JEFFERSON CITY • It’s the hottest political campaign of the summer in Missouri. Politicians are stumping and millions of dollars are being spent. Voters are being inundated with television commercials, radio ads, phone calls and campaign mail pieces.

But the battle over an attempt to cut Missouri’s income tax hinges on just a handful of state lawmakers.

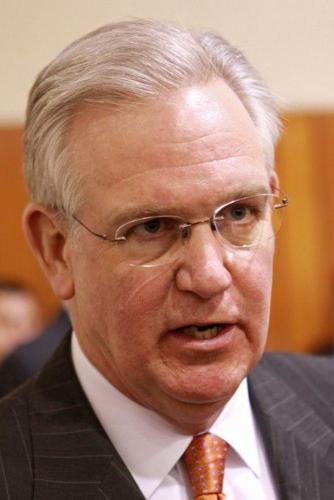

The Republican-controlled Legislature earlier this year approved the income tax cut — it would have been Missouri’s first in nearly a century — but Gov. Jay Nixon, a Democrat, vetoed the measure.

Nixon said the bill created too much uncertainty and would hurt schools and seniors. Supporters — mostly Republicans — said it would spur job growth and boost the state’s economy.

House Republicans will meet privately in St. Louis this week to get a sense of whether they have enough votes to override Nixon’s veto, sending the 10-year tax cut plan into law.

“It will be difficult for us to override it,” House Speaker Tim Jones, R-Eureka, acknowledged, though he and others remain hopeful.

The Senate has enough votes to override, but supporters of the tax cut are playing a tight numbers game in the House, where Republicans hold 109 seats – exactly the number of votes needed to overrule Nixon. As one of the top priorities for Republican legislative leaders, the tax cut measure passed the House in May with a 103-51 vote, with three Democrats voting in favor and six Republicans absent.

Two of the three Democrats who voted for the bill have already said they won’t vote to override Nixon. At least two Republicans who voted for the bill have said they are reconsidering their stance. And a few members from both sides of the aisle say they still aren’t sure how they will vote if the issue comes up during a Sept. 11 veto session.

Both sides appear to be holding out hope that if they campaign hard enough, they can get the votes they need.

On the side supporting the cut and the override: Grow Missouri, a new political campaign committee funded by retired investor Rex Sinquefield. Aided by business groups such as the Missouri Chamber of Commerce and Industry, the Missouri Restaurant Association and Associated Industries of Missouri, Grow Missouri has been on an advertising blitz to build support among voters.

On the opposite side: Missourians for Common Sense, an advocacy group that is reaching out to seniors in targeted districts, hoping they will call lawmakers and express opposition to the override. It’s less clear who is funding that group’s efforts. Separately, the Coalition for Missouri’s Future also is supporting Nixon’s veto, with support from education, social advocacy, health care, labor and religious organizations.

Nixon himself has spoken against the cut at nearly two dozen events across the state over the past three months. And he has sent numerous news releases pointing out what he believes are flaws in the legislation. The campaign is unusual for Nixon, who generally has limited his speaking engagements to local jobs announcements and other economic development issues. But this summer, the crusade against the tax-cut bill has been his main focus.

The centerpiece of the bill is a 50 percent tax cut, phased in over five years, for businesses that “pass through” their income to the owner’s personal return.

The bill also would drop the top personal income tax rate by one-half of a percentage point, to 5.5 percent. The corporate tax rate would fall by 3 percentage points, to 3.25 percent. Those cuts would be phased in over 10 years.

Passed in the final days of the session after months of debate and revisions, the tax cut legislation served as a feather in the cap of Republicans. They have often pointed to Kansas, and the ongoing border war that Missouri faces with its neighbor to the west, as justification for the measure.

But almost immediately after its passage, Nixon began hinting that he planned to veto the bill. He released a lengthy veto message at multiple news conferences in June.

In the weeks since, at stops ranging from drug stores to college campuses, Nixon has continued to raise points against it. He says the measure would raise taxes on prescription drugs and textbooks, and that it would eventually create an $800 million hole in the state budget, threatening funding for education and other programs.

Nixon, who has been traveling to many of his events aboard Missouri’s new $5.6 million state plane that costs nearly $900 an hour to operate, said, “As people learn more about the bill, they’re focused on why it’s not the right policy. I see it as an educational opportunity for Missourians.”

Meanwhile, Grow Missouri, the group leading the charge in favor of the override, is airing television, radio and online ads throughout the state.

“Great states grow. They grow jobs and paychecks, and they make great strides toward securing their futures,” Grow Missouri treasurer Aaron Willard said in a news release on the group’s efforts.

Sinquefield alone has funneled more than $2.3 million toward support for the override. A spokeswoman for Sinquefield declined the Post-Dispatch’s request to interview him.

As one of the largest political donors in the state, Sinquefield’s impact could be felt well beyond the veto session. Last month, he gave $25,000 to the House Republican Campaign Committee, which doles out campaign cash to help favored members win elections and to help seat new Republicans. Those who buck the party’s position could potentially face a financial challenge if they run for re-election next fall.

Still, Missourians for Common Sense, the group backing Nixon, has targeted 12 legislators, sending thousands of mail pieces and phone calls to older residents of their districts.

“Members of the Missouri House should be on notice: if they vote this September to implement a massive new tax on prescription drugs, they will see mail pieces like this for a long time and senior citizens in their communities will not forget,” the group’s spokeswoman, Christy Setzer, said in a statement. “Over the coming weeks, legislators should anticipate hearing from seniors in their communities, and the message will be clear: Nobody can afford this new, massive tax on prescription drugs.”

The group was formed as a federal 501c4 organization for issue advocacy, so it doesn’t have to disclose the names of its donors. According to the group, it is “financed by a coalition of Missouri businesses and individuals.”

Republican Rep. Robert Cornejo, of St. Peters, one of the 12 targets of the mail pieces, said he still supports an override and isn’t bothered by the attention.

“I’m completely fine with them spending money on my district,” he said. “If it means less money going to members who may not be so firm on their decision, then more power to them.”

Cornejo, who is in his first year in the Legislature after winning a narrow victory over his Democratic opponent in November, said income tax reform was his top priority on the campaign trail.

“The majority of people support it,” he said. “This is something that resonates with every voter who is working.”