PHOENIX — Gov. Doug Ducey has agreed to give up the emergency powers he granted himself 15 months ago, in order to get the last vote necessary for his tax cut plan for the most wealthy.

The deal means the Republican governor will no longer have the unilateral ability to create new laws and regulations and suspend others, using the justification of the pandemic, said Sen. Kelly Townsend, R-Mesa. Ducey's exercise of those powers has been a bone of contention for Townsend and many other GOP lawmakers.

With that promise from Ducey, Townsend became the 16th Senate vote for the permanent tax cuts of at least $1.3 billion — and potentially $1.8 billion — and also for the $12.8 billion state spending plan for the new fiscal year that begins in a week.

That moves the debate to the House on Thursday, June 24. House Majority Leader Ben Toma, R-Peoria, said he has the necessary 31 votes — all Republicans — to enact the plan.

Aside from Townsend's vote for the plan, Ducey got something else. Lawmakers inserted provisions into the budget to codify in state law some of the reasons he said he needed the emergency powers in the first place.

Those include a prohibition on cities and counties issuing their own emergency orders requiring the use of face masks, closing a business or, as Pima County did, imposing a curfew.

"He needed this in here in order for him to feel good about rescinding the emergency order because he's afraid of what Phoenix or Tucson are going to do,'' Townsend said Wednesday. "He's basically saying 'If I rescind the emergency order, then I need assurances that the cities can't do all this other stuff.' "

But there may be a delay: Townsend said she agreed to let Ducey defer ending his declaration until the state gets $450 million in COVID-19 relief funds Arizona is owed from the federal government, funds the state may be entitled to only if it still has a declared emergency.

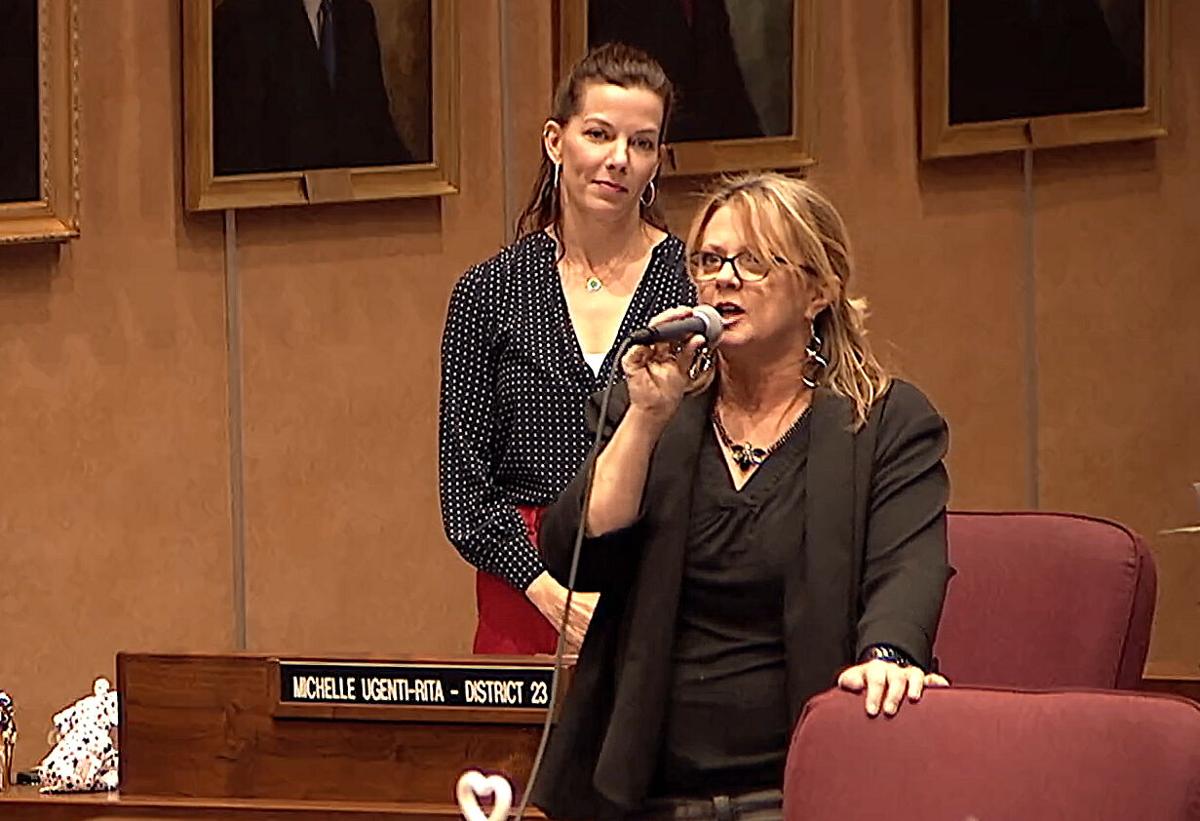

And, on the subject of gubernatorial emergencies, senators also approved a related proposal by Sen. Michelle Ugenti-Rita, R-Scottsdale, that limits future such declarations to no more than 120 days. Any extensions would have to be approved by the Legislature, and only for 30 days at a time.

As it is now, once a governor declares an emergency it can last as long as he or she wants. Lawmakers can void the action with a simple majority vote. But that does no good if they are not at the Capitol, as it takes either a call by the governor or a two-thirds vote to create a special legislative session.

Election audit

Townsend won another concession, as well: creation of a special legislative panel to review the results of the audit being conducted by the Senate of the 2020 election results in Maricopa County.

The audit results are not due until at least August, long after the regular session is expected to be over. But Townsend said if the panel concludes changes are needed in state election laws, she expects Ducey to call a special legislative session later this year, enacting them in time to affect the 2022 election.

Townsend conceded she does not have an absolute commitment from the governor to issue such a call. But she said if he balked "it would not be politically expedient.''

"If he doesn't do it, it's a political time bomb,'' she said.

Moreover, Townsend got something else in the budget: partial repeal of existing statutes that now allow the governor to order mandatory vaccinations of those with certain illnesses "or who are reasonably believed to have been exposed or may reasonably be expected to be exposed.'' The change would allow people to opt out based on "personal beliefs.''

Gubernatorial press aide C.J. Karamargin declined to comment on the the deal with Townsend.

The late-night action led to the key bills in the budget package — there are 11 of them — all passing the Senate largely along party lines after the GOP majority rejected every change sought by Democrats.

School funding issues

Some proposals sought additional funding, like one by Sen. Christine Marsh, D-Phoenix, to appropriate more money to raise teacher salaries statewide. She said current wages are still not enough to keep qualified people in classrooms.

Also rejected were plans to put more dollars into school repairs.

Democrats had no better luck beating back policy changes that Republicans included in the budget package, like imposing $5,000 fines on schools that allow the teaching of lessons suggesting that members of some races are responsible for actions taken by others of the same race.

"Why is your discomfort more important than my history?'' asked Sen. Martin Quezada, D-Glendale.

GOP lawmakers also approved expansion of who is eligible to get vouchers of state funds to send their children to private and parochial schools.

Tax-cut debate

But the key debate was over the plan to permanently cut at least $1.3 billion in taxes — and potentially up to $1.8 billion — with those at the top of the income scale getting the biggest cut, not in just dollars but in percentage, of what they would otherwise owe.

Quezada told his GOP colleagues they may live to regret their action.

"Once the people of Arizona realize what is actually in this budget, once they see this welfare-for-the-wealthy budget, they are not going to be happy,'' he said.

The plan would eventually move state income tax rates from the current four steps, ranging from 2.59% to 4.5%, to a flat 2.5% flat tax rate. It also would protect the wealthiest Arizonans from the full impact of Proposition 208, a voter-approved 3.5% surcharge on earnings over $500,000 a year to help fund education.

"The overwhelming majority of Arizonans are barely getting enough to fill a tank of gas while the wealthiest of Arizonans are getting enough to buy a new car,'' Quezada said of the tax-cut plan.

"It is a short-sighted effort to make the wealthiest Arizonans richer,'' said Senate Minority Leader Rebecca Rios, D-Phoenix.

But Sen. J.D. Mesnard, R-Chandler, said it makes sense that people who earn more and have higher taxes will get a bigger break.

Anyway, he said, the Republican-controlled Legislature has a record of helping those at the bottom of the income scale.

Mesnard cited a 2019 law that provided for a standard deduction of $24,000 for married couples, meaning anyone making less than that owes no state income taxes. Prior to that the figure was $10,366.

He also said that, absent the changes in the law, Arizona would have the second-highest top tax bracket in the country at 8%, meaning the current 4.5% cap plus the 3.5% surcharge from Proposition 208. Only California would be higher.

And Sen. Sonny Borrelli, R-Lake Havasu City, said the complaints of the Democrats smack of class warfare. "It seems kind of unfair to be attacking success in a system where we are a meritocracy, where you are actually rewarded for your efforts and you can actually pass on your successes to enrich other folks,'' he said.

Vehicle fee

The final budget has a small victory for some motorists.

Ugenti-Rita got a clarification in the law to say that anyone whose vehicle registration expires on June 30 is not required to pay the $32 per vehicle registration fee.

The fee already is set to self-destruct on that date. But the Department of Transportation has taken the position that even those who were buying new registrations that would be effective July 1 also had to pay it.

Her amendment ensures that the approximately 166,000 vehicle owners who already paid the fee will get a refund.