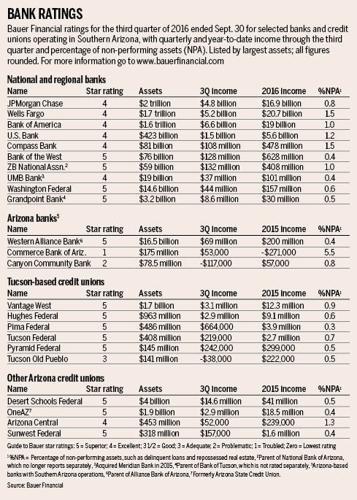

The overall health of Arizona’s banks continued steady improvement in the third quarter, judging by the latest ratings from a major bank research firm.

For the third quarter of 2016, 70.6 percent of banks operating in the state were “recommended” by Florida-based Bauer Financial Inc. — meaning they won one of Bauer’s top two ratings, “superior” or “excellent” — while 11.8 percent were rated “troubled” or “problematic.”

Nationally, 87 percent of banks were recommended by Bauer, while 2.6 percent were on the troubled or problematic list. Bauer bases its ratings on federal regulatory filings.

The percentage of recommended banks operating in Arizona was up from 68.4 percent in third-quarter 2015, while the percentage of banks rated troubled or problematic rose from 10.5 percent in the prior year.

For banks operating in Arizona, the only changes in Bauer ratings from the prior quarter involved two smaller banks with limited operations.

Mohave State Bank, which operates in Mohave County, saw its rating rise a half-star to four stars, or “excellent.” North Dakota-based First International Bank & Trust, which has three branches in the Phoenix area, dropped to four stars from five.

Ratings were unchanged for all rated banks operating in Tucson, including two local banks that have been under regulatory orders to raise capital.

Commerce Bank of Arizona remained at Bauer’s one-star, or “troubled” rating.

Commerce, which got slammed by a wave of bad small-business loans in the wake of the recession, has been under a consent order with federal and state regulators to raise its capital reserves since 2013.

The bank raised $2.7 million last year mainly from local investors and began a new fundraising round in December that is going very well, Commerce CEO John P. Lewis said.

Commerce Bank’s capital reserve ratios remain below the level required in the bank’s consent agreement with the Federal Deposit Insurance Corp., but its percentage of non-performing assets continued to improve, to 5.5 percent in the third quarter from 6.3 percent in second-quarter 2016.

Commerce posted net income of $53,000 in the third quarter and $106,000 through Sept. 30 last year, after reporting a $271,000 loss in all of 2015.

Canyon Community Bank posted a $117,000 third-quarter loss and is still rated just two stars, or “problematic” in Bauer’s most recent ratings.

The bank raised $9.5 million from a Texas-based investment holding company in November 2015, making it one of the state’s best-capitalized banks.

Canyon had filed a request with the Office of the Comptroller of the Currency to lift a 2013 consent order that required the bank to raise its capital reserves. The order remained in effect as of last week, according to online records.

Meanwhile, Arizona’s credit unions remain financially strong, with more than 84 percent recommended by Bauer and no troubled or problematic institutions.

Nationwide, 80.3 percent of credit unions were recommended while 2.2 percent were troubled or problematic.

Southern Arizona credit unions maintained their prior Bauer ratings, with locally based Vantage West, Hughes Federal, Tucson Federal, Pima Federal and Pyramid Federal all keeping the five-star “superior” ratings.