PHOENIX — The way Rep. Rachel Jones sees it, once you have paid off your house you should not have to worry about property taxes.

But the first-term Republican lawmaker from Tucson acknowledged there are a bunch of practical questions with her proposed legislation, including who would — or should — get a tax break. Her plan probably needs some major amendments to get any traction, she said.

But Jones said she decided to swing for the fences and start out asking for everything, figuring that gives her lots of negotiating room.

“You go big,’’ she told Capitol Media Services.

Some of it, Jones said, is philosophical.

“It’s awful that you’re charged taxes on something you own,’’ she said. Jones said that would be like buying a couch, paying the sales taxes and then having to pay some sort of fee for possessing it.

But she said her focus actually is narrower.

“My main heart issue behind it are those, especially elderly folks who are on a fixed income, who lose their homes,’’ Jones said. “I just talked with a constituent whose uncle lost his home last year because of this very issue. That’s just unacceptable.’’

Only thing is, her House Bill 2315 does not have any sort of “means testing.’’ She acknowledged that means anyone who pays off a mortgage at any age — or even has the resources to buy a house for cash — would be entitled to escape all property taxes if her measure were to become law as written.

“That is one thing I don’t like about it, especially with all the Californians moving in,’’ Jones said, referring to people with money who can buy a house outright with no mortgage. “That’s not ultimately my ‘mission accomplished’ at all.’’

There’s a related issue.

Some elderly will take out a “reverse mortgage,’’ using the equity in their paid-off homes to be able to stay there and pay other bills. And as HB 2315 is written, those people would go from paying no property taxes at all to once again having an annual bill.

Shifting the tax burden?

Jones also said she wants to be careful not to harm local governments which, unlike the state, are heavily dependent on property taxes. Schools also depend on locally raised taxes for budget overrides and paying off the bonds to build new schools.

“I understand how much property taxes go to police, education, all those things,’’ she said.

There might not be any net loss of revenues, though.

Most levels of government figure out how much they need to raise. Then they divide it into the total assessed valuation of the community. The result is a tax rate.

But if some property is removed from the tax rolls, that reduces the total assessed valuation. So the calculation divides the amount of money to be raised into that smaller base.

That, in turn, raises the tax rate that is imposed on everyone else who is not exempt from paying taxes — meaning the taxes not being paid by those with paid-off homes is shifted to them.

Jones said House research staff is crunching some numbers to figure out what that shift might be.

“I’m hoping to have a full, big compilation of all of that this week,’’ she said.

Renters’ contributions

Jones said she sees another side, too.

“There are a lot of renters in Tucson currently,’’ she said. “It’s becoming a big rental market. I don’t particularly like that people that are renting homes aren’t contributing to their community, either.’’

She said altering that could “kind of take some of the pressure off’’ of homeowners.

Jones acknowledged, though, that renters may not be getting an entirely free ride.

The landlords who own the homes and apartments are themselves paying property taxes, which they can pass on to tenants.

There is another unanswered question in HB 2315.

As crafted, it would exempt those without mortgages from paying any property taxes. Those include not just the basic levies to operate government but also the taxes that people voted to impose on themselves, such as overrides, bond debt and special districts for everything from fire protection to street lights.

That would mean people who are exempt from taxes are able to approve new levies that affect everyone else.

“That’s a really good question,’’ Jones said, adding she’s going to have to think about that issue as her bill goes through the legislative process. She said she’s a big fan of voter approval of taxes “because that’s the best way to get people’s opinion on something.’’

Pima County’s rate is highest

How much Arizona homeowners might save if Jones’ bill were to become law depends on both the value of the home and where they live.

The home’s full cash value is roughly equal to about 80% of its market value. Owner-occupied homes are assessed for tax purposes at 10% of that value.

So a home valued by assessors at $350,000 has its property taxes computed based on $35,000. Assuming a tax rate of $9 per $100 of assessed valuation, that’s about $3,150 a year.

But the tax rate can vary, with the Arizona Department of Revenue pegging the figure at anywhere from $3.39 in Greenlee County, which has the benefit of a copper mine to bolster its revenues despite a low tax rate, to $13.81 in Pima County.

These figures also vary within counties depending on taxes imposed by cities, schools and other special districts.

No date has been set for a hearing on Jones’ measure.

As Tucson's third consecutive rainy day started on Tuesday, Jan. 17, washes around town continued to flow following record rain, as seen near the North Swan Road overpass north of Fort Lowell.

A daily total of 0.59 inches of rain was recorded at Tucson International Airport on Jan. 16, which broke the previous daily record of 0.37 inches set in 1987, according to the National Weather Service.

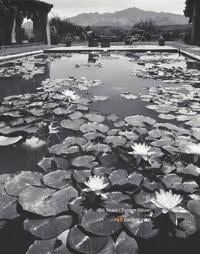

Photos: Peek inside these 80+ historic Tucson homes

Take a peek into these Southern Arizona homes from the 50s and 60s.

For more historical Tucson photos, subscribe to the weekly Tucson Time Machine newsletter here: http://tucne.ws/time.

University of Arizona librarians and friends Patricia Paylore and Phyllis Ball lived in what was called a round house. It was actually a hexag…

The home of Mrs. Charles Patterson was photographed for the Tucson Citizen Around Your Home section in 1958.

The home of Joseph A. Moller and family was photographed for the Tucson Citizen Home section in 1958. Architecturally, the house was Spanish, …

The home of E.J. Meyer was featured in the Tucson Citizen in 1958. The family members did a lot of the work on the home themselves.

The home of Margaret Sanger Slee, noted birth control pioneer, was featured in the Tucson Citizen in 1959. The first architect she approached,…

The Tucson Citizen showcased Josef von Isser's two-room home March 15, 1958. The 70-year-old von Isser had been a world traveler and his belon…

The home of M.J. Lang and family was photographed for the Tucson Citizen Home section of Nov. 15, 1958. The family wanted a home in which anyo…

The home of Fred Landeen and his family was photographed for the Tucson Citizen Home section of Sept. 20, 1958. The family wanted a place suit…

The home of Mr. and Mrs. Chester Krebbs was photographed for the Tucson Citizen Home section in 1958. The house had been a showplace ever sinc…

The home of Mr. and Mrs. Al Kivel and their daughters was photographed for the Tucson Citizen Home section in 1958. The Kivels planned the hom…

The Copins home was photographed for the Tucson Citizen Home section in 1958. The home was designed with outdoor spaces that could be used ext…

The Keller home was photographed for the Tucson Citizen home section. It was hard not to notice the 19 Herefords on the ranch.

The home of C. W. Kaufman and family was photographed for the Tucson Citizen home section in 1963. The family especially likes the desert and …

The Tucson Citizen photographed the home of Mr. and Mrs. Don Kaneen and family in 1960. The Kaneens kept making improvements to the home.

The Tucson Citizen photographed the home of Mr. and Mrs. William Kalpin in 1965. The owners designed the house, built it, did the interior des…

The home of Mr. and Mrs. J. E. McAdams, Rancho Romero, was photographed by the Tucson Citizen in 1958.

The Tucson Citizen photographed the home of William C. Jordan and his family in 1964 for its Home section. The home was off of North Oracle Ro…

The Foothills home of Halvan and Retta Jones was photographed in 1965 for the Tucson Citizen Home section. The four-bedroom house was a size t…

The home of Mr. and Mrs. Pierre Janssen, in the Catalina Foothills, was photographed by the Tucson Citizen in 1960. The home was designed so t…

The Tucson Citizen photographed the home of Howard Jacobson and his family in 1964, for its home section. The house, in Tucson Country Club Es…

The home of Dr. Charles Jacobson and his family was photographed by the Tucson Citizen in 1962. The family had an affinity for Oriental art.

The home of Carl H. Ingwer Jr. and his family was photographed for a Tucson Citizen feature in 1960. The family took a relatively new home and…

A newlywed couple honeymooning in Nassau met a woman who described her home in Tucson, and it sounded wonderful. Later they bought a house and…

The Tucson Citizen featured the home of Richard Hopkins in a 1961 Home section. The house would be the site for the Tucson Woman's Symphony As…

The home of Mrs. and Mrs. Charles Hollis was photographed by Bill Sears of the Tucson Citizen in 1957, shortly after a new kitchen was added. …

In 1966, the Tucson Citizen photographed the townhouse of Thomas Holland and family in Skyline Bel Air Estates.

In 1966, the Tucson Citizen photographed the home of William J. Hill and family for its home section. The family selected the site for the hom…

The Tucson Citizen featured the home of Dr. and Mrs. Donald Hill in 1957. The family enjoyed a country style of living.

The home of Peter D. and Recie Herder was photographed by the Tucson Citizen in 1964. The couple came to Tucson to teach, but ended up with fu…

The Tucson Citizen photographed the home of Robert E. Heineman and family in 1964. The home was once out on the edge of town, but by 1964, Tuc…

The Tucson Citizen photographed the home of Betty Hazen in 1963. Hazen pitched in when the home was built. Adobe bricks were made with the top…

The home of Elk Harwood and family was photographed for the Tucson Citizen home section in 1966. The entire family, including the poodles, app…

The home of Beverly and Art Hansen was photographed for the Tucson Citizen Home section in 1958. The Hansens wanted a home where they could ca…

The home of Dr. and Mrs. Christopher Guarino was photographed in 1962 for the Tucson Citizen. A recent addition and uplift of the existing spa…

The Tucson Citizen photographed the home of the Arthur Grunewald family. The house was a backdrop for many paintings and other works of art, b…

The home of Mrs. Frank Griffin was photographed in 1965 for the Tucson Citizen home section. Frank and Gay Griffin donated the land in Tubac t…

The ranch house of Col. and Mrs. Ernest Greene on East Speedway was photographed for the Tucson Citizen home section in 1957.

Alvin Gordon's home was photographed for the Tucson Citizen home section in 1963. The home had Spanish, Mexican and Native American accents.

The Tucson Citizen photographed a home for a 1966 home section that showed what an interior designed can do for his own home. In this case, a …

The home of the Gilbertsons was photographed by the Tucson Citizen in 1960. The family called the home "Casa de Monte Cielo" or "House of the …

The home of F. T. "Limie" Gibbings was photographed by the Tucson Citizen in 1963. It was a treasure trove of antiques.

The home of Mrs. Laura Ganoung was photographed by the Tucson Citizen for its Home section. Mrs. Ganoung's home was filled with antiques inclu…

The Tucson Citizen photographed the home of Alfonso P. Garcia and his family in Hermosillo, Sonora, Mexico, in 1961. The style of the home was…

The home of Frederic Galbraith and his family was decorated with items gathered from travels. Four large Oriental rugs had camel footprints in…

Dr. and Mrs. Walter Franklin of Globe, Arizona, reconstructed a house in Alamos, Sonora, Mexico, and made it an estate with strong Greek influ…

The Tucson Citizen photographed the home of the J.R. Fleming family in 1965. The house on West Ina Road had doubled in size and had plenty of …

The growing Fishburn family meant making a decision to move or enlarge their home. They chose to make changes to their home and the Tucson Cit…

The Tucson Citizen photographed the home of Mrs. John Fell in 1959. The home was compared to a Mediterranean villa.

The Tucson Citizen photographed the home and State House of Governor Luis Encinas in Hermosillo, Sonora, Mexico, in 1963.

The home of Ernesto V. Felix in Nogales, Sonora, Mexico, was photographed by the Tucson Citizen in 1964.

The C. J. Farringtons found that life in a mobile home suited them after having lived in a larger home. The ease of maintenance made the small…

The Tucson Citizen photographed the home and State House of Governor Luis Encinas in Hermosillo, Sonora, Mexico, in 1963.

The home of Mr. and Mrs. Richard Eggleston was photographed for a May 27, 1961 feature in the Tucson Citizen's home section.

A vacation to Alamos, Sonora, Mexico, had the DuVal family so enchanted with the place that they bought a restored home there.

The home of Dr. and Mrs. Calmes was photographed for the Tucson Home section in 1963. The home was decorated with care for the holidays each year.

The Tucson Citizen photographed the home of Agnes Duggan for its Home section June 8, 1957.

The home of Mr. and Mrs. Ken Duffy was photographed by the Tucson Citizen in 1961. Native rock collected from the property provided many of th…

The home of Kenneth Dimmick and his family was photographed in 1965 by the Tucson Citizen for its home section. The family wanted a house that…

The Indian Ridge home of Dr. and Mrs. Paul DeVries was photographed by Tucson Citizen photographer Bill Sears in 1959.

In 1960, the Tucson Citizen featured photos of the home of Ralph de Rose. The home reflected the influence of the two years the family lived i…

The Tucson Citizen photographed the home of Mr. and Mrs. John Denton in 1960. The house was designed by Josias Joesler and was a good fit for …

On Nov. 9, 1963, the Tucson Citizen featured the El Encanto home of Tucson's mayor, Lew Davis, in the Home section.

The Harlan Davis family home was photographed by the Tucson Citizen for the home section in 1964 The home features a playground outside and a …

The Tucson Citizen showed photos of the home built in about 1896 by George Roskruge. In 1961, his niece Mrs. Beppie L. Culin had lived in the …

The Tucson Citizen ran a spread of photos of the M.P. Craven home in 1961. The home was built of burnt adobe and situated in the desert.

The home of Gordon Cox and family was called a palace by the craftsmen who worked on it. The home was photographed in 1965 for the Tucson Citi…

Photographed and featured in the Tucson Citizen in 1964, this remodeled home featured touches of the past with modern features.

In 1964, the home of Mr. and Mrs. Arthur Costello was photographed for the Tucson Citizen home section. The house's design was inspired by a m…

The home of Dr. and Mrs. Howard D. Cogswell was photographed in 1960 for the Tucson Citizen home section.

The home of writer Walt Coburn and his wife was photographed in 1958. The photos showed a home filled with hand-carved furniture and relics fr…

In 1960, the Tucson Citizen featured the home of Ed and Evelyn Carmack, who remodeled their home in the Catalina Foothills Estates so it would…

The family home of Roy Laos, Jr. and Anna Laos on 4th Avenue in Tucson, as photographed by Bill Sears in 1963.

A remodeling project at the John Taylor Braddock home in 1964 gave the home more space and a lighter feel. These photos ran in the Tucson Citi…

Mr. and Mrs. James R. Blake designed a home that would serve the needs of their active youngsters and also their desire to entertain. The home…

In 1962, Mrs. Walter C. Bischoff, had taken her time furnishing her home in early American antiques because she collected authentic pieces. Th…

This home is a modern version of the old adobe hacienda. Photos were taken in 1957 for the Tucson Citizen home section.

The home of Mrs. J.S. Bernard in Tucson Country Club Estates was the subject of a Tucson Citizen article on Oct. 17, 1959. The house combined …

The home of Mr. and Mrs. Paul Bauder, in the Catalina Foothills Estates, was a part of the Tucson Fine Arts Association home tour on March 26,…

The Bailey home was photographed in 1960. It had been built as an experimental house — one of five homes in Tucson built of perlite block. The…