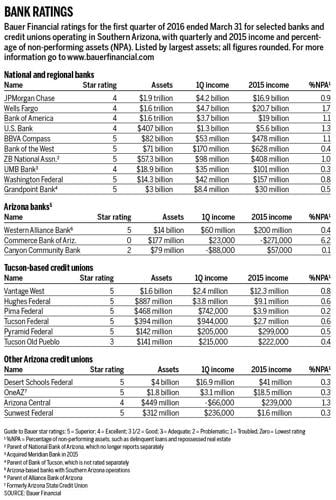

The financial health of Arizona’s banks and credit unions remained essentially unchanged in the first quarter of 2016 while improving slightly nationwide, according to the latest ratings from Bauer Financial.

In Southern Arizona, two Tucson-based banks continue efforts to raise capital to comply with regulatory orders, though that didn’t help their Bauer ratings.

Canyon Community Bank, which in the fourth quarter of 2015 saw its Bauer rating rise one notch, to two stars or “problematic,” remained at two stars despite a significant injection of capital.

Meanwhile, Commerce Bank of Arizona still is rated “zero” stars by Bauer, though the bank raised new capital last year.

Florida-based Bauer Financial bases its ratings on data reported to federal regulators.

In the first quarter, Bauer rated 66.7 percent of Arizona banks “recommended” at five stars (“superior”) or four stars (“excellent”) — unchanged from the prior quarter but slightly lower than the same period in 2015.

Bauer rated 11.1 percent of Arizona banks “troubled” or “problematic,” also unchanged from the prior quarter and down from 13.6 percent in first-quarter 2015.

Nationwide, Bauer rated 84.4 percent of banks as recommended in the first quarter, up slightly from the prior quarter, while the percentage of banks rated as troubled or problematic fell to 2.9 percent from 4.7 percent in the same period in 2015.

Among Arizona’s credit unions, 84.1 percent were recommended, unchanged from the prior quarter, while none were rated troubled or problematic in the first quarter.

Nationally, Bauer rated 79.8 percent of credit unions as recommended and 2.4 percent troubled or problematic, a slight improvement on both counts.

Canyon Community Bank got an infusion of cash in November from Texas-based Highgate Holdings LLC, which made Highgate a 77 percent owner of the bank.

After reaping a small profit in 2015, Canyon Community posted a $88,000 loss in the first quarter, while it cut its percentage of nonperforming assets to below 1 percent, from more than 2 percent in the prior quarter. Total assets rose to $79.5 million from $72 million.

Commerce Bank of Arizona reported a $23,000 profit in the first quarter, after earning $635,000 in the fourth quarter of 2015.

The bank raised $2.7 million in new capital last year and has worked to otherwise bolster its finances under an FDIC order.

In the first quarter, Commerce Bank saw a slight improvement in one of its capital ratios — key measures of capital reserves — but it remained out of compliance with the FDIC order.

The bank’s leverage capital ratio remained about the same at 6.3 percent and its risk-based capital ratio improved to 8.8 percent, while nonperforming assets improved to 6.2 percent from 6.7 percent in the prior quarter.

Among Arizona-based banks with operations in Southern Arizona, Western Alliance Bank, parent of Alliance Bank of Arizona, retained its five-star or “superior” rating. All other Arizona banks operating here retained their prior Bauer ratings.

Five Tucson-based credit unions kept their five-star ratings: Vantage West, Hughes Federal, Pima Federal, Tucson Federal and Pyramid Federal.

All of the other credit unions operating in the state retained their previous Bauer ratings except Yuma-based A.E.A. Credit Union, which gained a third star to rise from problematic to adequate.