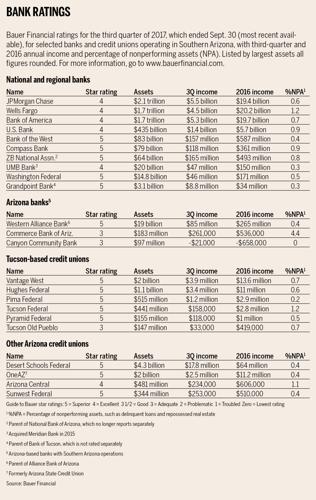

Arizona banks and credit unions seem to be out of the woods in their recovery from the Great Recession, judging from the latest ratings of financial institutions by Bauer Financial.

But the state still has a lower percentage of top-rated banks than the national average.

None of the state’s banks were rated “troubled” or “problematic” in Bauer’s ratings for the third quarter of 2017, after two Tucson-based banks — Commerce Bank of Arizona and Canyon Community Bank — completed their recoveries and earned 3-star, “adequate” ratings.

Commerce Bank of Arizona and Canyon Community Bank raised their ratings after raising millions of dollars in new capital to meet regulatory orders.

Bauer rated 75 percent of Arizona banks as “recommended” — with a rating of either 4 stars (excellent) or 5 stars (superior) in the third quarter.

That’s up from about 71 percent in the prior quarter, though it lagged the national average of 89 percent in the quarter that ended Sept. 30.

Nationally, Bauer rated 2 percent of banks as troubled or problematic.

Commerce Bank and Canyon Community Bank fell to Bauer’s lowest ratings – Commerce was at “zero” stars and Canyon was at 1 star, or “troubled” until mid-2016 — as they wrote off bad business loans in the wake of the recession.

Since 2015, Commerce raised more than $13 million from local investors, prompting the Federal Deposit Insurance Corp. and the Arizona Department of Financial Institutions to lift a 2013 consent order last August.

Canyon Community Bank raised $9.5 million in 2015 from a Texas-based investment holding company in exchange for a majority ownership stake in the bank.

In the third quarter, Commerce Bank posted net income of $261,000, bringing its 2017 income through the third quarter to $745,000, after earning $536,000 for all of 2016.

The bank’s percentage of nonperforming assets — things like delinquent loans — fell but remained relatively high at 4.4 percent.

Canyon Community Bank reported a third-quarter net loss of $21,000 and lost $85,000 through the third quarter.

But Canyon’s new investment helped the bank raise its risk-based capital ratio — a key measure of financial strength — to a statewide high of nearly 36 percent. And Canyon reported that it had no nonperforming assets at the end of the third quarter.

Lauren Kingry, Canyon Community Bank president and CEO, said the consent order imposed by the Office of the Comptroller of the Currency in 2013 remains in place but he hopes it will be lifted soon, based on the bank’s much stronger financial position.

“Canyon is very excited about some of the programs that are staged for 2018 and we believe this is our breakout year,” Kingry said in an email.

Meanwhile, statewide ratings for Arizona’s credit unions fell after a Tempe-based credit union saw its rating drop to zero from 3 stars in the third quarter, but local credit unions remain strong.

Altier Credit Union, formerly SRP Credit Union, saw its Bauer rating crash after posting a quarterly net loss of more than $9 million in the third quarter and its capital ratio fell to 2.3 percent.

That dragged down Arizona’s overall credit-union ratings, but they were still higher than the national average. Bauer rated 81.4 percent of the state’s credit unions recommended and 2.3 percent troubled or problematic, compared with national numbers of 80.3 percent 2.6 percent, respectively.

The Tucson area’s five biggest credit unions — including Vantage West, Hughes, Tucson Federal, Pima and Pyramid — maintained their top, 5-star Bauer ratings.

Bauer uses bank call reports and other regulatory data to rate all U.S. chartered banks and all federally insured credit unions with assets of at least $1.5 million.