The Arizona Board of Regents announced new proposed financial rules Tuesday for the state's three public universities amid the University of Arizona's budget woes.

The UA, Arizona State University and Northern Arizona University may face more monitoring and scrutiny over their budgets by both ABOR and a newly required peer-review process involving all three universities.

The universities must scrap the way they now handle their budgets and institute a centralized process intended to prevent overspending by colleges, units and programs.

The regents' report also states that:

- The universities must put budget controls on financial aid they provide for out-of-state students.

- UA, ASU and NAU now must have specific board approval to expend cash reserves below established thresholds.

- UA President Robert C. Robbins must find outside experts to help with the transition.

- Robbins should review the UA’s finance-related offices to look for more centralization and efficiencies.

The proposed rules were announced just one day before Robbins will present the UA's plan to deal with its financial crisis to ABOR in a 5 p.m. meeting Wednesday, Dec. 13.

View the regents meeting livestream, beginning Wednesday at 5 p.m., at Tucson.com.

"To guard against" UA mistakes

Though the changes may impact all three universities, ASU and NAU were not mentioned by name a single time in the regents' three-page document, called the "University Financial Oversight Enhancements and Expectations" report. The University of Arizona, however, was named repeatedly and ABOR framed the report around its financial issues.

"To guard against the mistakes made at the University of Arizona, the board will reinforce existing financial management requirements and monitoring by implementing additional governance principles and review mechanisms to increase the board's insight into — and confidence in — university financial processes," the report stated.

"The University of Arizona ended fiscal year 2022 with $844.5 million in cash reserves," the first line of the report reads. "By the end of fiscal year 2023, that number dropped to $704.5 million, a reduction of $140 million."

According to the document, the reduction was "caused by a combination of planned expenditures of cash reserves and unanticipated expenditures authorized by individual budget units." The report specifically mentions high spending in research, capital investments, and unplanned expenditures of inflation, and more financial aid authorized.

"Overall, the majority of the university's budget units spent beyond their base budgets," the report states.

ASU and NAU did not run into these problems.

UA officials first raised alarm bells on Nov. 2 when Robbins and Senior Vice President for Business Affairs and Chief Financial Officer Lisa Rulney told ABOR that the university miscalculated its days cash on hand. Though they initially projected 156 days cash on hand, the UA reported having a predicted 97, after admitting to a miscalculation of $240 million.

Because the UA increased its expenditures and spent down cash balances, it fell short in a metric "established and defined by Moody's," the report said. "An increase in expenditure reduces days cash on hand at the same rate as a reduction in cash reserves."

Regents Chair Fred Duval "may" designate two regents as points of contact for the UA. Over the next 12 months, Robbins and an external consultant will report progress to a board committee.

UA Faculty Senate President Leila Hudson wasn't happy with the report.

"In ignoring the expertise of the faculty and other stakeholders of the university in favor of centralized decision making (and) depending very heavily on the same high-level administrators who got us into this crisis in the first place is not ideal," she said. "The Board of Regents themselves are political appointees who do not necessarily have expertise in university governance and management."

Hudson also didn't like the report's timing, coming before Robbins will present his plan.

"The timing suggests that there is a certain amount of disarray in the admin and ABOR," Hudson said. "Or perhaps something which I am loath to contemplate: that they were not being completely aboveboard in how corrective policy will be formulated going forward."

Budgeting controls

The board listed financial management principles to be followed.

First, each university will employ a centralized financial planning and budgeting process. Processes like Responsibility Centered Management (RCM) and Activity Informed Budgeting (AIB) will be eliminated.

The UA has used both budgeting models in recent years. It switched from RCM to AIB in 2022, to the disappointment of many faculty members. Under AIB, colleges are taxed by the university, and central administration can spend that money in whatever ways it pleases.

Recently, faculty have pointed fingers at Robbins, claiming he was not spending that money responsibly. Instead of reinvesting in colleges, they argued, he spent the money on loans to the athletics department and on large passion projects.

Though she was enthusiastic that AIB is being thrown out, Hudson was frustrated with the centralization of the new budgeting model, which has yet to be officially announced.

"The idea that we would follow up the bad system of RCM with the worse system of AIB with what might be the worst system of all, of going back to the old patronage model in which the center distributes and allocates resources without any kind of proportional mechanism whatsoever, is disturbing," she said. "Now to see our governors basically throw out the baby with the bathwater and say there will be no model at all is again concerning to me."

ABOR said each university also will use a centralized management and control structure for information technology; and that the universities must be more transparent in budget communications.

Each university is also expected to enact budgetary controls to prevent college, unit or program expenditures in excess of established budgets. According to an internal financial document obtained by the Arizona Daily Star, units within UA overspent by about $125 million last fiscal year.

Hudson was also disappointed with this aspect of the plan.

"The document reiterates something that we widely understand to be not true," she said. "The deficits, both annual and long term, are not the result of overspending in the units. We can say that categorically. The problem is not the spending in the units."

"The problem is, as the president himself has described it, the overinvestment of our surplus from the center that didn’t pay off the way they thought it would pay off."

It's "catastrophic," Hudson said, that ABOR implied otherwise.

The budget controls now expected on institutionally funded financial aid for out-of-state students are another direct response to UA's situation.

In a Faculty Senate meeting last month, Robbins said the UA is losing money on students who in high school had a GPA between a 3.75 and 4.0 because of the amount of merit money and financial aid they are awarded.

“If you look at the band from 3.75 GPA to 4.0, there are a lot of students here that pay nothing,” he said. “We lose money on every one.”

More monitoring

The board said a more detailed analysis of university cashflows "may include" the following:

Reporting on monthly operating cash balance, identifying trends and the impact of material one-time or unusual inflows and outflows.

Identifying and explaining significant fluctuations from existing patterns and levels of cash flow.

Adding a mid-year (six-month) financial update to a board committee, incorporating comparison of actual revenue and expense to prior years, as well as fiscal year-end projects, including days cash on hand.

Peer review

ABOR is also introducing a new peer review process. Each university will document its financial planning and analysis processes, and a "visiting team" made up of representatives from the board office and the other two universities will evaluate their "sufficiency and success."

The first round of peer reviews must be completed within 12 months of the policy's adoption, and after the initial reviews, only one university will complete a peer review each year on a rotating basis.

Additionally, the chief financial officers of each of the three universities must conduct an annual summit to share "innovations in how they budget, manage institutional cash (and) develop financial projections of various types," among other topics.

"No idea what to expect"

Hudson said the report, and anticipation about Wednesday's presentation by Robbins, are "causing a great deal of concern" among faculty, staff and students.

The faculty feel ignored in what should be their shared governance roles, she said.

"I literally have no idea what to expect" from Wednesday's presentation by Robbins, "because of this gnawing suspicion that all of the work we have done in good faith has been merely a side show to a policy that’s being worked out at some other level," Hudson said. "I certainly hope that President Robbins will reciprocate our good faith."

DuVal

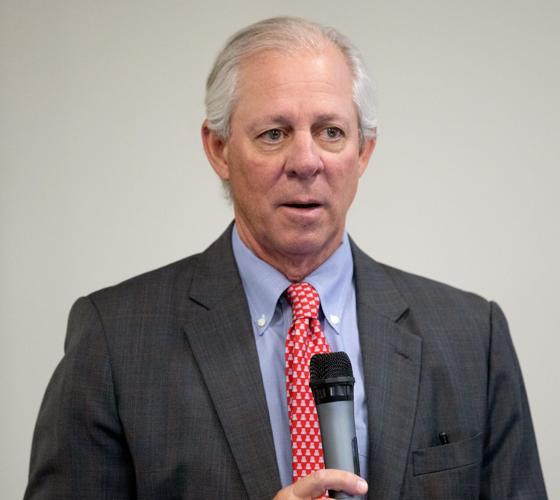

UA President Robert C. Robbins

University of Arizona President Robert Robbins talks about the financial issues facing the university and possible solutions at a Faculty Senate meeting on Nov. 6.