Faced with continuing complaints about road conditions, Pima County has started a campaign to explain how transportation dollars are spent and what can be done to better maintain the crumbling inventory of streets.

“There’s just a huge amount of misinformation being made about how the county spends its money on roads,” Pima County Administrator Chuck Huckelberry said.

So county officials recently wrote and printed thousands of copies of a multipage brochure attempting to show the breakdown of county transportation funding and suggesting the best fix for roads would be more money.

In the process, they are planting the seed that gasoline taxes, which have been unchanged since 1991, must increase. Arizona’s 18-cents-a-gallon gas tax ranks among the 10 lowest in the country.

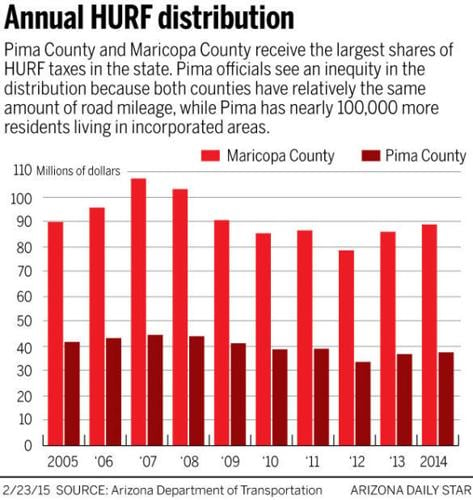

Most of the county’s more than $50 million transportation budget comes from the state’s Highway User Revenue Fund (HURF). This year, HURF accounts for about $37.5 million of the total. State vehicle license taxes and charges for services make up the remainder.

To combat what Huckelberry sees as erroneous or politically motivated information about county roads spending, the brochure blames lack of road funds on:

- The nearly 25 years since there was an increase in the gas tax, which is assessed per gallon rather than on the amount of the sale, making it unresponsive to inflation, unlike road building and repair costs.

- Cars getting better gas mileage, therefore using less gas and paying less tax, while putting the same demand on the streets.

- The Legislature frequently changing the formula for distributing highway funds.

“The consequence is that we have bad roads,” Huckelberry said.

Some county supervisors have taken the brochure to constituent and business groups to discuss transportation funding issues and to hear what the community wants from the county.

Supervisor Ray Carroll said he wants to speak to as many business groups as possible to explain the issue in hopes of gaining support from constituents who have more sway with the Legislature and governor.

“We’re being stripped of funds that we rightly deserve,” Carroll said.

But he said the people he’s been talking with in the community are concerned that any new tax, whether an increase in the gas tax or another funding source, would be open to further raids by the Legislature.

Carroll said he supports an increase as long as future lawmakers won’t be allowed to divert the money to different sources.

“You have to protect it with a lockbox,” Carroll said.

Gas tax history

The Arizona Legislature created the Highway User Revenue Fund in 1974, making it the main source of funding for city and county transportation departments. The sharing arrangement with local governments made taxes uniform statewide and prevented local governments from imposing their own taxes on fuel.

Originally, counties were to receive 15 percent of the fund and cities 17 percent. The Arizona Highway Patrol received 57 percent and state highway fund 11 percent.

The Arizona Department of Transportation also was established in 1974, and its operations have since been funded through HURF and other fees and taxes.

Over the years, however, the Legislature has repeatedly altered the HURF funding formula, changing the distribution levels, using the fund to pay for additional government services, and basically slicing more pieces from the HURF pie.

Lawmakers have added funding for the Department of Public Safety, regional projects of the Pima and Maricopa associations of governments, economic vitality programs and balancing the state general fund.

Since 2005, the Legislature has pulled more than $400 million from the road fund into the state’s general fund.

DPS funding from HURF, for example, has gone from $12.5 million in 2001 to more than $125 million by 2012.

Huckelberry argues that the constant reallocations have left counties with less money to fund road repairs and few options to address the growing need.

While an increase in the gas tax remains the big target, county leaders have in the past identified multiple options to raise revenue locally.

These have included allocating more from the county general fund to transportation, pouring year-end general fund balances into pavement preservation, borrowing from the development impact fee fund, levying a countywide property tax earmarked for road repairs and imposing an additional half-cent sales tax also allocated for roads.

“A number of counties have dedicated sales taxes for transportation,” Huckelberry said. “We’re the only country that hasn’t enacted it.”

He estimates such a tax could generate $80 million annually, but he added that it could bring up issues of inequity because it would mean collecting a sales tax in cities and towns to fund only county roads.

He said that issue could be offset by redistributing some of the money back to the incorporated areas. But even then, imposing a new sales tax would require a unanimous board vote, which seems unlikely.

“We already have a half-cent sales tax,” Supervisor Ally Miller said, referring to the Regional Transportation Plan that funds improvement projects throughout the county.

Miller said she’s also concerned that not enough of a new tax would go toward fixing existing roads and would instead support employee salaries.

Given the unlikely support for a sales tax, “the only option on the table is bonding,” with the money dedicated to road repairs, Supervisor Sharon Bronson suggested, as a way to get through the immediate crunch.

She said the Legislature’s history of reallocating HURF money has diminished the ability of local governments to address needs.

In addition, Bronson said the gas tax has not kept pace with infrastructure needs.

“The state has failed to keep up with inflation in terms of the gas tax,” Bronson said, adding that any long-term solutions would have to come from the state level.

But one thing that might come from the state level has some in Pima County concerned that funding future road projects could become even more difficult.

HB 2572 would limit how the county can spend its HURF allocation, requiring that 80 percent of HURF dollars go “for road construction, reconstruction, maintenance, repair or roadside development, including materials and labor.”

The remaining 20 percent could be used for salaries and administrative costs.

Miller called it “a good bill” that assures roads get fixed. But Huckelberry said the bill could force the county to default on about $19 million a year in road debt approved by voters with the understanding it would be repaid from HURF funds.

Plus, the bill calls for the county to pay Transportation Department workers through the general fund and would force cuts in other areas.

Carroll said he doesn’t see the issue of roads going away anytime soon.

“I think undoubtedly, the priority for all the 15 counties is for the roads,” he said. “All of the counties are just as full of potholes as Pima County.”