Lea Marquez Peterson

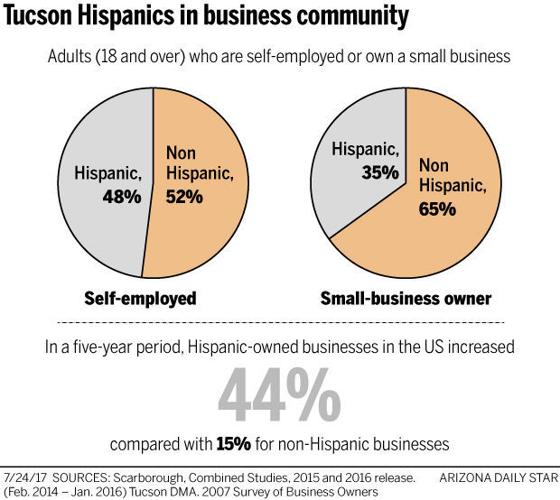

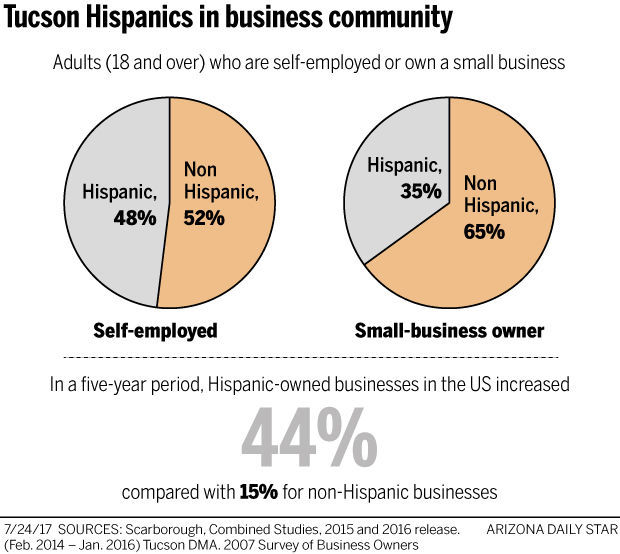

A recently released report showed that Hispanic small-business owners are confident about their growth prospects and anticipate that revenue will increase some 71 percent in 2017. Seventy-six percent of Hispanic small-business owners plan to grow their business over the next five years as compared to 55 percent of non-Hispanic owned businesses.

This national trend is reflected in Tucson and throughout Southern Arizona.

Daily, our chamber team meets with entrepreneurs who are launching new businesses or expanding existing businesses. We have responded by increasing the number of business-education courses that we host for members at our four Hispanic chambers in Southern Arizona and by highlighting small-business lending options.

Last year, our chamber launched ArizonaBizLoans.com in partnership with the Arizona Chamber of Commerce to meet the borrowing needs of those small businesses that were deemed too risky for banks and credit unions. Businesses that are planning to grow need to hire employees, and the Hispanic small-business-owner report indicated that 54 percent of Hispanic business owners plan to hire in 2017.

But how difficult is it to borrow money for a small business in Southern Arizona today? National data show that 35 percent of Hispanic business owners intend to apply for a loan in 2017 versus only 9 percent of non-Hispanic business owners. We also know that Hispanic-owned businesses tend to be smaller on average around the country. This may be due to the fact that most Hispanic business owners start their business using personal savings, personal credit cards and relying on family and friends.

As a business community, we need to continue to pay attention to lending challenges and how they impact our ability to scale our businesses and improve the economy of Southern Arizona.

Hispanic small businesses rely heavily on family for support, more so than the general market. Family members often provide financial and operational assistance while also helping run the business, and they play an influential role in business decisions. Business owners should seek additional information on succession planning and the dynamics of running a family owned business as a tool to scaling their business in the future.

This information (and more) on the purchasing power in the Hispanic community will be featured in our 2017 Hispanic Market Outlook event on Sept. 28 in Tucson. Our Hispanic Market Outlook report is a comprehensive Hispanic-market research study that documents, in more than 150 pages, the economic impact of the Hispanic market.

The data focus on Pima, Cochise and Santa Cruz counties and is not information that is readily available. The report and event are hosted in partnership with Telemundo, which assists in the analysis of national data and provides local and regional numbers that we can utilize to grow our region.

Register today at www.TucsonHispanicChamber.org to attend the presentation and learn about connecting with Hispanic-owned businesses and the fast-growing Hispanic market.