated

Voters put on masks outside the Avra Valley Fire District Station 191 before casting ballots, on Nov. 3, 2020.

Election Day, Pima County and Arizona, 2020

Updated

A voter prepares a ballot outside the Avra Valley Fire District Station 191 polling place, on Nov. 3, 2020.

Election 2020 Arizona Voting

Updated

A voter leaves the polling place at Tucson Arizona Boys Chorus, 5770 E. Pima St., in Tucson, Ariz. on Nov. 3, 2020.

Election 2020 Arizona Voting

Updated

A woman walks towards the Drexel Heights Community Center 5220 S San Joaquin Ave. to cast her vote on November 3, 2020.

Election 2020 Arizona Voting

Updated

Campaign signs adorn an area just off the property at Drexel Heights Community Center 5220 S San Joaquin Ave. on November 3, 2020.

Election Day, Pima County and Arizona, 2020

Updated

A voter puts on a face covering before entering the Himmel Park Library polling place, on Nov. 3, 2020. Photo by Josh Galemore / Arizona Daily Star

Election Day, Pima County and Arizona, 2020

Updated

A polling worker welcomes a voter to the Himmel Park Library polling place, on Nov. 3, 2020. Photo by Josh Galemore / Arizona Daily Star

Election Day, Pima County and Arizona, 2020

Updated

A voter drops off their ballot on Election Day outside State Farm Stadium early, Tuesday, Nov. 3, 2020, in Glendale, Ariz. (AP Photo/Matt York)

Election Day, Pima County and Arizona, 2020

Updated

A voter, November 3, 2020, at the Islamic Center polling place, 12125 E Via Linda, Scottsdale, Arizona.

Election Day, Pima County and Arizona, 2020

Updated

Voters wait in line, November 3, 2020, at the Tempe History Museum polling place, 809 E. Southern Ave., Tempe.

Election Day, Pima County and Arizona, 2020

Updated

Voters stand in line outside a polling station, on Election Day, Tuesday, Nov. 3, 2020, in Mesa, Ariz. (AP Photo/Matt York)

Election Day, Pima County and Arizona, 2020

Updated

Voters stand in line outside a polling station, Tuesday, Nov. 3, 2020, in Mesa, Ariz. (AP Photo/Matt York)

Election Day, Pima County and Arizona, 2020

Updated

A school crossing guard stops cars for voters entering a polling station, Tuesday, Nov. 3, 2020, in Phoenix. (AP Photo/Matt York)

Election 2020 Arizona Voting

Updated

A line forms outside the Dr. Martin Luther King Jr. Neighborhood Center just over an hour after the polls opened Tuesday morning, Nov. 3, 2020, in Yuma, Ariz. (Randy Hoeft/The Yuma Sun via AP)

Election 2020 Arizona Voting

Updated

Voters arrive at the Dr. Martin Luther King Jr. to cast their vote in the general election early Tuesday morning, Nov. 3, 2020, in Yuma, Ariz. (Randy Hoeft/The Yuma Sun via AP)

Election 2020 Arizona Voting

Updated

A woman walks into the St. Margaret Mary's Church, 801 N Grande Ave. to cast her ballot on November 3, 2020.

Election 2020 Arizona Voting

Updated

An election worker processes early voting ballots at Pima County Elections Center, 6550 S. Country Club Rd., in Tucson, Ariz. on Nov. 3, 2020.

Election 2020 Arizona Voting

Updated

An election worker processes early voting ballots at Pima County Elections Center, 6550 S. Country Club Rd., in Tucson, Ariz. on Nov. 3, 2020.

Election Day, Pima County and Arizona, 2020

Updated

The television news network, MSNBC, is projected onto screens at the Mark Kelly Election Night watch party for friends and family at Hotel Congress in downtown Tucson, Ariz. on November 3, 2020. Kelly is the democratic candidate for the U.S. Senate.

Election Day, Pima County and Arizona, 2020

Updated

Chairs are set up on the patio for friends and family at Hotel Congress for the Mark Kelly Election Night watch party in downtown Tucson, Ariz. on November 3, 2020. Kelly is the democratic candidate for the U.S. Senate.

Election Day, Pima County and Arizona, 2020

Updated

The sun begins to set behind a voting sign at Gideon Missionary Baptist Church, 3085 S. Campbell Ave., in Tucson, Ariz. on Nov. 3, 2020.

Election Day, Pima County and Arizona, 2020

Updated

Poll workers check their phones as they wait for voters at a local polling station Tuesday, Nov. 3, 2020 in Tucson, Ariz. (AP Photo/Ross D. Franklin)

Judge throws out lawsuit, finds no fraud or misconduct in Arizona election

UpdatedPHOENIX — A judge tossed out a bid by the head of the Arizona Republican Party to void the election results that awarded the state’s 11 electoral votes to Democrat Joe Biden.

The two days of testimony produced in the case brought by GOP Chairwoman Kelli Ward produced no evidence of fraud or misconduct in how the vote was conducted in Maricopa County, said Maricopa County Superior Court Judge Randall Warner in his Friday ruling.

Warner acknowledged that there were some human errors made when ballots that could not be read by machines due to marks or other problems were duplicated by hand.

But he said that a random sample of those duplicated ballots showed an accuracy rate of 99.45%.

Warner said there was no evidence that the error rate, even if extrapolated to all the 27,869 duplicated ballots, would change the fact that Biden beat President Trump.

The judge also threw out charges that there were illegal votes based on claims that the signatures on the envelopes containing early ballots were not properly compared with those already on file.

He pointed out that a forensic document examiner hired by Ward’s attorney reviewed 100 of those envelopes.

And at best, Warner said, that examiner found six signatures to be “inconclusive,” meaning she could not testify that they were a match to the signature on file.

But the judge said this witness found no signs of forgery.

Finally, Warner said, there was no evidence that the vote count was erroneous. So he issued an order confirming the Arizona election, which Biden won with a 10,457-vote edge over Trump.

Federal court case remains to be heard

Friday’s ruling, however, is not the last word.

Ward, in anticipation of the case going against her, already had announced she plans to seek review by the Arizona Supreme Court.

And a separate lawsuit is playing out in federal court, which includes some of the same claims made here along with allegations of fraud and conspiracy.

That case, set for a hearing Tuesday, also seeks to void the results of the presidential contest.

It includes allegations that the Dominion Software voting equipment used by Maricopa County is unreliable and was programmed to register more votes for Biden than he actually got.

Legislative leaders call for audit but not to change election results

Along the same lines, Senate President Karen Fann and House Speaker Rusty Bowers on Friday called for an independent audit of the software and equipment used by Maricopa County in the just-completed election.

“There have been questions,” Fann said.

But she told Capitol Media Services it is not their intent to use whatever is found to overturn the results of the Nov. 3 election.

In fact, she said nothing in the Republican legislative leaders’ request for the inquiry alleges there are any “irregularities” in the way the election was conducted.

“At the very least, the confidence in our electoral system has been shaken because of a lot of claims and allegations,” Fann said. “So our No. 1 goal is to restore the confidence of our voters.”

Bowers specifically rejected calls by the Trump legal team that the Legislature come into session to void the election results, which were formally certified on Monday.

“The rule of law forbids us to do that,” he said.

In fact, Bowers pointed out, it was the Republican-controlled Legislature that enacted a law three years ago specifically requiring the state’s electors “to cast their votes for the candidates who received the most votes in the official statewide canvass.”

He said that was done because Hillary Clinton had won the popular vote nationwide in 2016 and some lawmakers feared that electors would refuse to cast the state’s 11 electoral votes for Trump, who won Arizona’s race that year.

“As a conservative Republican, I don’t like the results of the presidential election,” Bowers said in a prepared statement. “But I cannot and will not entertain a suggestion that we violate current law to change the outcome of a certified election.”

Photos of the 2020 General Election voting, election night and ballot processing in Pima County, Maricopa County and throughout Arizona.