Raytheon Co. on Thursday reported a lower first-quarter profit of $429 million, but both its earnings and revenues beat Wall Street estimates and it raised its profit forecast for 2016.

The company’s Tucson-based Raytheon Missile Systems business unit posted net sales of $1.72 billion, up 17 percent, while its operating income slipped 7 percent.

The Waltham, Massachusetts-based parent company had net income of $1.43 per share, compared with earnings of $1.78 per share in first-quarter 2015.

First-quarter earnings were cut by 8 cents per share for accounting adjustments related to the acquisition of cybersecurity products maker Forcepoint.

The defense contractor posted revenue of $5.76 billion in the first quarter, up 9 percent from the same period a year ago.

Analysts on average had forecast earnings of $1.37 per share on revenues of $5.45 billion.

Raytheon shares were down about 2 percent in midafternoon trading on the New York Stock Exchange.

Raytheon said it expects full-year 2016 earnings to be $6.93 to $7.13 per share, up from an earlier forecast of $6.80 to $7 per share. The company maintained its projection of annual revenue in the range of $24 billion to $24.5 billion.

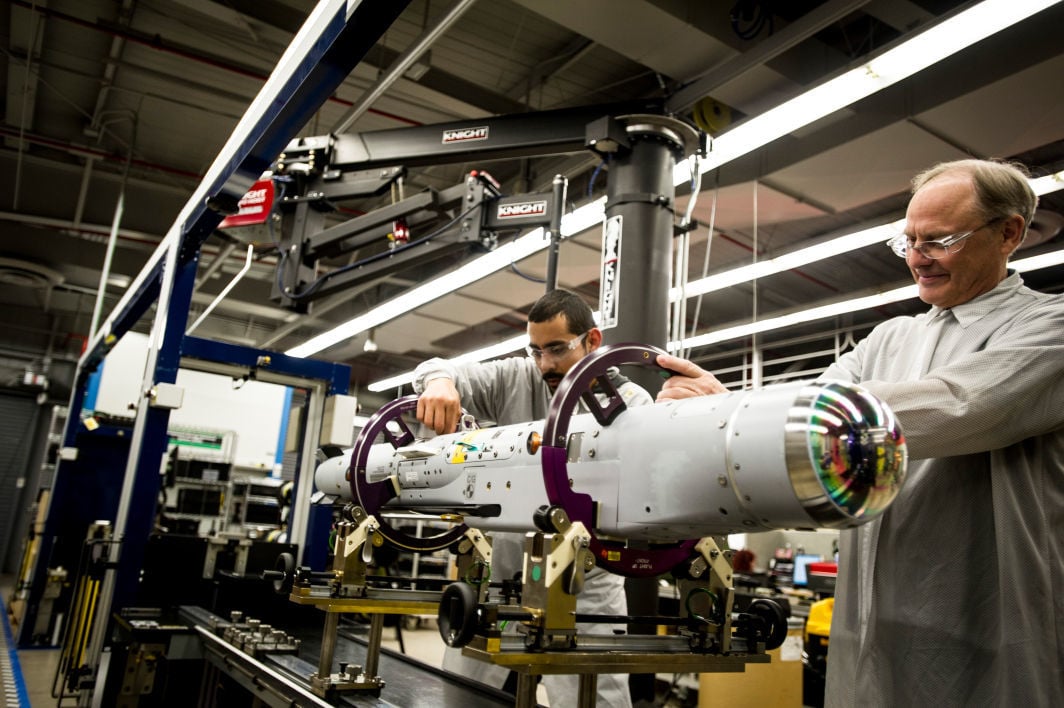

Raytheon said the increase in net sales at Missile Systems was mainly driven by higher sales of Paveway guided-bomb kits and Advanced Medium-Range Air-to-Air Missiles (AMRAAMs).

The decrease in Missile Systems’ operating income compared with first-quarter 2015 was mainly due to higher net program efficiencies and a favorable resolution of a contractual issue in 2015, along with lower incentive fees on a missile defense program in the first quarter of 2016.

During the quarter, Missile Systems booked $646 million for AMRAAM for the Air Force, U.S. Navy and international customers, $272 million for the Standard Missile-6 for the U.S. Navy and $225 million for Paveway for the Air Force and foreign allies.

First-quarter sales at other reporting Raytheon divisions also rose, with Space and Airborne Systems posting a 7 percent increase from 2015 and Intelligence, Information and Services and Integrated Defense Systems each reporting 2 percent increases.