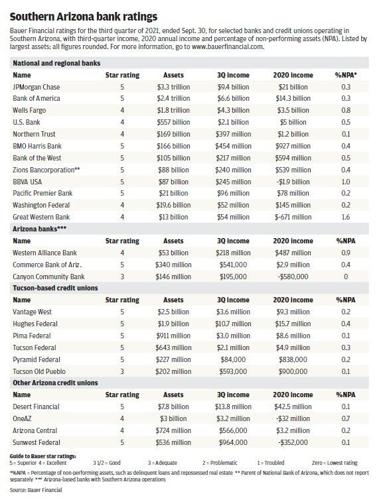

Tucson’s only locally owned bank, Commerce Bank of Arizona, and Tucson-based Hughes Federal Credit Union rose to the top in the third quarter, while other institutions operating in Southern Arizona maintained their financial strength ratings in the most recent report by Florida-based Bauer Financial.

Though Commerce Bank had been rated four stars or “excellent,” earning Bauer’s top, five-star or “superior” rating was a major achievement for Commerce, which had been rated zero stars, or “troubled,” in 2016.

Stung by business-loan losses in the wake of the Great Recession, Commerce Bank was ordered by regulators to raise its capital reserves in 2013.

After Commerce raised more than $13 million from local investors and cleaned up its balance sheet, the Federal Deposit Insurance Corp. lifted its consent order in 2017, and the bank’s financial strength and Bauer rating steadily improved.

The turnaround was led by longtime Tucson banker John P. Lewis, who came out of retirement to take the helm at Commerce in 2013 and retired in 2020.

Paul Tees, Tucson market president and chief credit officer for Commerce Bank, said the earning of a fifth star from Bauer is a big deal for the bank, especially amid the resurgent pandemic.

“I think what the Bauer rating shows is that we’re continuing to improve all facets of the bank,” he said. “It’s important to our employees who have worked very hard over the last couple of years and kept our customers happy with everything that has been going on — it really recognizes their hard work and perseverance in all this.”

Tees, a Tucson native who joined Commerce in February after a 30-year career in commercial lending and wealth management, noted that Commerce processed about 550 loans to local businesses through the federal Paycheck Protection Program pandemic-relief loan program.

Nearly all of the bank’s borrowers qualified for loan forgiveness under the U.S. Small Business Administration program, Tees said.

The bank also participated in the Federal Reserve’s low-interest Main Street Lending Program for small- to medium-size businesses affected by COVID-19, he said.

Commerce has grown its core loan portfolio more than 30% this year alone, while steadily boosting profits and clearing out non-performing assets like delinquent loans, Tees said.

Despite the pandemic, Commerce also moved three of its four offices in the past year, Tees noted. The bank employs about 50 people and has three offices in the Tucson area, including its headquarters, now at 7315 N. Oracle Road, and a branch office in Scottsdale.

Commerce earned net income of $541,000 in the third quarter, and just over $2 million through the first three quarters of 2021 after posting a profit of $2.9 million for 2020.

PPP loans earned Commerce $384,000 in loan-origination fees in the third quarter, the bank’s parent company, CBOA Financial Inc., said in a news release.

The mainly local investors who backed Commerce Bank during its darkest days have shares in the bank they can sell publicly. CBOA Financial is traded on the over-the-counter “pink sheets,” where it has been trading recently for $3 per share.

All the other banks operating in Southern Arizona maintained their previous Bauer star ratings except for Utah-based Zions Bancorp, parent of National Bank of Arizona, which dropped to four stars or “excellent” from five stars.

Canyon Community Bank, which is locally-based but majority-owned by a Texas investment group, also continued to improve its balance sheet after raising nearly $10 million in 2015 to comply with a regulatory order to boost its capital in 2013.

Canyon Community kept its three-star or “adequate” Bauer rating after earning $195,000 in the second quarter. The bank has posted income of $758,000 through the first three quarters of the year, after a reporting a loss of $580,000 for all of 2020.

Meanwhile, the U.S. Comptroller of the Currency on Nov. 30 ended its regulatory order that Canyon raise its capital reserves. Canyon now has among the highest capital reserves in the state and reported zero non-performing assets in the third quarter.

Hughes Federal Credit Union returned to a five-star, “superior” rating in Bauer's third-quarter report, after dropping to four stars earlier this year.

Credit unions strong

Hughes Federal Credit Union returned to a five-star, “superior” rating in Bauer’s third-quarter report, after dropping to four stars earlier this year.

Hughes has maintained an “excellent” or “superior” rating from Bauer, which also means it is “recommended” by the ratings firm, for 125 consecutive quarters — more than 30 years, noted Elisa Ross, Hughes vice president of marketing, sales and service.

“This rating emphasizes our commitment to the financial wellness of our community by providing exceptional financial products and services to the people of Southern Arizona,” Ross said.

Third-quarter bank and credit union ratings from Bauer Financial

All other Arizona credit unions operating here maintained their Bauer ratings, with locally-based Vantage West, Pima Federal, Tucson Federal and Pyramid Federal all keeping five-star ratings.

Founded in 1983 and based in Coral Gables, Florida, Bauer bases its depositor-focused ratings on financial reports banks and credit unions file with regulators.

The company receives no payment from the institutions it rates but offers free basic ratings and detailed rating products for a fee at bauerfinancial.com.