For some Tucson drivers, sticker shock doesn’t end at the car lot. It can strike again when they shop for auto insurance.

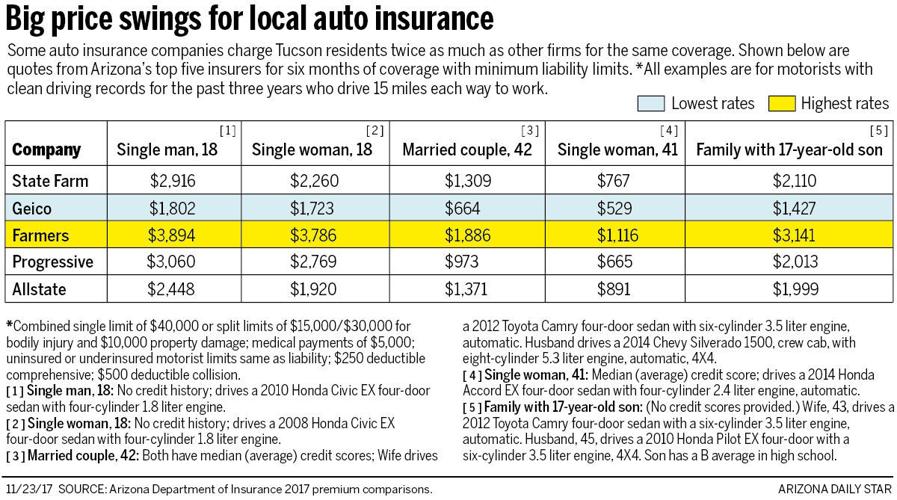

The rates major insurers charge local motorists are all over the map, with some charging hundreds or thousands of dollars more than others — in some cases more than double — for the same coverage, data on file with the state insurance department show.

An 18-year-old single woman with a clean driving record, for example, can pay anywhere from about $1,700 to nearly $3,800 for six months of minimum liability coverage in one case cited in the Arizona insurance department’s 2017 rate comparison.

A married couple with clean driving records can pay between $664 and $1,886 depending on which company they pick, the state’s hypothetical examples show.

Similar price spreads were also reported for several other types of customers in this year’s annual state sampling.

The Arizona Daily Star examined premiums for Tucson drivers from the top five insurers by volume in Arizona: State Farm, Geico, Farmers, Progressive and Allstate.

Geico consistently charged the lowest rates, and Farmers the highest, with the others falling somewhere in between.

What accounts for the steep variations?

Lanny Hair, executive vice president at Independent Insurance Agents and Brokers of Arizona, Inc., said insurers base rates on formulas that try to predict each driver’s risk of having an accident. But they differ on the factors they consider and the importance of each factor.

“Each company has their own secret sauce, their own way of slicing and dicing the data,” Hair said.

“Everyone has their own algorithm that uses different actuarial indicators. For example: are you married? Do you have a checking account? Do you own a home? They’re all trying to find the magic formula that will bring them the best price for that risk.”

Credit ratings, education levels and ZIP codes can also figure into the rates insurers charge.

So can the level of customer service a company provides.

For example, while Geico offers the lowest rates, it has the highest rate of customer complaints: about one complaint for every 8,000 Arizona vehicles covered. Conversely, Farmers charges the most but has the fewest complaints: roughly one for every 20,000 vehicles it covers in the state.

The Consumer Federation of America, which tracks insurance rates in Arizona and elsewhere, says the price variations in Tucson are common in insurance markets nationwide.

“Auto insurance rates throughout the country make no sense,” J. Robert Hunter, the federation’s director of insurance, said in a recent news release on the topic.

“The extreme dispersion of prices for identical risks means that market competition is not working to assure prices are reasonable.”

Stephen Briggs, a spokesman for the Arizona Department of Insurance, disagreed.

“The wide range of prices demonstrates a very competitive market,” he said.

“Some customers might want the cheapest coverage, some might want the best customer care.

“We put out the comparisons so people can make an informed decision. What they choose is up to them.”