Defense contractor Raytheon Co. posted higher third-quarter revenue and earnings amid strong demand for weapon systems including smart-bomb kits made by the company’s Tucson-based Missile Systems unit.

But the company’s shares fell 3.5 percent in trading Thursday on the New York Stock Exchange, after the results missed some analyst estimates.

The Waltham, Massachusetts-based parent company reported third-quarter net sales of $6 billion, up 4 percent from the same period a year ago.

Raytheon posted quarterly net income of $529 million, or $1.79 per share, compared with earnings of $447 million or $1.47 per share in third-quarter 2015.

The most recent quarterly results benefited from a pension adjustment benefit of 23 cents per share, after posting a 9-cent adjustment a year ago.

The revenue fell just short of Wall Street’s average expectations based on a poll of 17 analysts by Thomson Financial, though it beat the average projection of five analysts polled by Zacks Investment Research.

The third-quarter earnings beat both analyst forecasts with the pension accounting adjustment but fell short without it.

Raytheon raised its annual earnings forecast to a range of $7.28 to $7.38 per share and slightly raised the low end of its annual revenue projection, to a range of $24.2 billion to $24.5 billion.

Raytheon Missile Systems, one of five reporting Raytheon business units, reported that its net sales rose 6 percent to $1.8 billion, while operating income jumped 10 percent to $241 million.

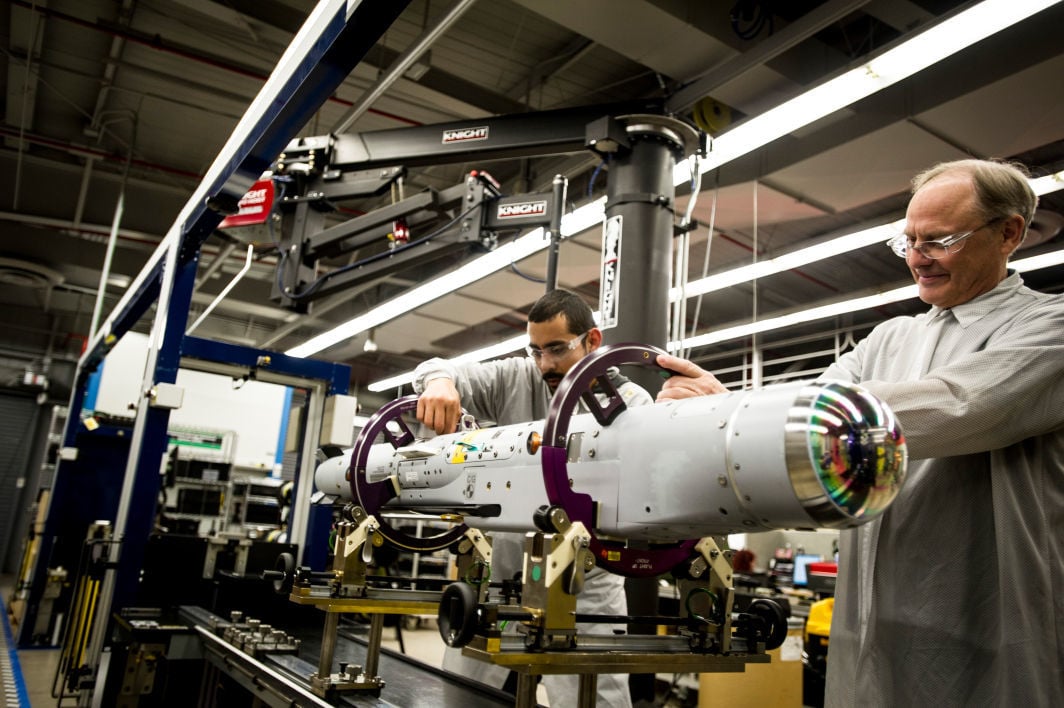

Raytheon attributed the increase to higher sales of Paveway precision bomb-guidance kits and the Advanced Medium-Range Air-to-Air Missile.

During the quarter, Missile Systems booked $538 million in sales of its Standard Missile-3 interceptors, $376 million for Phalanx close-in weapon systems and $176 million for TOW (Tube-launched, Optically-tracked, Wireless-guided) antitank missiles, for both U.S. and international customers.

Sales at Raytheon’s Space and Airborne Systems group rose 10 percent mainly on the strength of a classified international program, though operating income fell 1 percent.

Among other reporting Raytheon units, Raytheon Integrated Defense Systems reported a 6 percent drop in sales as radar and an international communications program lagged.

Net sales at Raytheon’s Intelligence, Information and Services unit rose 1 percent compared with third-quarter 2015, while its new Forcepoint cybersecurity business reported a 31 percent sales increase.

Raytheon shares closed Thursday at $136.28, down $5.00.