For Tucson and Southern Arizona, the road to recovery from the Great Recession has been a long slog, but there are signs that the economy and jobs growth will be on the upswing in 2017.

The labored rebound is evident in the Star 200 survey, as most of the region’s biggest employers showed little or no growth in their payrolls in 2015.

The area’s biggest private employer, Raytheon Missile Systems, and major government employers like Davis-Monthan Air Force Base, Fort Huachuca and Pima County reported flat or slightly higher employee counts compared with the prior year.

Others reported mostly small gains or losses, with the biggest losses coming at copper miners Freeport-McMoRan and Asarco.

But it’s not all gloom and doom.

Economists are optimistic that the Tucson-area economy, which has lagged behind Phoenix and the state, will break out of its malaise and start growing jobs at a somewhat faster clip in 2017. For statistical purposes, the Tucson Metropolitan Statistical Area is all of Pima County.

A state economist recently forecast that the job growth in the Tucson area would accelerate to a rate of nearly 2 percent in the next two years, up from about one-half of 1 percent in 2014 and 2015.

State economist Doug Walls said he expects Pima County will add another 14,393 jobs in the coming two years for a 1.9 percent growth rate, citing an uptick in both construction activity and hiring in the financial sector.

And on an unadjusted basis, state data show, Tucson-area non-farm employment in February grew 2.9 percent over the year on a seasonally unadjusted basis, faster than the U.S. annual rate of 1.9 percent, though still lagging behind Phoenix.

University of Arizona economist George Hammond said that although Tucson’s economic rebound is still lagging, he also foresees an uptick in hiring.

Hammond said he may well revise his jobs forecast upward, from a projected 0.9 percent in non-farm jobs, when the Economic and Business Research Center presents its next forecast update June 1.

But Hammond says he’s not sure he trusts the unadjusted state data, because figures from the second half of 2015 and the first part of 2016 show such a dramatic upward trend.

“It doesn’t look much like what came before,” Hammond said. “I’m a little worried that we may see some of that job growth get revised away.”

Hammond looks for so-called “fiscal drag” — lower government spending — to ease, perhaps boosting employment at the state’s universities and government agencies.

On the federal level, a more stable budget may buttress local employment in government as well as government-dependent industries like defense, Hammond said.

RAYTHEON WEATHERS CUTS

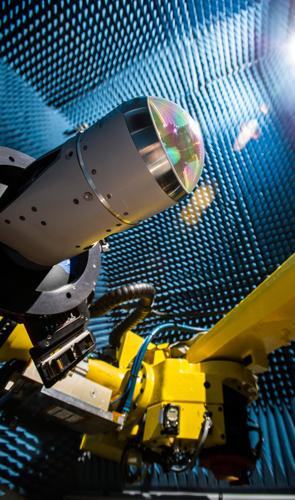

Amid a turbulent few years for the U.S. defense budget, Tucson-based Raytheon Missile Systems hung in there in 2015.

The area’s biggest private employer has offered the same employment figure for the past two years, 9,600 full-time equivalent workers. Raytheon announced no major new job initiatives, but the local division hasn’t announced mass layoffs since what it described as a small reduction in 2013.

The flat employment at Raytheon is the result of constant adjustment of its large workforce as it responds to changing contracts and needs.

“As the contracts change we make adjustments, and we’re always looking for efficiencies for the customer,” Raytheon spokesman John Patterson said. “We make little adjustments all the time — it’s a balancing act, getting that right.”

To boost production efficiency, Patterson said, Raytheon also has added automation for things like product handling.

While it’s showing no net growth, Missile Systems had more than 300 job listings — mostly for engineers and other professionals — posted on its employment website as of early April.

Other major defense contractors have announced significant layoffs in recent years, and major program cuts can and do have an effect on Raytheon’s payroll. In 2010, Raytheon laid off about 225 local salaried workers, citing program cancellations.

But analysts and company executives say Raytheon is less vulnerable to defense budget cuts than some of its peers because it makes munitions used on a variety of platforms, such as ships, rather than the pricey platforms themselves.

Indeed, some of Missile Systems products are in high demand as conflict rages in the Middle East, and foreign allies buy many of Raytheon’s weapon systems.

“We feel we’re in a better position than our peer group,” Patterson said. “Many of our products are must-haves, like AMRAAM (the Advanced Medium-Range Air to Air Missile), which 36 nations now use.”

While Tucson has not seen major cuts at Raytheon in recent years, it also missed out on about 300 jobs in 2010 when the company decided to locate a new missile plant in Alabama — partly because the Tucson plant lacked the necessary buffer space for expansion.

Local officials have since rerouted a major roadway and set aside land south of Raytheon’s campus at Tucson International Airport to provide a greater buffer, while planning an aerospace and defense corridor further south.

Elsewhere among Southern Arizona defense contractors, Northrop Grumman and General Dynamics each reported cuts last year at their sites at Fort Huachuca in Sierra Vista.

SMALL GAINS AT THE TOP

The region’s biggest employer, the University of Arizona, posted a small gain in 2015 as state budget cuts were offset by other funding sources (see story, Page 13), while the state of Arizona itself reported a small increase after shedding hundreds of jobs in the wake of the recession.

But the city of Tucson shed more workers last year, cutting its staffing to the lowest level since the 1990s (see story, Page 13).

Most school districts also lost jobs, led by Tucson Unified — the region’s sixth-largest employer — which said it cut 364 full-time positions, partly by moving some employees into part-time jobs.

Among other job losers in the top 20 of the Star 200 were copper producers Freeport-McMoRan and Asarco, which shed hundreds of jobs in 2015 in response to sagging copper prices (see story, Page 17).

Among major health-care employers, Banner-University Health Center announced an undisclosed number of layoffs in June. And Carondelet Health Network, which changed majority ownership last year, dropped about 80 employees, or 2 percent of its local workforce.