As Tucson climbs out of the housing market’s “lost decade,” a lack of prepared land could pose a disruption to the boom the market saw last year.

During the housing crash, the Tucson metro area still absorbed more than 30,000 home lots, but the replacement rate did not keep up. Banks tightened lending for speculative developments and neither private developers nor homebuilders wanted to take the risk.

“What you have is a pressure-cooker situation in the Tucson metro area land market,” said Will White, a land broker with Land Advisors Organization. “What has ignited the fuse, and accelerated the situation, is that the market is improving and homebuilders are performing better than anticipated.”

Of the 77 active single-family communities in the metro area — discounting active adult — 37 have less than 30 lots available and 27 have between 31 and 75 lots.

“If we don’t consistently supply the market with developed lots, there will be a ceiling to the amount of homes that can be produced,” White said. “That would be a tough pill to swallow in a Tucson market that is showing more and more demand for new housing.”

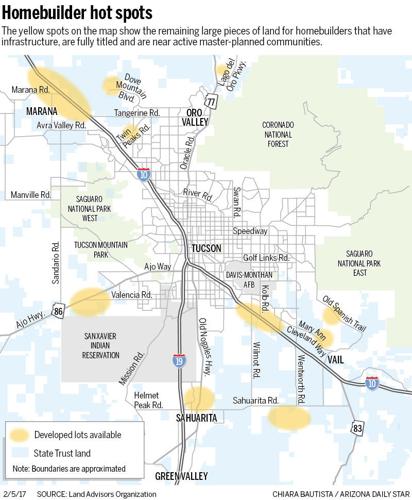

Developed lots mean the land is fully titled and has infrastructure.

It takes three to four years to bring a raw parcel to the point of selling a home on it.

“The 2016 residential market and local economic news caught the industry by surprise,” White said. “Homebuilders are now playing catch-up to build their lot inventory pipeline for the next two to three years.”

There were 2,697 single-family residential permits issued in 2016, a 24 percent increase over 2015.

Dean Wingert, vice president of Crown West Land Group, a land developer, said the increase in permits, combined with job announcements were what national homebuilders needed to see to spur more investment in the Tucson area.

“Last year finally showed some good, positive movement,” Wingert said. “Homebuilders all have direction to grow their division and we need to look well ahead.”

He said most homebuilders don’t want develop the land, they just want to build houses so they’ll look for land developing partners.

Land developers, meanwhile, don’t do speculative development because each homebuilder has different preferences on lot width and dimensions and land division of 100 lots cost more than $3 million.

“It’s hard to get financing for that speculative work, especially with the history Tucson has,” Wingert said.

Because most of the big homebuilders in the market are national companies, the authorization for land acquisition comes from a corporate office elsewhere.

“There’s always this difficulty if you’re a buyer of land for a homebuilding company because you know you need to keep buying land and yet you can’t just move things too quickly,” Wingert said. “The vast majority of homebuilding are companies that are not in Tucson and it’s hard for the local guy to get a meeting of the minds.”

Crown West is the land developer at Gladden Farms, where there are 1,400 single-family houses and more ongoing development with four different homebuilders.

White said the land crunch is actually good news for Tucson.

“The demand for land is higher than we have seen it in some time,” he said. “High demand versus limited and shrinking land supply will favor the landowner in Tucson for some time.

“The great news is that Tucson has rebounded well and the future looks very bright.”