PHOENIX — Citing the indictment of one of its former members, the Arizona Corporation Commission voted Tuesday to review a policy allowing utility company owners to pass along some of their personal income tax burden to customers.

But it remains unlikely that anyone will get a refund, even if the policy is overturned.

Separately, the Corporation Commission voted to take a closer look at everything from the management of Johnson Utilities to the rates that company charges water and sewer customers. Whether that results in changes will depend on the findings of an outside consultant.

Both votes follow the indictment of Gary Pierce, who was chair of the Corporation Commission and instrumental in both the policy on taxes and in having the panel approve overall higher rates for Johnson Utilities.

Pierce is charged with accepting bribes through money paid by company manager George H. Johnson to Pierce’s wife, Sherry. That $31,500, according to federal prosecutors, was funneled to the couple through lobbyist Jim Norton by was of an unidentified — and unindicted — co-conspirator.

Gary Pierce, Sherry Pierce, Johnson and Norton pleaded innocent last week. A trial is tentatively set in federal court for Aug. 1.

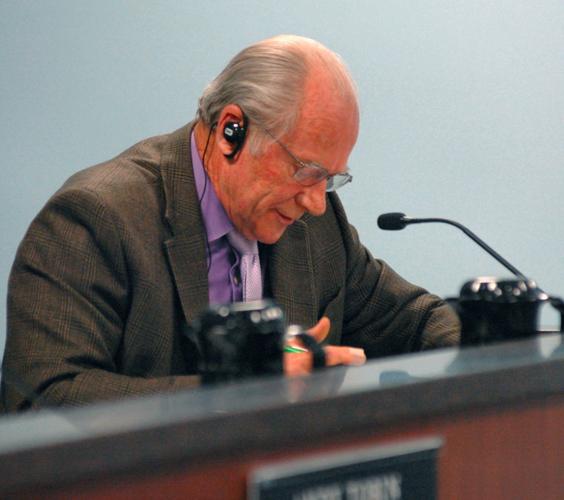

“I’m sick to my stomach over this whole thing,” said commission Chairman Tom Forese during a break in the first commission meeting since the four appeared in court.

“It is up to the courts to decide guilt,” he continued. “But that this could have possibly happened in this place is really, really troubling.”

Commissioner Andy Tobin said the damage to the regulatory board’s reputation is “severe.”

“I think you repair it by opening up as much as you possibly can,” he said.

Most immediately, current commissioners are revisiting the 2013 vote on tax policies.

Regular corporations — known in IRS code as C-corporations — have long been entitled to pass the cost of income taxes to customers. But smaller corporations and limited liability companies pay no income taxes, with earnings instead passed through to owners.

The policy change, advanced by Pierce, sought to provide some equity by allowing the owners of those small companies to have their income tax costs be borne by ratepayers.

On Tuesday, Pinal County Supervisor Mike Goodman said the commission should not have given the benefits of a C-corporation to smaller firms.

“If that’s what the individual is after, they should be changing their type of corporation,” he said. “I don’t think its fair to the customer to be paying that rate to offset somebody’s personal income taxes.” Johnson Utilities serves Goodman’s district in Pinal County.

But Bob Burns, the only current commissioner who was on the panel in 2013 — and who voted for the change — said he sees it as a matter of fairness. He said one type of corporation should not get different treatment than another.

Still, Burns voted with the others Tuesday to have a consultant review the policy.

That still leaves the question of what happens if the panel decides the change was unjustified, including whether customers should get a refund.

“If something has been done inappropriately, they deserve it,” said Forese, referring to a refund.

However, the commission’s own attorney told the panel that forcing affected utilities to give back cash collected in prior years would be an illegal retroactive act.

Forese was undeterred. “If it needs to be fixed, we’ll fix it,” he said.

One surprise Tuesday was an offer by John LeSueur, who had been Pierce’s staff adviser, to provide the commission’s hired consultant with details of how the tax law change came to be.

Addressing the commission by phone, LeSueur, now with the Attorney General’s Office but representing himself on his own time, said he had received a partial waiver from Pierce from the normal confidentiality that would keep him from disclosing conversations between Pierce as the client and he as Pierce’s de facto legal adviser at the time.

LeSueur told regulators he has records of how the policy was changed.

Potentially most significantly, he said it had not started with Johnson Utilities but in 2009 — years before the vote — in a case involving a small water company. That could affect not only the commission’s inquiry, but could also prove relevant as Pierce defends himself in court against claims that his vote on the tax issue was linked to money allegedly furnished by Johnson to Pierce’s wife.

But LeSueur didn’t get very far in his details, with Forese cutting him off and telling him to report what he knows not to the commission but to whatever consultant is hired to review the matter.

“It sounds like you don’t want me to speak,” LeSueur responded. “I’m willing to wait,” he continued. “I just think the public deserves as much sunshine on this issue as early as possible.”

LeSueur also mentioned, before being cut off, that no one from the FBI had interviewed him before the indictments were handed up.

Tax policy aside, the other question for the commission is whether the rates that Johnson Utilities is now charging customers are appropriate.

Those rates are based, at least in part, on the commission’s 2011 vote — also advanced by Pierce, according to the indictment — to increase the “fair value” of the utility’s wastewater division. That, in turn, entitled the company to collect more.

Commissioner Doug Little said he does not want a full-blown rate case.

“Every time there’s a rate case, the rates go up,” he said. Little said he prefers a more limited review of the company’s charges.

That’s the way the commission members voted. But they also agreed to have an outside consultant see if the current management — including Johnson himself — is capable of running the company or needs to be replaced.