PHOENIX — Some corporate tax cuts enacted during the recession are now taking a bite out of state revenues.

Tax collections for December were $844 million, new figures from the Joint Legislative Budget Committee show. That’s 4.8 percent less than the same time a year ago.

But what’s really pulling the number down is a drop of 45.6 percent in corporate income tax collections — from more than $125 million a year ago to less than $68 million now.

“The large decline in the tax category is an indication that the state may finally be experiencing the revenue loss from the corporate tax reductions that began to be phased in on Jan. 1, 2014,” the report says.

The reason they’re showing up now, according to legislative staffers, is that most large corporate filers got a six-month extension of the filings that were due last April. The state Department of Revenue did not process those forms until December.

The result is that corporate income tax refunds, which were $19.4 million in December 2014, sharply increased to $50 million this past month.

But that’s only the tip of the iceberg.

JLBC staffers figure that the cuts that already have taken effect will reduce revenues by the end of this budget year by $97 million from what they otherwise would have been.

And by the 2019 budget year, corporations will be paying just $352 million — half of what they otherwise would be paying.

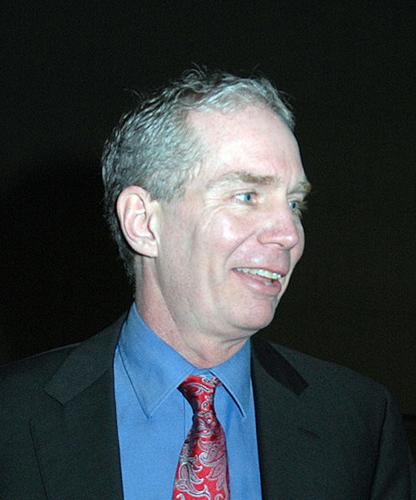

But gubernatorial press aide Daniel Scarpinato said his boss, who proposed a conservative budget amid concerns about future revenues, has no interest in keeping those future cuts from taking place. He said Doug Ducey believes lower taxes are the key to economic growth.

“We are in competition with every other state in the country,” he said.

“Other states are doing tax reform, other states are figuring out how to be more competitive,” Scarpinato continued. “And for Arizona to walk out of that game and say ‘We’re not going to compete, we’re going to raise taxes’ would be really irresponsible.”

And eliminating tax cuts that have not yet taken effect — and give up revenues that are not yet due — would effectively be a tax hike, Scarpinato said.

“Employers and job creators need certainty,” he said. “And if we pull the rug from underneath and say, ‘These are the tax rates you were expecting, and now we’re going to change all that,’ that would be very detrimental to everyday Arizonans and to our economy.”

But House Minority Leader Eric Meyer said he has heard all that before.

Meyer said he is still waiting for the economic boom that proponents said would occur the moment the phase-down of the tax rates was approved.

Before the changes were approved, corporations paid a flat rate of just under 7 percent. For last tax year it was 6 percent. And by the end of this tax year, it will be 4.9 percent.

Separately, lawmakers approved a change in how some multistate corporations can compute how much of their income — and, by extension, their taxes — are allocated to Arizona.

All totaled, the changes ultimately will reduce revenues by more than $530 million annually by the time of full implementation in 2019.

Meyer noted that the state’s jobless rate is still close to a full percentage point above the national average. And the number of people working now is still less than it was before the recession.

“And the jobs that we’re creating aren’t, in many cases, the high-wage, high-tech jobs that other states are creating,” he said.

Meyer called it “the old trickle-down economics idea.”

“The reality is those tax cuts go in the form of dividends to shareholders all over the world,” he said. “And we’re not assured they create a single job here.”

It all comes down to priorities, he said.

“If we want to invest in education and our universities, you have to have revenues come from somewhere,” Meyer said. “And we tend to just cut taxes without any plan to fund the things that we need to fund in our state.”

Scarpinato said Ducey’s proposed budget does prioritize education, citing the $3.5 billion proposal on the May 17 ballot for additional K-12 funding. And he said there is $90 million above that from the general fund.

That $3.5 billion, however, is meant to settle a lawsuit over the state’s failure to meet a voter mandate to increase funding for education to account for inflation. And about half of the $90 million is to keep schools even with additional enrollment and inflation.

Scarpinato also said that Ducey is “changing the trend line” on university funding, citing the $8 million in his budget proposal. That, however, follows Ducey signing a budget for this year that cut $99 million from the state’s universities.