PHOENIX — So you’ve got all your W-2s and 1099s and you’re ready to start doing your taxes.

But if one of those forms is about your state income tax refund, here’s a piece of advice: Don’t.

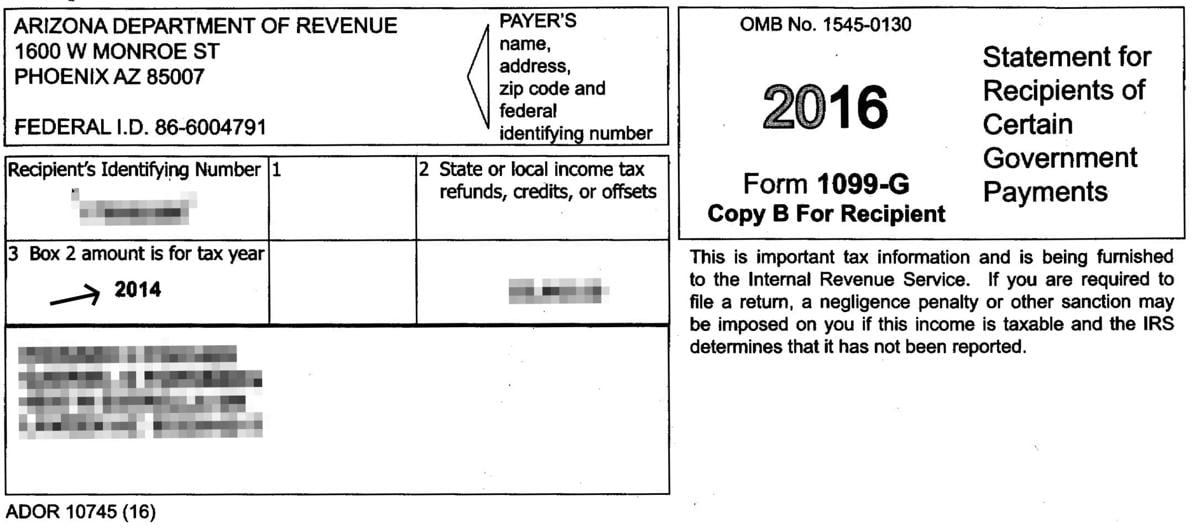

It turns out the Arizona Department of Revenue put the wrong numbers on those 1099-G forms, the ones that tell you how much of a refund you got in 2016 on your 2015 taxes. As it turns out, the numbers are from 2014, which is printed on the form in box No. 3.

And the agency’s problem becomes your problem if you file your returns using the wrong numbers.

It means what you list on your federal tax return as your refund from the state won’t match what the state is telling the IRS. And that’s exactly the kind of thing that is likely to kick out your return for the kind of special scrutiny — or a letter in your mailbox from the IRS — that sends shivers down the spines of taxpayers.

Don’t take it personally. Out of about 3 million Arizona individual tax returns, about 580,000 generated refunds last year. And the 1099-Gs sent to every one of those taxpayers is wrong.

Department spokesman Ed Greenberg said his agency, which learned of the problem after calls from Capitol Media Services and others, is working to send out corrected forms. But he had no answer when that will happen.

So what went wrong? Greenberg said no one knows.

“We’re going to pinpoint how this error occurred and prevent it from happening in the future,” he said.

But he said the more immediate goal is to get corrected 1099-G forms out so taxpayers have the correct information for their federal tax returns.

All that comes at a cost — and not just in postage for 580,000 new forms. There’s also the staff time to make the fixes and even having to reprint all of them. Greenberg said he has no idea what the cost will be.