Tucson’s small business owners belonging to underrepresented communities will soon be able to receive resources to help them grow and maintain their ventures through a new loan fund that will provide capital for operations.

The city of Tucson has teamed up with the Tucson Industrial Development Authority, which helps small businesses and nonprofits secure financing, to create the AVANZA Revolving Loan Fund to supply loans to small business owners who are often underserved in the banking industry.

The AVANZA fund is part of Transform Tucson Fund, a new program IDA CEO Dre Thompson described as a “series of initiatives … that have really been designed to target areas within the city of Tucson that have received under investment.”

The exact amount of funding has yet to be ironed out, but preliminary considerations are to invest around $6 million into the loan fund. That includes a tentative amount of $1.5 million from the city of Tucson, which the IDA is prepared to match.

Additionally, a total of $3 million has already been raised for the AVANZA loan fund through support from foundations like the Sorensen Foundation, the Robert Wood Johnson Foundation and the JP Morgan Chase Foundation.

Unlike other loans provided by mainstream banking industries, the AVANZA fund doesn’t require applicants to provide collateral to secure a loan, something that often deters small business owners from accessing the money they need to operate. Thompson said one in four are “credit invisible,” meaning they don’t have the credit history to access a loan.

“There’s a lot of historic reasons why this is the case, but a lot of folks don’t have that credit history. So they’re prohibited from participating in traditional capital … you need to get a loan in order to stabilize your credit score, but you can’t get a loan until you have a high credit score,” she said.

Instead, the IDA will look at “ the core foundation of the business” such as cash flow history, according to Thompson.

The fund will also have options for smaller loans ranging from $5,000 to $250,000 to better fit applicants’ needs.

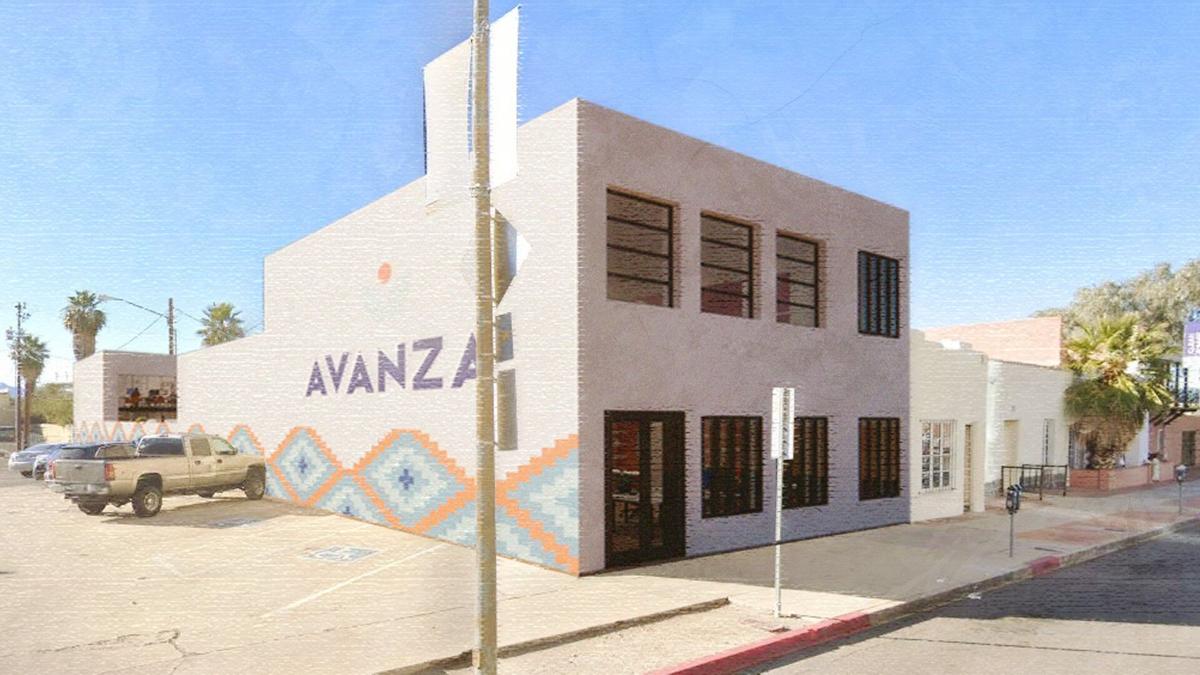

The Transform Tucson Program Fund also created the AVANZA Empowerment Center that’s scheduled to open as soon as Fall 2025. The business hub, located downtown, will be a place for small business owners to receive resources to help grow their business, such as access to a commercial kitchen and event spaces to hold meetings, according to the city.

The IDA is putting nearly $1.1 million into the center, while Tucson is set to fund $925,000 in construction costs.

The IDA will begin approving AVANZA loans in April, but other resources are available in the meantime.

“As the building is being built, we’re working on ways to streamline the experience for small businesses … we’re going to make it easy for them to receive the business support and lending in a streamlined way,” Thompson said.

Tucson’s Latino small business owners typically have less access to resources that help entrepreneurs grow their operations, which has led to an overall decrease in participation. According to Tucson’s IDA, less than 30% of the $7.8 million it has invested in small businesses throughout the region went to women or minority-owned businesses.

“This is an area that we really wanted to target and understand where the barriers (are) and how (we can) break those down,” Thompson said, adding that Tucson ranks below the national average for new Latino-owned businesses.

That’s often due to a shortage of capital available, something the AVANZA fund hopes to address.

The overarching Transform Tucson plan will continue to provide helpful resources through Connect Tucson, a program that provides one-on-one training through the city’s business navigation team. These resources include workshops on how to grow a business using social media, financial coaching and navigating licensing and permitting processes.

These resources are available to anyone seeking business guidance, and will also be provided to all AVANZA loan recipients through the Transform Tucson fund.

Tucson Mayor Regina Romero, who brought the initiatives before Tucson’s councilmembers for approval, called the combination of programs a “permanent investment towards creating more opportunity for access to capital” and said future plans are in the works to expand Transform Tucson.

“We want to make sure that we are providing the services that are not being provided by others,” she said.

For more information about Tucson’s small business assistance programs, visit connecttucson.com or call the small business assistance line at 520-837-4100.

Watch now: Hola Chingona, 412 E. Seventh St., is home to slippers shaped like conchas, horchata-flavored lip balm and funky earrings.