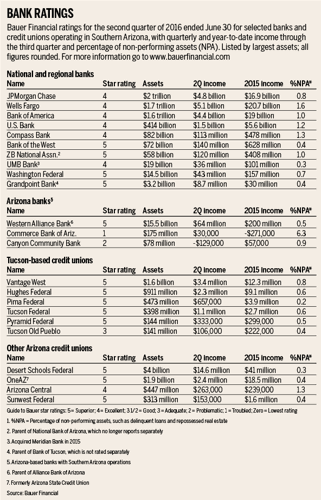

Tucson’s only locally owned community bank took a step up in the latest Bauer Financial ratings of financial institutions, as Arizona’s banks and credit unions gained strength in the second quarter.

Commerce Bank of Arizona earned back one star in Bauer’s five-star rating system, after posting its second quarterly profit since 2011.

Commerce Bank’s one-star rating, which translates to “troubled” in Bauer’s rating system, is an improvement from the zero-star rating the bank has been saddled with since 2014.

Commerce, which got slammed by a wave of bad small-business loans in the wake of the Great Recession, has been under a consent order with federal regulators to raise its capital reserves.

The bank raised $2.7 million last year mainly from local investors and is planning for a new fundraising round in the spring, and it’s also been cutting costs and shedding bad assets, said John P. Lewis, president and CEO of Commerce Bank of Arizona.

“We’re kind of doing it the old fashioned way,” said Lewis, a longtime local banker who founded and headed the former Southern Arizona Community Bank.

Lewis said Commerce has cut its problem loans by 64 percent, to $12 million in value, since the end of 2013, while cutting operating costs by some $2 million and boosting its performing loans by $19 million or 16 percent.

Commerce posted its first quarterly earnings since 2011 in the first quarter, Lewis noted. The bank continued that in the second quarter, posting $30,000 in net income after earning $23,000 in the first quarter.

Commerce saw its percentage of non-performing assets, such as delinquent loans, rise slightly to 6.3 percent.

Commerce’s capital ratios remain below the requirements of a consent order the state-chartered bank signed with the Federal Deposit Insurance Corp. in 2013.

But Lewis said regulators have been satisfied with the bank’s progress, and he’s happy Florida-based Bauer recognized some improvement.

“One star is a step in the right direction,” Lewis said.

Meanwhile, Tucson-based Canyon Community Bank saw its Bauer rating remain at two stars, or “problematic,” after Bauer elevated the bank from one star in the fourth quarter of 2015.

Canyon Community raised $9.5 million from an investment holding company in November, making it one of the state’s best-capitalized banks.

The investment from Highgate Holdings LLC made the Texas-based company a majority owner of Canyon Community Bank and left Commerce Bank of Arizona as Tucson’s only fully locally owned bank.

Canyon has filed a request with the Office of the Comptroller of the Currency to lift a consent order the bank has operated under since mid-2013.

In the second quarter, Canyon posted a loss of $129,000, but its non-performing assets remain below 1 percent and it far exceeds its capital reserve requirements, thanks to the Highgate investment.

Among other banks operating in Southern Arizona, Alabama-based Compass Bank lost one Bauer star, dropping to four stars from five, while the rest maintained their previous Bauer ratings.

Overall, about 67 percent of Arizona’s banks were rated as “recommended,” with either the top “superior” or “excellent” ratings from Bauer, while 11 percent were rated “troubled” or problematic.

That’s an improvement from the second quarter of 2015, when 65 percent of Arizona banks were recommended by Bauer and 15 percent were troubled or problematic.

By comparison, nationwide, Bauer rated 85.6 percent of banks “recommended,” while 2.8 percent were troubled or problematic, an improvement from 81 percent and 3.8 percent in second-quarter of 2015.

Meanwhile, Bauer rated 84 percent of Arizona credit unions “recommended,” with none troubled or problematic. Nationally, 80.3 percent were recommended and 2.3 percent were troubled or problematic in the second quarter.

Southern Arizona credit unions maintained their prior Bauer ratings, with locally based Vantage West, Hughes Federal, Tucson Federal, Pima Federal and Pyramid Federal all keeping the five-star “superior” ratings.