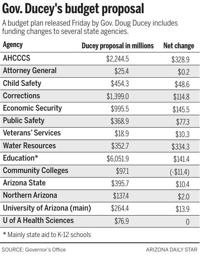

PHOENIX — Buoyed by strong state revenues, Gov. Doug Ducey is proposing a $14.25 billion spending plan for the new fiscal year, about 8.6% more than this year, including tax cuts aimed at the poor to reward them for working.

Other spending priorities include:

$227 million in new K-12 funding above and behind what’s required to keep pace with enrollment growth and inflation;

$127 million for higher education, including $46 million for “economy workforce initiatives’’ at the three universities to prepare students for careers in future jobs;

About $26 million to for would-be nursing students to attend the privately run Creighton University to help staff Arizona hospitals;

About $26 million to increase the amount of money given to people who agree to take care of relatives instead of them going into foster care or congregate care settings.

The budget also includes $160 million to start work on increasing the state’s water supply.

That is far short of the $1 billion commitment he made in his State of the State speech. But aides said that promise was for over three years, meaning after he has left office.

And even then, much of the money is not for grand projects like desalination but instead for shorter-term solutions like water banking and paying tribes and others to use less Colorado River water.

Ducey also wants to put $50 million into border security, paying for more officers to patrol the area and help fund counties with the cost of detaining and prosecuting people for state crimes.

But some of that money is going to erect what the Governor’s Office is calling “physical barriers’’ along stretches of the border where they have access. And that specifically means private lands.

Aides said the most likely targeted areas are in Cochise County where ranchers have property right up against the international boundary.

What they envision, however, is not the style of fence the feds already built before construction was stopped by the Biden administration. Instead, they are looking at a chain-link fence, similar to what is around state prisons.

Those fences also will feature “no trespassing’’ signs, a move that the Governor’s Office said is designed to allow police to prosecute those crossing the border illegally under state charges.

The new budget also is built on the premise that the 2.5% flat tax proposal approved last year will, in fact, take effect this year — at an annual cost of $1.9 billion — despite the fact that foes have gathered enough signatures to delay it until the public can vote on it in November.

While a judge has said the tax cut is subject to referendum, there is still a challenge to whether there are sufficient signatures on the petitions. And even if that fails, GOP legislative leaders are planning a maneuver that effectively would quash a public vote by repealing last year’s version and reenacting something new — and possibly different — this year.

Several lawmakers already are angling for even bigger tax cuts. Rep. Jake Hoffman, R-Queen Creek, is proposing a further reduction in that flat tax, to $1.5 billion.

But Ducey’s proposal is more targeted.

It creates a state version of the federal Earned Income Tax Credit that targets low-income households where someone is working and, in most cases, where there is a child.

Eligibility is based on income, maxing out at $57,414 a year for married couples filing jointly who have three or more qualifying children, with lower limits for smaller families. The Governor’s Office estimates that 577,000 Arizonans will qualify at a cost of $74 million a year.

The maximum benefit is about $325 a year, with an average of $128.

There also is a separate — and as of yet undefined — plan to cut business property taxes.

Strictly speaking, the state gets no property tax revenues.

But when the state alters the basis for how those taxes are assessed to reduce what business pays, it can shift the tax burden onto homeowners to pay for local governments, community colleges and other schools.

That has proven a a nonstarter among lawmakers who have to go to those same homeowners every two years to get reelected. So prior cuts to business taxes have included some compensating tax relief for homeowners.

Ducey’s budget sets aside $58 million for that, leaving it up to lawmakers how to enact business tax cuts.

The governor’s aides say business tax relief is justified based on data they say show that Arizona has the 10th highest industrial property tax rates in the nation.

Much of the new money for K-12 education, above inflation and enrollment growth, is earmarked for school capital needs. That includes money for grants to schools for needed repairs as well as cash to begin three new high schools at Marana, Pima and Nadaburg school districts.

Ducey’s plan also includes $58 million to help low-performing schools — those rated D or F by the state Department of Education as well as some C-rated schools where 60% or more of the students come from low-income households. The cash of $150 a student for up to three years is designed to help schools improve; if they do not, then the governor will ask the state Department of Education to step in.

But that $150 is less than Ducey wants to give schools that already have an A rating, up to an extra $429 per student for schools with a high number of children in poverty and $241 for those with fewer students in need.

The biggest share of the funds for higher education are linked to training in specialized fields.

For example, Arizona State University is getting $21 million for new programs in engineering, There’s $415 million for the University of Arizona for its programs in health, mining, space and defense, with about $10 million for Northern Arizona University for health care professions.

The budget does have a specific sensitivity to how the COVID-19 outbreak has highlighted the shortage of nurses in the state. That includes the nearly $26 million for would-be nurses to go to the accelerated nursing program at Creighton University, with students having to promise to work at a hospital in Arizona for four years.

There also is a $450 million deposit into the state’s “rainy day’’ fund, bringing it up to 10% of the total state budget, the maximum permitted by law.

Other priorities in the governor’s program include:

$248 million for targeted pay raises for state workers.

$400 million to complete another 20 miles of upgrading I-10 to three lanes in each direction between Casa Grande and Sun Lakes;

$50 million for communities outside Pima and Maricopa counties to leverage federal dollars for “shovel-ready’’ transportation projects;

$92 million for building repairs and upgrades in the state prison system;

$8.2 million to increase the number of Adult Protective Services caseworkers;

$177 million for projects at state parks, about half for sewage treatment systems, though $118 million of that is coming from federal cash.