The proposed Rosemont Mine faces potentially lengthy construction delays due to low copper prices, just as the project heads into what could be a final round of government permitting.

Hudbay Minerals Inc., the Toronto-based company proposing to build the mine, has cut the value of the Rosemont project on its balance sheet by $114.5 million because of the copper prices and expected delays in mine construction, the company said in a recent news release.

The Rosemont delay seems fairly indefinite, since Hudbay won’t say when it hopes to start construction, at an estimated $1.5 billion cost, or what copper price it needs to justify construction. But Hudbay predicts favorable economic conditions to return “sooner rather than later,” an outlook not shared by all industry experts.

Just last fall, Hudbay’s then-CEO, David Garofalo, told a mining trade journal he hoped to start construction on the controversial project by mid-2016. That forecast assumed the company could first secure two remaining key federal permits and overturn a court ruling that tossed out the mine’s state air-quality permit.

But copper prices have continued deteriorating, and copper companies have cut jobs globally. Locally, the industry pinch was felt most strongly when Freeport McMoRan Copper and Gold announced last fall that it is shutting down its Sierrita Mine near Green Valley, which employed more than 1,000 people.

In its news release, Hudbay also said lower copper prices have reduced the value of its new Constancia Mine in Peru by $198 million. Together, the value reductions accounted for most of Hudbay’s reported 2015 loss of $331.4 million, compared to a 2014 profit of $65.2 million.

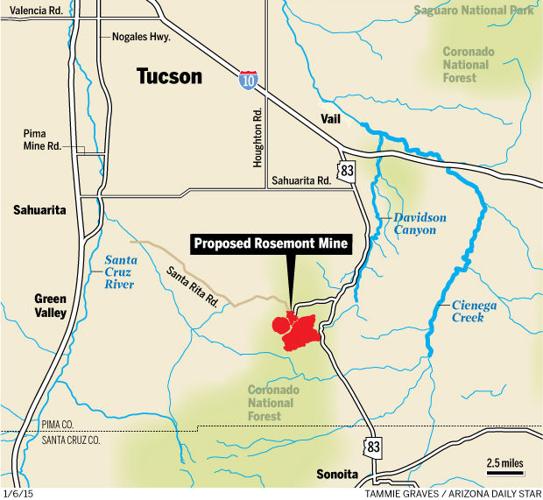

This latest delay follows an already prolonged process for getting Rosemont built on the east side of the Santa Rita Mountains southeast of Tucson.

Since the site’s previous owner, Augusta Resource Corp., filed a mining plan with the federal government in 2007, the mine has been delayed repeatedly for environmental reasons, led by endangered-species and water-supply issues. Opposition has been fierce from environmentalists and nearby communities such as Green Valley.

Federal agencies have been divided, with the Forest Service favorable and the Environmental Protection Agency most critical. Augusta and Hudbay have announced several timetables and schedules for the project before, only to have to withdraw them after new obstacles developed.

In May 2014, the Forest Service delayed its final decision — which almost certainly would have been an approval — shortly after remote cameras photographed an ocelot near the mine site.

Through much of that time, copper prices were good, so good that existing Tucson-area mines were having trouble filling vacancies. In early 2011, prices peaked in the $4 range and stayed above $3 for some years.

Now, the U.S. Fish and Wildlife Service plans to release its second biological opinion on the mine this month. That’s generally considered one of the last steps before the Forest Service makes a final decision. The Forest Service, however, wasn’t ready to say last week when it expects to decide, and lawsuits could also delay the project.

But copper prices have plunged the past two years and recently were stuck in the $2.10 to $2.20 per pound range. On Friday, they rose 3 percent to $2.27 a pound.

In its news release, Hudbay forecast copper prices of around $2.20 a pound in 2017 and 2018, and about $3 in 2019 and thereafter. Garofalo said last May that no new copper mine will open anywhere until the price hits $3.50.

Some observers have said in recent days that the prices of copper and other commodities have bottomed out, but others warn that the price recovery could be prolonged.

In response to questions, Hudbay spokesman Scott Brubacher emphasized that the price will not be the only factor driving a decision to start building Rosemont. “There are a whole range of other factors that get considered in a decision like that,” he said.

They include commodity supply and demand; internal rates of return on the investment based on cost of capital; and cost of production, equipment, supplies, electric power and fuel. In that mix of factors, “one figure could offset another,” Brubacher said.

MOODY’S DOWNGRADE

At the same time, the Moody’s investor ratings service downgraded Hudbay’s $920 million in unsecured corporate bonds last week to Caa1. Bonds with a Caa rating are considered “speculative of poor standing and are subject to very high credit risk,” Moody’s says. A “1” added to the rating signifies the company’s bonds are in the highest grade of that class. Unsecured bonds, unlike secured bonds, don’t have collateral backing them.

Moody’s maintained Hudbay’s overall corporate rating and its probability of default at B3, when it has recently downgraded those ratings for many other mining companies, Hudbay spokesman Brubacher noted. The B3 rating means a company is subject to high default risk, Moody’s says.

But Moody’s also lowered the outlook for Hudbay’s future overall rating from positive to negative last week.

The company had received a positive rating outlook in January after its new Constancia mine swung into full production last year, dramatically boosting Hudbay’s total 2015 revenues from 2014. But continued metal price declines changed that outlook to negative, said Jamie Koutsoukis, a vice president and senior analyst for Moody’s Canada in Toronto.

“I wouldn’t say that Hudbay is in better shape” than companies whose ratings were cut, Koutsoukis said. “It means they haven’t seen the same deterioration as other companies. With Constancia up and running, they’re getting new, incremental cash flows, while other companies are running at a steady state.”

ECONOMISTS SPLIT

Hudbay based its 2019 copper price forecast on its belief that improvements in Chinese and global growth “could improve overall sentiment towards commodities,” spokesman Brubacher said.

If sentiment remains weak, a lack of investment in new copper mines to replace old ones with declining production will create a deficit in the next several years, which should increase the price even if demand stays slow, he said.

John Tilton, a mining economist and professor at the Colorado School of Mines, said of Hudbay’s forecast: “2019 is a long way off. I would be reluctant to forecast a price of $3 by then, but would not consider such a forecast unreasonable.”

A second economist said he doesn’t think a $3 copper price is likely by 2019 and that he wouldn’t invest in new mineral projects today based on an assumption of future price increases.

“The extended commodity boom ended just two years ago,” said Marian Radetzki, a retired economics professor at Lulea University of Technology in Sweden. “While it lasted, it brought about a lot of excess capacity, and historical experiences of earlier booms suggests it takes quite some time, much more than five years, to get markets back to long-run equilibrium.

“In the meantime, prices tend to remain depressed at levels that do not motivate investments in new capacity, just as they should when excess capacity exists,” said Radetzki, who has published a book and several papers on global commodity markets.

Economist David Humphreys said Hudbay’s price forecast isn’t out of line for 2016 and 2017, but is “probably above consensus for 2019. But then, a lot could happen between now and 2019.”

Humphreys said he agrees with a general view that this year will mark the bottom of the copper market. “That does not mean the rebound from this point will be strong. Probably it will not be,” said Humphreys, former chief economist for the mining companies Rio Tinto and Norilsk Nickel.

But the market’s bottoming could signal that the basis for recovery is being laid and that this is a suitable time to invest in new capacity, Humphreys said. “There is some logic in committing to investment in cyclical troughs, in the hope that production will catch the tide of rising prices,” he said.

Asarco bailed out

The low copper price won’t discourage Hudbay from pursuing Rosemont, the company said. That’s unlike Asarco, which abandoned its plans to build Rosemont in the late 1990s because of low prices. If permitted, Rosemont should be one of first new copper projects once prices and capital market conditions improve, Brubacher said.

“The fundamental qualities that make Rosemont attractive remain: a high-quality deposit with a long mine life, low production costs, in a jurisdiction that understands and supports responsible modern mining and the economic benefits that flow from it,” he said.

For Rosemont’s longstanding opponents, the industry’s boom and bust cycle triggering the current low prices is one more reason not to build it.

“Project proponents have for nearly 10 years offered rosy economic forecasts in a deceptive effort to obscure the environmental devastation that would result if the mine was built,” said Gayle Hartmann, president of the opposition group Save the Scenic Santa Ritas, in a news release. “Hudbay’s decision to delay construction of Rosemont proves this is not an economically sustainable project, suitable for 21st century economic development in Southern Arizona.

“It’s been pretty clear for some time that they had a lot of obstacles in their way. Slowing it down is just a way for them to save face,” Hartmann said.

Another opponent, Randy Serraglio, conservation advocate for the Center for Biological Diversity, said, “The truth is that this project should never be built. The tremendous damage that the Rosemont Mine threatens to our air, water, wildlife and beautiful landscapes is simply too great.

“Hudbay’s vague statements make it clear why Tucson should not roll the dice on an extremely risky proposal like Rosemont. In Arizona and around the world, there are mass layoffs, bankruptcies and unpaid environmental liabilities, as mining companies make others pay for their mistakes.”

Everything in the commodities business is cyclical, countered a Tucson business-community leader.

“This project will come online when permits are properly issued, the price of commodities goes up and that allows investors to say let’s get back in the game,” said Rick Grinnell, president of the pro-Rosemont Southern Arizona Business Coalition. “Look at the 1950s when we had major industrial development here; then in the ’60s, we had a major recession. Economics has always been a game of cycles. It’s all a matter of supply and demand.”

In general, the view among business leaders about the Rosemont delay and low copper prices varies between the feeling that it’s a big concern and that it’s a blip, Grinnell added.

In a downturn like this, everyone in related businesses such as mining-engineering firms and chemical suppliers is feeling the pinch, he said.

“Is this a concern? Yes. But people in this industry have also seen this cycle of commodity prices, not just in copper but in gold and silver. ...

“We live in a world economy now, but people will absorb this and will get through this. The industry will survive.”