The Desert Angels, a Tucson-based group of individual “angel” investors, has boosted dozens of local startup companies with seed money critical to their success.

Now, a new study shows how the Desert Angels — one of the nation’s most active angel investor groups — has had an overall annual economic impact of more than a half-billion dollars in Arizona.

Angel investors are individuals who by virtue of their wealth are allowed to invest in unregistered securities issued by private companies.

A recent study funded by the Phoenix-based Flinn Foundation found that from 2010 through 2019, members of Desert Angels invested $47.3 million into 95 portfolio companies.

Of those, 65 companies representing $31.5 million in investments were still active in Arizona in 2019 and created $647.7 million in direct and indirect economic benefits to the state that year, according to the study, conducted by the Phoenix-based consulting firm Applied Economics.

The remaining companies were either acquired, closed, or are based outside of Arizona.

The 65 companies included the analysis — including many University of Arizona technology spinoffs and UA alumni founders — accounted for 1,833 direct jobs and $144.3 million in estimated direct annual labor income in 2019, the study found.

With indirect impacts, such as jobs created by the company hiring and spending, the study found the Desert Angel-backed companies accounted for an estimated 3,600 direct and indirect jobs and $239.9 million in total labor income, Applied Economics found.

Despite the pandemic, the Desert Angels were among the most active angel groups in 2020, ranking first among such groups in the Southwest with 20 deals worth a total of $6.3 million — tying for eighth among about 300 angel groups surveyed nationwide by the Angel Capital Association.

“I think these numbers are impressive, but I don’t think we fully capture everything,” said Joann MacMaster, who was named the first CEO of the 20-year-old Desert Angels in a restructuring last year.

“This doesn’t reflect the mentoring and all the other non-financial contributions our members have made, and that’s really important, too.”

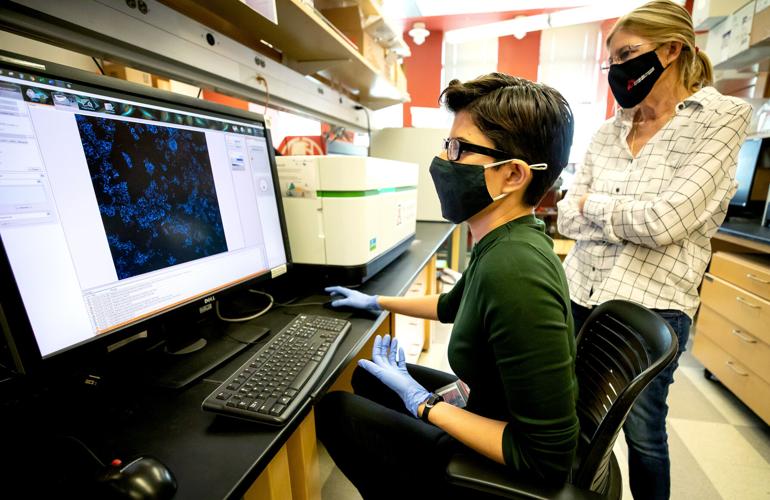

Life-science focus

MacMaster said she advocated for Desert Angels to perform an economic impact study after working on a similar study in her prior job as a senior director for Tech Launch Arizona, the UA’s technology commercialization arm.

As part of the study, UA students surveyed the nearly 100 Desert Angel portfolio companies to gather data that was plugged into a common economic-impact software model, she said.

“It allows us to set a foundation, so in a few years when we do another study we’ll have a lot more data and a better picture of the kind of impact we’re having on the state of Arizona,” said MacMaster, who has been a Desert Angel member since 2011.

While members of the angel group have invested in a variety of companies, life-sciences companies make up the largest sector of the Desert Angel portfolio at 44%, followed by information technology at 28% and other manufacturing at 18%.

Companies in the life sciences sector generated a total economic impact of $396.0 million in 2019 (61% of the total) and accounted for 1,007 jobs and $93.0 million in estimated annual payroll.

Local life-science startups the Desert Angels have invested in include several UA technology spinoffs, including Reglagene, NuvOx Pharma, Regulonix, Paradigm Diagnostics, Avery Therapeutics, Calimmune and BioVigilant.

The head of the Flinn Foundation, a nonprofit which since 2002 has backed a plan to turn Arizona into a hotbed of the biosciences, said the study shows the value of the Desert Angels funding and promoting early-stage Arizona bioscience companies.

“A principal goal in Arizona’s Bioscience Roadmap — our state’s plan for global competitiveness in the life sciences — is to form a hub of entrepreneurs and bio startups,” said Tammy McLeod, president and CEO of the Flinn Foundation. “The Desert Angels are making that possible, with dollars that create jobs, attract new resources to our region, and bring new innovations to market.”

Community-minded investors

The nonprofit Desert Angels have about 100 members who vet investment prospects together through a screening committee and at monthly “Shark Tank”-like pitch dinners.

But the angels invest individually in amounts ranging from about $10,000 to $25,000, with multiple angels typically investing together in deals averaging about $200,000 to $250,000, MacMasters said.

Some companies also may qualify for additional investment by the Desert Angels’ “sidecar” funds, which all members can invest in.

Angels typically invest in exchange for ownership shares in a company, or debt instruments that can be converted to company stock. They typically cash in when a company is acquired or goes public.

A major distinction of angel investors is that in addition to making a profit, they also want to help drive their local economy, MacMaster said.

“Part of our mission is, in fact, to help the local Arizona economy grow,” MacMaster said. “We really want to look for those Arizona companies, we are really focused on the economic and social impact and supporting local companies.”

But the angels still need a return on their investment, and that may mean investing in companies outside of Arizona, she said, noting that the 2019 study doesn’t include results for four out-of-state Desert Angel-backed companies.

While angels don’t disclose their investment returns, Desert Angel investors have cashed in on a number of successful “exits” when their companies were acquired or went public.

Notable exits include Calimmune, a gene-therapy startup founded by a UA alumnus and acquired by Australian drug giant CSL Ltd. in 2017 for an initial price of $91 million, or up to $325 million if the company reaches certain milestones; Paradigm Diagnostics, a Phoenix company acquired last year with a related company by Exact Sciences for $40 million; and most recently, the acquisition of Phoenix-based Picmonics, a visual learning company founded by a former UA medical student, by medical education software company TrueLearn.

Critical funding source

To increase the impact of its members’ investments, the Desert Angels have partnered with other angel groups and in some cases, venture capital firms, to co-invest in startups as part of larger funding rounds, MacMaster noted.

Locally, the Desert Angels have partnered with UAVenture Capital, a fund launched in 2019 to focus on UA-linked startups, on investments in non-opioid pain drug developer Regulonix and Post.Bid.Ship., an online shipping platform founded by a UA alum.

The head of Reglagene, a cancer drug-development company spun off from UA research and backed by the Desert Angels, said the angel money is critical not only to fund ongoing operations but to help the company reach milestones needed to attract larger, venture capital funding.

“Drug discovery, especially where we’re starting from, is an expensive business,” said Reglagene CEO Richard Austin. “There’s not enough investment from Desert Angels alone to get us where we need to be, but it was critical to win at home to go outside of Tucson to look for funding. If the Desert Angels opted not to back us, we would not have had a company — it’s just that simple.”

Reglagene, which has developed a research platform for cancer and other drugs based on regulating gene activity through secondary DNA structures known as quadraplexes.

The company has raised $3 million from investors to fund its early efforts, with Desert Angels providing about half of a $1.5 million equity round in 2018 and a $1.5 million sale of convertible debt last summer, said Austin, who himself is a longtime Desert Angel.

The company, which is in preclinical studies of its drugs for brain cancer and a rare form of bone cancer, is in the process of a new, multimillion-dollar fundraising round led by a venture-capital firm, Austin said.

The next funding round will enable it to file Investigational New Drug (IND) applications for two drugs with the U.S. Food and Drug Administration.

The IND application is the final step before the first phase of human clinical trials, Austin said, adding that a successful Phase 1 trial is often enough to take a drug company public and give investors a return within a few years.

Even if Reglagene or its core technology is acquired, Austin says he hopes it will continue to develop drugs in Tucson.

“Our dream is to leave a biotech company footprint in Tucson, with the jobs and growth that go along with that, and that’s part of the mission of the Angels,” he said.

Crediting angels

MacMaster said the Desert Angels’ efforts have been buoyed by a state income-tax credit that allows angel investors to claim credits of up to 35% of a qualifying investment in an Arizona company.

That credit was set to expire this year, but the Legislature extended the credit to allow the state Commerce Authority to certify a total of $2.5 million in tax credits each fiscal year for the next 10 years.

“It’s hugely important because the majority of states have some kind of tax incentive program, and if Arizona had not renewed it, we would have lost members to other states,” she said, noting that Connecticut officials have courted some Desert Angels to invest there based on that state’s available credits.