PHOENIX — The Goldwater Institute is challenging a 2022 law aimed at bringing Hollywood to Arizona.

Its new lawsuit charges that allowing the state to give $125 million a year in tax credits is an unconstitutional gift to private companies that agree to produce their films and commercials in Arizona. Attorney Parker Jackson argues that reducing what someone otherwise would have to pay the state in taxes is no more legal than if the treasurer wrote out a check to the company.

It will now be up to Maricopa County Superior Court Michael Herrod to decide whether to block the Arizona Commerce Authority from issuing more than $1.6 million in credits that were earned on two already-produced films.

The Goldwater Institute, which advocates for limits on government, wants the judge to bar the state from issuing any more credits. And there could be a lot: The law allows the state to provide $125 million in credits every year in the future.

Film crew members worked on the set of the HBO Max television show “Duster” in the Menlo Park neighborhood on the corner of West Congress Street and South Grande Avenue in this October 2021 file photo. The show was partially filmed here before Arizona’s tax credits were approved, in 2022, to help attract Hollywood spending.

Sen. David Gowan, R-Sierra Vista, who championed the 2022 law, said he believes the credits are legal. If Goldwater wins the lawsuit, it could have ripple effects, he added.

“If they get a victory here, any of our tax credits that we have that have helped beef up our state and our economy here are at peril,’’ Gowan said.

The idea behind the credits, according to proponents, was to breathe new life into what was once a more thriving film industry in Arizona, dating back at least as far as the 1930s when John Ford saw Monument Valley and decided to film Stagecoach in the state with John Wayne.

For a long time the studios at Old Tucson were also a site for various Westerns, ranging from The Lone Ranger to Three Amigos, before much of the facility was destroyed in a 1994 fire.

But more recently, productions that are supposed to be portraying events in Arizona actually were filmed elsewhere.

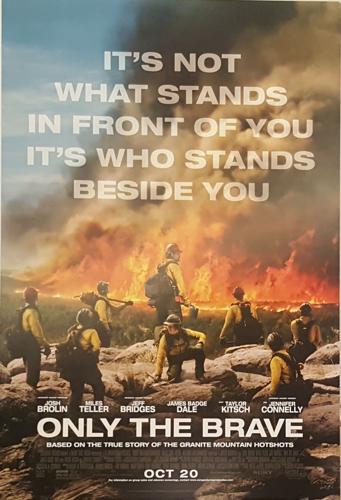

During debate on the 2022 legislation, Rep. Sen. Stephanie Stahl Hamilton, then a Democratic representative from Tucson, cited “Only the Brave,’’ the 2017 movie about the deaths of the 19 Granite Mountain Hotshots who died while fighting the 2013 Yarnell Hill Fire. She noted that the movie, which had a budget of $38 million, was not shot in Arizona.

“That is our story and that is our history,’’ she said. “It had to be filmed in New Mexico because it’s not economically feasible for them to shoot that film in our own state.’’

“Only the Brave,” a 2017 movie about the deaths of the 19 Granite Mountain Hotshots who died while fighting the 2013 Yarnell Hill Fire, was filmed in New Mexico, even though it was about Arizona events.

Adding insult to injury was the 2008 film “Hamlet 2’’ starring Steve Coogan, Catherine Keener, Amy Poehler and Elisabeth Shue about a failed actor teaching high school drama.

It opens with the main character asking “Where does one go for dreams to die?’’ — only to pan to a sign that says “Welcome to Tucson Arizona.’’ Yet the whole thing was filmed in Albuquerque.

During debate, Gowan argued that Arizona sometimes needs to put a little money on the table to generate economic development. He said that’s how the state managed to land investments by Apple, Intel and Amazon.

“We needed to help those businesses think about Arizona,’’ Gowan said. Without the incentives and tax credits for those kind of corporations, “they would have flown right over us, gone into Texas or some other state,” he said.

The lawsuit does not mention any of that. Instead, the Goldwater Institute lawyer asks the judge to look at the question of whether the credits for the film industry are legal in the first place.

Over the years, Arizona lawmakers have approved a host of tax credits.

Some are geared for private individuals, such as giving them a dollar-for-dollar offset to the state taxes they owe for money given to organizations that provide tuition for students to attend private and parochial schools. There is a similar credit for donations to extracurricular activities at public schools.

Most, however, are aimed at businesses. Companies get to deduct from their state income taxes what they spend in research and development, buying certain pollution control equipment, and employing members of the National Guard.

But at least part of what makes the film credit different — and, Jackson contends, a violation of the Gift Clause of the Arizona Constitution — is it is refundable. Put simply, a company can get a check from the state if the amount of credits it earns exceeds the taxes it owes.

Jackson also called the $125 million in available credits “a massive burden on current and future taxpayers.’’

There’s also the question of whether the benefits the state is supposed to receive from attracting film and commercial producers exceeds what it is costing taxpayers.

That is crucial.

When the bill was being debated in 2022, Kevin McCarthy, president of the Arizona Tax Research Association, warned lawmakers that the Supreme Court has ruled that any tax credit or payment of state funds that exceeds the benefit clearly violates the Gift Clause. The purpose of that provision, he said, was to protect taxpayers from special interests that can hire high-powered lobbyists to get special treatment.

Proponents of the 2022 law argued that the state will get benefits in the form of sales taxes spent by production companies and their employees as well as income taxes from the workers who are hired.

But Jackson said courts have ruled that only direct benefits count, not anticipated future tax collections.

Even if that were not the case, the record on tax credits Arizona previously granted for the film industry has not been good.

The state enacted a similar program in 2005 and expanded it in 2007. A report said the credits generated 317 full-time jobs in the industry in 2008. Another 413 were created indirectly from spending by filmmakers in the state.

All totaled, according to the report, that generated about $2.3 million in additional state and local taxes.

But it turned out that Arizona gave out more than $8.6 million in credits to get that gain. A similar report for 2007 showed a $1.7 million loss to the state.

Lawmakers repealed the program in 2015.

Gowan, however, insisted that the new credit is different than the prior program. He said it requires those seeking the credits to show, subject to a state audit, that they have spent the money in Arizona.

The Arizona Commerce Authority, whose members also are being sued, did not comment. But the agency was not the one pushing for the law and is involved only because lawmakers tasked it with implementing the credits.

List: 40 movies filmed in Tucson and southern Arizona

The Fabelmans (2022)

This image released by Universal Pictures and Amblin Entertainment shows Gabriel LaBelle in a scene from "The Fabelmans."

Tucson locations: Tucson Mountain Park and the Sonoran Desert

Cast: Michelle Williams, Gabriel LaBelle, Paul Dano, Judd Hirsch, Seth Rogen

Genre: Drama: Growing up in post-World War II era Arizona, young Sammy Fabelman aspires to become a filmmaker.

Tombstone (1993)

Kurt Russell stars as Wyatt Earp in "Tombstone" filmed at Old Tucson Studios in 1993. Copy photo taken at Quality Inn Flamingo in Tucson, Ariz., on Thursday March 31, 2011.

Tucson and Arizona locations: Old Tucson, Babocomari Ranch in Sonoita, Texas Canyon, Little Dragoon Mountains, Skeleton Canyon, Empire Ranch in Sonoita, Elgin, Sonoran Desert, Chiricahua National Monument, San Simon Valley, Mescal, Tucson Mountains, San Pedro River, Las Cienegas National Conservation Area, Patagonia, Whetstone Mountains, Turkey Creek, Mount Lemmon, Fort Crittenden, Tucson, Harshaw, St. David, Granite Mountains in Prescott, Sierrita Mountains, Benson.

According to the Internet Movie Database, Tombstone was not a location for the movie shoot.

Cast: Kurt Russell, Val Kilmer, Sam Elliott, Bill Paxton

Genre: Biography, drama, history: A dramatic retelling of the events leading to and following the famous Gunfight at the OK Corral.

Box office gross: $56.51 million

Almost Famous (2000)

Amost Famous

Tucson and Arizona locations: Old Ajo Highway, Tumacácori, Interstate 19, Amado, Tucson

Cast: Billy Crudup, Patrick Fugit, Kate Hudson

Genre: Adventure, comedy, drama: A high schooler travels with a rock band for a story in Rolling Stone magazine.

Box office gross: $32.53 million

A Star is Born (1976)

In this Dec. 23, 1976, file photo, producer Jon Peters, from left, Barbra Streisand and Kris Kristofferson appear at a preview of the film "A Star is Born" in New York. (AP Photo/Suzanne Vlamis)

Tucson and Arizona locations: Tucson Convention Center, Pima County Courthouse, Old Tucson Studios, Sonoita and Tempe.

Cast: Barbra Streisand, Kris Kristofferson, Gary Busey, Oliver Clark

Genre: Drama, romance, musical: A has-been rock star falls in love with a young, up-and-coming songstress.

Box office gross: $80 million

Major League (1989)

The north side of Hi Corbett Field, 700 S. Randolph Way., in Tucson, Ariz. on January 23, 2020.

Tucson locations: Hi Corbett Field, Tucson

Cast: Tom Berenger, Charlie Sheen, Corbin Bernsen, Margaret Whitton

Genre: Comedy, sport: The new owner of the Cleveland Indians puts together a team she hopes will lose so she can move the team. The team disagrees.

Box office gross: $49.8 million

Transformers: Revenge of the Fallen (2009)

Rows of B-52's sit on the hard desert soil in Tucson, Arizona. The dry air and hard soil are the two main reasons the "Boneyard" is located here.

Tucson location: Davis Monthan Air Force Base, Boneyard

Cast: Shia LaBeouf, Megan Fox, Josh Duhamel, Tyrese Gibson

Genre: Action, adventure Sci-fi: The Autobots and Decepticons battle in this sequel.

Box office gross: $402.11 million

Wild Wild West (1999)

Will Smith in a scene from the movie "Wild Wild West."

Tucson location: Old Tucson

Cast: Will Smith, Kevin Kline, Kenneth Branagh, Salma Hayek

Genre: Action, comedy sci-fi: Based on the old TV show of Secret Service agents after the Civil War.

Box office gross: $113.81 million

Public Enemies (2009)

Johnny Depp stars as legendary Depression-era outlaw John Dillinger, in "Public Enemies." (AP Photo/Universal Pictures, Peter Mountain)

Tucson location: Congress Hotel front

Cast: Christian Bale, Johnny Depp, Christian Stolte, Jason Clarke

Genre: Action, biography, crime: Feds try to take down John Dillinger.

Box office gross: $97.1 million

Can't Buy Me Love (1987)

Patrick Dempsey (in his pre-“McDreamy” era) stars as a high school nerd trying to be a cool kid in “Can’t Buy Me Love.”

Tucson locations: Davis-Monthan Air Force Base boneyard, Scoops on Speedway, a house on North Hill Farm Drive, a house on North Christmas Avenue, The Loft Cinema, Pima Air and Space Museum, Tucson High School, Tucson Mall, Arcade on Speedway, Speedway boulevard, Winterhaven neighborhood, Hill Farm

Cast: Patrick Dempsey, Amanda Peterson, Courtney Gains

Genre: Comedy, drama, romance: An outcast pays the most popular girl in school to be his girlfriend for a month.

Box office gross: $31.62 million

Young Guns (1988)

Main Street in Old Tucson in 1991.

Tucson locations: Old Tucson, Tucson, Sonoran Desert

Cast: Emilio Estevez, Kiefer Sutherland, Lou Diamond Phillips, Charlie Sheen

Genre: Action, western: Young gunmen led by Billy the Kid become deputies and take their authority too far.

Box office gross: $45.66 million

Young Guns II (1990)

Tucson and Arizona locations: Old Tucson, Bisbee, Sonoran Desert, San Rafael Ranch State Park in Patagonia, Tucson Mountains, Ironwood Forest National Monument, Sierrita Mountains, Warren, Tumacácori National Historical Park

Cast: Emilio Estevez, Kiefer Sutherland, Lou Diamond Phillips, Christian Slater

Genre: Action, western: Patrick Floyd Garrett receives a bounty to kill Billy the Kid.

Box office gross: $44.14 million

Revenge of the Nerds (1984)

Actors Anthony Edwards, far right and Robert Carradine, center, stumble with their suitcases during a scene for the film, "Revenge of the Nerds." Photo taken: January 30, 1984.

Tucson locations: Catalina Park Inn, Catalina Park, Bear Down Gym at the University of Arizona, Friends Meeting House on Fifth Avenue, University of Arizona, Cochise Hall at UA, Old Main at UA, Scottish Rite Temple on Scott Avenue, Old Tucson

Cast: Robert Carradine, Anthony Edwards, Timothy Busfield, Andrew Cassese

Genre: Comedy: A group of bullied college outcasts and misfits fight back.

Box office gross: $40.9 million

The Quick and the Dead (1995)

Extras for the movie "The Quick and the Dead," during filming at the Mescal Exit 297.

Tucson and Arizona locations: Old Tucson, Mescal, Sierrita Mountains, Sonoran Desert, Tucson Mountains, Ironwood Forest National Monument, Sonoita, Las Cienegas National Conservation Area

Cast: Sharon Stone, Gene Hackman, Russell Crowe

Genre: Action, romance, thriller: A female gunfighter enters a dueling tournament to avenge her father's death.

Box office gross: $18.64 million

Romy and Michele's High School Reunion (1997)

Lisa Kudrow and Mira Sorvino in a scene from Romy and Michele's High School Reunion.

Tucson locations: Tucson streets

Cast: Mira Sorvino, Lisa Kudrow, Janeane Carofalo

Genre: Comedy: Two dimwitted friends concoct an elaborate lie to impress classmates at their high school reunion.

Box office gross: $29.21 million

Stir Crazy (1980)

"Stir Crazy" filming at the Tucson Rodeo Grounds April 10, 1980. Citizen file photo by H. Darr Beiser.

Tucson locations: Downtown, Tucson Rodeo Grounds, Pima Community College West Campus, former Whistle Stop bar on Craycroft Road, Pima County Courthouse; other Arizona locations: Arizona State Prison in Florence, Arizona

Cast: Gene Wilder, Richard Pryor, Georg Stanford Brown, JoBeth Williams

Genre: Comedy: Two friends are set up and wrongfully accused of a crime they didn't commit.

Box office gross: $101.3 million

The Trial of Billy Jack (1974)

Tucson locations: Old Tucson Studios and Colossal Cave Mountain Park

Cast: Tom Laughlin, Delores Taylor, Victor Izay, Teresa Kelly

Genre: Action, drama

Box office gross: $89 million

Movie sets at Old Tucson in 2012.

The Cannonball Run (1981)

Tucson location: Old Tucson

Cast: Burt Reynolds, Roger Moore, Farrah Fawcett, Dom DeLuise

Genre: Action, comedy: Eccentric competitors participate in a cross-country road race.

Box office gross: $72.18 million

A scene from the movie, "Three Kings." (AP Photo/Warner Bros., Murray Close)

Three Kings (1999)

Arizona locations: Tucson, Casa Grande. Sacaton Mine in Casa Grande, Yuma, Eloy, Sonoran Desert, Coolidge, Marana, Phoenix

Cast: George Clooney, Mark Wahlberg, Ice Cube, Spike Jonze

Genre: Action, adventure, comedy: After the Persian Gulf War, four soldiers plan to steal gold that was stolen from Kuwait.

Box office gross: $60.65 million

The Postman (1997)

Release date: Dec. 25, 1997

Tucson and Arizona locations: Tucson, Sahuarita, Green Valley, Sopori Ranch, Amado and Nogales

Cast: Kevin Costner, Will Patton, Larenz Tate, Olivia Williams

Genre: Action, adventure, sci-fi: In post-apocalyptic America in the year 2013, an unnamed wanderer retrieves a postman's uniform and undelivered bag of mail, which he delivers to a nearby town

Box office gross: $17.6 million

Rene Russo, Don Johnson and Kevin Costner star in "Tin Cup."

Tin Cup (1996)

Tucson and Arizona locations: Hotel Congress, Tubac, Sonoita, Nogales.

Cast: Kevin Costner, Rene Russo, Don Johnson, Cheech Marin

Genre: Comedy, drama, romance: A washed up golf pro tries to qualify for the US Open.

Box office gross: $53.85 million

In this undated photo released by Disney, John Voight, left, portraying Kentucky coach Adolph Rupp, shakes hands with Josh Lucas, right, playing Texas Western coach Don Haskins in a scene from the motion picture "Glory Road." (AP Photo/Disney Enterprises, Inc., Frank Connor)

Glory Road (2006)

Tucson location: Bear Down Gym at the University of Arizona

Cast: Josh Lucas, Derek Luke, Austin Nichols, Jon Voight

Genre: Biography, drama, sport: Texas Western coach leads the first all-black starting line-up college basketball team to the NCAA championship.

Box office gross: $42.64 million

Chevy Chase, Steve Martin, and Martin Short in The Three Amigos.

Three Amigos (1986)

Tucson and Arizona locations: Old Tucson, Coronado National Forest, Florence, Apache Junction, Superstition Mountains, Apache Trail, Superstition Wilderness, Sonoran Desert, Gold Canyon

Cast: Steve Martin, Checy Chase, Martin Short

Genre: Comedy, western: Three actors go to a Mexican village to perform their onscreen roles unaware they are in a real fight.

Box office gross: $39.25 million

The cast and producer of Tyler Perry's feature "The Family That Preys." (PRNewsFoto/Lincoln Mercury)

The Family That Preys (2008)

Tucson and Arizona locations: Tucson, Sonoita

Cast: Kathy Bates, Alfre Woodard, Sanaa Lathan

Genre: Drama: Two families from different walks of life learn to work together.

Box office gross: $37.02 million

Murphy's Romance (1985)

Tucson and Arizona locations: Tucson (street scenes), Florence, Tubac, Keating Building in Florence, Eloy, Coolidge, Main Street Vault in Florence, Valley Art Theater in Tempe, Tempe, Main Street in Florence

Cast: Sally Field, James Garner, Brian Kerwin

Genre: Comedy, drama, romance: A divorcee and her son move to a ranch and she befriends a local man.

Box office gross: $30.76 million

Sammy Davis JR, and Dean Martin are cornered by mobsters (L to R) Alex Rocco, Michael Gazzo, Abe Vigoda and Henry Silva, all after the million-dollar purse offered for Cannonball Run II. Photo by Arcafin V.V./Claridge Pictures Inc.

Cannonball Run II (1984)

Tucson and Arizona locations: Tucson, Bisbee, Old Tucson, Arizona State School for the Deaf and the Blind Campus

Cast: Burt Reynolds, Dom DeLuise, Dean Martin

Genre: Action, comedy: This sequel features another cross country race.

Box office gross: $28.08 million

The Fox Theater on 17 W. Congress, Wed April 25, 2012.

Escape from New York (1981)

Tucson location: Fox Theater

Cast: Kurt Russell, Lee Van Cleef, Ernest Borgnine

Genre: Action, adventure, sci-fi: Manhattan is now a maximum security prison and the U.S. president has crashed into it.

Box office gross: $25.24 million

Holly (Drew Barrymore, left) introduces Jane (Whoopi Goldberg) to her new boyfiend, Abe (Matthew McConaughey, in Warner Bros.' "Boys on the Side." Photo by Suzanne Hanover

Boys on the Side (1995)

Tucson and Arizona locations: Tucson, Tumacácori, Teatro Carmen, Elusian Grove Market in Barrio Viejo, Tucson General Hospital (since demolished), Big Horn Restaurant in Amado, Tucson Elks Lodge, Amado

Cast: Whoopi Goldberg, Mary-Louise Parker, Drew Barrymore, Matthew McConaughey

Genre: Comedy, drama: Three very different women drive cross country and become close friends.

Box office gross: $23.45 million

Madhouse (1990)

Tucson and Arizona locations: Tucson, Phoenix

Cast: Richard Alexander, Kirstie Alley, John Larroquette

Genre: Comedy: A yuppie couple's villa is overrun by uninvited guests.

Box office gross: $21.04 million

8 Seconds (1994)

Tucson location: Tucson Rodeo Grounds, other Tucson locations

Cast: Luke Perry, Stephen Baldwin, James Rebhorn

Genre: Biography, drama, sport: The life of Lane Frost, 1987 PRCA Bull Riding World Champion.

Box office gross: $19.6 million

Wes Studi stars as Geronimo, the legendary Apache leader and medicine man who defied the U.S. Cavalry.

Geronimo: An American Legend (1993)

Tucson and Arizona locations: Old Tucson, Monument Valley, Kayenta, Red Mesa, Kaibab National Forest, Williams (Grand Canyon Railway), Mexican Water, San Francisco Peaks, Skeleton Canyon, Teec Nos Pos, Tucson

Cast: Jason Patric, Gene Hackman, Robert Duvall

Genre: Drama, history, western: The story of the Apache chief and his resistance to the U.S. Government's subjugation of his people.

Box office gross: $18.64 million

Kirk Douglas shows other actors how to draw and whirl during the filming of "Posse" at Old Tucson.

Posse (1993)

Tucson and Arizona locations: Old Tucson, Florence, Sonoran Desert, Empire Ranch in Sonoita, Sierrita Mountains, Tucson Mountains, Benson, Tucson

Cast: Mario Van Peebles, Stephen Baldwin, Charles Lane

Genre: Western: Buffalo soldiers find gold, desert and help defend a black town from the KKK.

Box office gross: $18.29 million

Old Tucson

Lightning Jack (1994)

Tucson and Arizona locations: Old Tucson, Page, Sonoran Desert, Tucson Mountains, Sierrita Mountains, Flagstaff

Cast: Paul Hogan, Cuba Gooding Jr., Beverly D'Angelo

Genre: Comedy, western: An Australian outlaw in the wild west.

Box office gross: $16.82 million

Terminal Velocity (1994)

Tucson and Arizona locations: Old Tucson, Douglas, Little Colorado River Canyon, Tucson, Flagstaff, Phoenix

Cast: Charlie Sheen, Nastassja Kinski, James Gandolfini

Genre: Action, mystery, romance: A maverick skydiver and a former KGB agent team up to stop the Russian mafia.

Box office gross: $16.48 million

The Getaway (1994)

Tucson and Arizona locations: Tucson, Prescott, Phoenix International Raceway, Hotel Del Sol in Yuma, Downtown Yuma, Flagstaff, Sonoran Desert, Coolidge, Maricopa County Courthouse and Old Phoenix City Hall, Apache Lodge in Prescott, Arizona Biltmore Resort in Phoenix, Phoenix Greyhound Park, Union Station in Phoenix

Cast: Alec Baldwin, Kim Basinger, Michael Madsen

Genre: Action, adventure, crime: An ex-con and his wife flee after a heist goes wrong.

Box office gross: $16.1 million

Cast member Drew Barrymore attends the premiere of Confessions Of A Dangerous Mind at the Mann Bruin Theatre in Westwood, California, Wednesday December 11, 2002.

Confessions of a Dangerous Mind (2002)

Tucson and Arizona locations: Tucson, White Stallion Ranch, Nogales

Cast: Sam Rockwell, Drew Barrymore, George Clooney

Genre: Biography, comedy, crime: Adaptation of the cult memoir of game show impresario Chuck Barris.

Box office gross: $16 million

Flirting with Disaster (1996)

Tucson and Arizona locations: Tucson, Cave Creek, Phoenix, Scottsdale, Carefree, Marana

Cast: Ben Stiller, Patricia Arquette, Téa Leoni

Genre: Comedy: A young man searches for his birth parents.

Box office gross: $14.89 million

Fire Birds (1990)

Tucson and Arizona locations: Army Pilot Training Post in Tucson, Mammoth, Mesa, Sonoran Desert, Apache Leap Mountains in Superior, Superstition Mountains, Davis-Monthan Air Force Base, Superior, Picketpost Mountain in Superior, Superstition Wilderness, Miami, Globe, Reymert, Tonto National Forest, Apache Junction, Amphitheater High School

Cast: Nicolas Cage, Tommy Lee Jones, Sean Young

Genre: Action, adventure: Elite Apache helicopter pilots must destroy powerful drug cartels.

Box office gross: $14.76 million

Stay Tuned (1992)

Tucson and Arizona locations: Old Tucson, Florence, Tucson

Cast: John Ritter, Pam Dawber, Jeffrey Jones

Genre: Adventure, comedy, fantasy: a husband and wife are sucked into television sets and must survive twisted versions of TV shows.

Box office gross: $10.74 million

The Titan II Missile which is part of the Titan Missile Museum, is outside Tucson in Sahuarita, Ariz, on Nov. 14, 2018.

Cyborg (1989)

Tucson and Arizona locations: Titan Missile Museum in Green Valley, The Domes in Casa Grande, Davis-Monthan Air Force Base, Casa Grande, Green Valley, Tucson

Cast: Jean-Claude Van Damme, Deborah Richter, Vincent Klyn

Genre: Action, sci-fi, thriller: Hunt for a killer in a plague-infested future.

Box office gross: $10.17 million

The Wraith (1986)

Tucson locations: North Sixth Avenue, Fourth Avenue, Sabino Canyon, Catalina Highway, Davis-Monthan Air Force Base, East Fifth Street, West Ajo Way and East Benson Highway.

Cast: Charlie Sheen, Nick Cassavetes, Sherilyn Fenn, Randy Quaid

Genre: Sci-fi, horror: A high-schooler returns from the dead to get revenge on the psychotic drag racer who killed him.

Box office gross: $3.5 million

Westerns filmed at Old Tucson

Arizona

Updated

Visitors at Old Tucson often have a chance to watch actual movie or television filming. Shown in the foreground, they watch actor Cameron Mitchell at work. John Wayne, Paul Newman, Glenn Ford, Clint Eastwood and Kirk Douglas are among the galaxy of stars frequently filming here. July 1977 Tucson Citizen file photo.

Arizona

1940

Starring: Jean Arthur, William Holden, Warren William

The Last Round-up

Updated1947

Starring: Gene Autry, Champion, Jean Heather

Broken Arrow

Updated1950

Starring: James Stewart, Jeff Chandler, Debra Paget

Winchester ’73

Updated1950

Starring: James Stewart, Shelley Winters, Dan Duryea

The Last Outpost

Updated1951

Starring: Ronald Reagan, Rhonda Fleming, Bruce Bennett

Flaming Feather

Updated1952

Starring: Sterling Hayden, Forrest Tucker, Arleen Whelan

Ten Wanted Men

Updated1955

Starring: Randolph Scott, Jocelyn Brando, Richard Boone

The Violent Men

Updated1955

Starring: Glenn Ford, Barbara Stanwyck, Edward G. Robinson

Backlash

Updated1956

Starring: Richard Widmark, Donna Reed, William Campbell

Broken Star

Updated1956

Starring: Howard Duff, Lita Baron, Bill Williams

Reprisal!

Updated1956

Starring: Guy Madison, Felicia Farr. Kathryn Grant

Walk the Proud Land

Updated1956

Starring: Audie Murphy, Anne Bancroft, Pat Crowley

3:10 to Yuma

Updated1957

Starring: Glenn Ford, Can Heflin, Felicia Farr

Gunfight at the OK Corral

Updated1957

Starring: Burt Lancaster, Kirk Douglas, Rhonda Fleming

The Guns of Fort Petticoat

Updated

Filming of the Guns of Fort Petticoat.4/56. at Old Tucson.

1957

Starring: Audie Murphy, Kathryn Grant, Hope Emerson

Gunsight Ridge

Updated1957

Starring: Joel McCrea, Mark Stevens, Joan Weldon

The Badlanders

Updated1958

Starring: Alan Ladd, Ernest Borgnine, Katy Jurado

Buchanan Rides Alone

Updated1958

Starring: Randolph Scott, Craig Stevens, Barry Kelley

Gunsmoke in Tucson

Updated1958

Starring Mark Stevens, Forrest Tucker, Gale Robbins

The Lone Ranger and the Lost City of Gold

Updated1958

Clayton Moore, Jay Silverheels, Douglas Kennedy

The Last Train from Gun Hill

Updated1959

Kirk Douglas, Anthony Quinn, Carolyn Jones

Rio Bravo

Updated

Rio Bravo. May 24 1958. Tucson Citizen file photo. At right is Ricky Nelson, who turned 18 at Old Tucson filming the movie Rio Bravo. Movies.

1959

Starring: John Wayne, Dean Martin, Ricky Nelson

Cimarron

Updated1960

Glenn Ford, Maria Schell, Anne Baxter

Heller in Pink Tights

Updated1960

Sophia Loren, Anthony Quinn, Margaret O’Brien

The Deadly Companions

Updated1961

Maureen O’Hara, Brian Keith, Steve Cochran

A Thunder of Drums

Updated1961

Richard Boone, George Hamilton, Luana Patten

Young Guns of Texas

Updated1962

James Mitchum, Alana Ladd, Jody McCrea

Lilies of the Field

Updated1963

Sidney Poitier, Lilia Skala, Lisa Mann

McClintock!

Updated1963

John Wayne, Maureen O’Hara, Patrick Wayne

Arizona Raiders

Updated1965

Audie Murphy, Michael Dante, Ben Cooper

The Great Sioux Massacre

Updated1965

Joseph Cotten, Darren McGavin, Philip Carey

And Should We Die

Updated1965

Nathan Hale, Klair Bybee, Dana Rosado

El Dorado

Updated1967

John Wayne, Robert Mitchum, James Caan

Return of the Gunfighter

Updated1967

Robert Taylor, Chad Everett, Ana Martin

Hombre

Updated

Movie "Hombre" . King Ranch. Sasabe Road. 3/11/66. Citizen file photo. This is a scene at Old Tucson.

Hombre

1967

Paul Newman, Fredric March, Richard Boone

The Last Challenge

Updated1967

Glenn Ford, Angie Dickenson, Chad Everett

A Time for Killing

Updated1967

Inger Stevens, Glenn Ford, Paul Petersen

The Way West

Updated1967

Kirk Douglas, Robert Mitchum, Richard Widmark

Lonesome Cowboys

Updated

Warhol Filming. Old Tucson. January 26, 1968. Tucson Citizen photo. Blond in in cowboy hat and glasses is Andy Warhol. Movie title "Lonesome Cowboys."

1968

Viva, Tom Hompertz, Louis Waldon

Heaven with a Gun

Updated1969

Glenn Ford, Carolyn Jones, Barbara Hershey

Young Billy Young

Updated1969

Robert Mitchum, Angie Dickenson, Robert Walker Jr.

Dirty Dingus Magee

Updated1970

Frank Sinatra, George Kennedy, Anne Jackson

Monte Walsh

Updated1970

Lee Marvin, Jeanne Moreau, Jack Palance

Rio Lobo

Updated1970

John Wayne, Jorge Rivero, Jennifer O’Neill

The Animals

Updated1970

Michele Carey, Henry Silva, Keenan Wynn

Scandalous John

Updated1971

Brian Keith, Alfonso Arau, Michele Carey

Yuma

Updated1971

Clint Walker, Barry Sullivan, Kathryn Hays

Pocket Money

Updated1972

Paul Newman, Lee Marvin, Strother Martin

Joe Kidd

Updated

Old Tucson- Movie. Tucson Citizen. December 2, 1971. Clint Eastwood and director John Sturges, right.

Joe Kidd

1972

Clint Eastwood, Robert Duvall, John Saxon

The Life and Times of Judge Roy Bean

Updated

Old Tucson- Movie. Tucson Citizen. December 2, 1971.

The Life and Times of Judge Roy Bean

1972

Paul Newman, Ava Gardner, Roy Jenson

Guns of a Stranger

Updated1973

Marty Robbins, Chill Wills, Dovie Beams

The Man Who Loved Cat Dancing

Updated1973

Burt Reynolds, Sarah Miles, Lee J. Cobb

Hawmps!

Updated1976

James Hampton, Christopher Connelly, Slim Pickens

The Outlaw Josey Wales

Updated1976

Clint Eastwood, Sondra Locke, Chief Dan George

The Frisco Kid

Updated1979

Gene Wilder, Harrison Ford, Ramon Bieri

The Villain

Updated1979

Kirk Douglas, Arnold Schwarzenegger, Ann-Margret

The Three Amigos

Updated1986

Steve Martin, Chevy Chase, Martin Short

Young Guns II

Updated1990

Emilio Estevez, Kiefer Sutherland, Lou Diamond Phillips

Tombstone

Updated1993

Kurt Russell, Val Kilmer, Sam Elliott

Lightning Jack

Updated1994

Paul Hogan, Cuba Gooding Jr., Beverly D’Angelo

The Quick and the Dead

Updated1995

Sharon Stone, Gene Hackman, Russell Crowe

5 'modern movies' that were filmed in Tucson

Revenge of the Nerds (1984)

Updated

Actors Anthony Edwards, right, and Robert Carradine stumbled with their suitcases. Annette Knapp, left, and Susan Schellmeyer, were extras.

University of Arizona graduates everywhere will recognize the setting of this 1980s campus comedy.

Administrators at the UA first approved filming of the movie on campus and then revoked it.

"We were concerned that the movie does not portray campus life in a representative way," Dudley B. Woodard Jr., vice president for administrative services and member of the university's executive staff, said in a 1983 Star story.

Later, after a meeting with senior UA officials, movie producers and members of the city and state film commissions, the UA made an about-face.

The UA agreed to let "Nerds" film in Tucson if the director reduced the shooting schedule to avoid disrupting campus activities, shot the lurid scenes elsewhere, took advice from fraternities, and did not mention the UA anywhere in the film, according to a 2007 Star story.

Local locations: Bear Down Gym, Arizona Stadium and University of Arizona campus frat houses, the Quaker meeting house on Fifth Avenue, the Scottish Rite Temple downtown.

Can't Buy Me Love (1987)

Updated

Photo of Patrick Dempseyon the set of the 1987 movie "Can't Buy Me Love" filmed at Tucson High. This is scanned from a 1987 THS yearbook.

This 1980s teen movie is the most Tucson-centric of our list. Set and filmed all around Central Tucson, watching this movie might make you feel homesick or nostalgic depending on your current location.

Local locations: Tucson High School, Old Fort Lowell neighborhood, Winterhaven neighborhood, the Boneyard, Tucson Mall, Pima Air & Space Museum; Fun Fact: Scoops, the pizza/milkshake hangout in the movie is currently a Los Betos on Speedway Boulevard near Country Club Road.

Major League (1989)

Updated

Spring training scenes in this iconic baseball movie were shot at Hi Corbett Field.

Fast Fact: On July 14, 1988, Paramount paid the 6,000-strong Hi Corbett Field crowd with $5,400 in hot dogs.

Tombstone (1993)

Updated

Kurt Russell stars as Wyatt Earp in "Tombstone" filmed at Old Tucson Studios in 1993.

A modern retelling of the Tombstone and Wyatt Earp legend, this film starring Kurt Russell, Val Kilmer and Sam Elliott was filmed at Old Tucson Studios' Mescal location near Benson.

"The actors loved hanging out at (Hotel) Congress," said Laurie Ross, who served as a locations manager for "Tombstone" and "Boys on the Side," according to a 2007 Star story.

The filming of Tombstone at Old Tucson Studios.

Tin Cup (1996)

Updated

Rene Russo, Don Johnson and Kevin Costner star in "Tin Cup"

A washed up golf pro played by Kevin Costner tries to qualify for the US Open to win the heart of Rene Russo.

From a 2007 Star story: "The film called for a pond to be put in on what was then the Tubac Country Club's 16th hole. Golfers are still making like Costner and shanking balls into Tin Cup Lake on the fourth hole of the Tubac Golf Resort & Spa's Rancho Nine course."

Local locations: Hotel Congress, the former Beacon's Value Village Thrift Store (now a Goodwill) on North Fourth Avenue, Tubac Golf Resort & Spa and Santa Rita Golf Course (now closed) in Corona de Tucson.